1.94 Bcf/d exported last year, exclusively from Cheniere’s Sabine Pass

Cove Point and Sabine Pass expansion will add to exports in 2018, with Cheniere’s Corpus Christi plant and others slated to come online in 2019

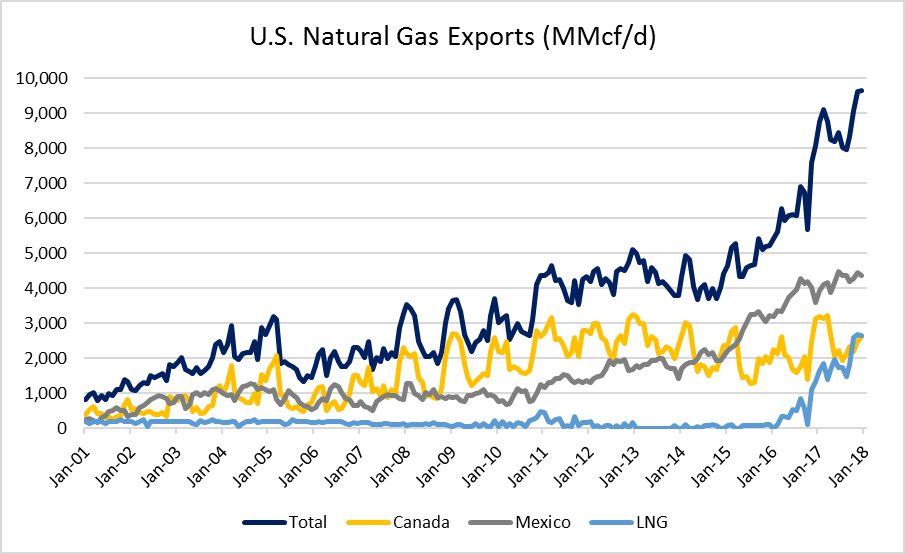

After decades of exclusively importing LNG, American exports of the chilled gas are booming. According to the EIA, shipments of U.S. LNG quadrupled in 2017 averaging 1.94 Bcf/d compared to 0.5 Bcf/d in 2016.

Like last year, all LNG shipments in 2017 came from Cheniere’s Sabine Pass terminal, which sent gas to 25 different countries. In 2017, no other LNG export projects in the U.S. had completed construction and were up and running.

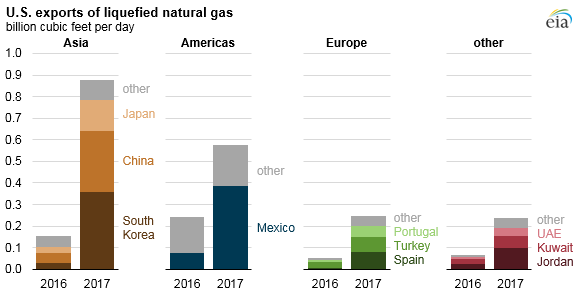

While the total number of destinations have increased, three countries consume more than half of all American LNG output. Mexico, South Korea and China have each established themselves as major demand centers for early U.S. LNG.

Mexico consumes LNG, pipeline gas

Mexico is the largest single consumer of U.S. LNG, which may be surprising as the country already consumes a large volume of pipeline-transported gas. Pipeline gas to Mexico represents 49% of total U.S. gas exports, and the country consumes 20% of LNG exports, so Mexico accounts for 53% of all American gas exports.

Domestic production of natural gas in Mexico is falling, while demand is showing steady expansion. While the country planned to construct additional pipelines to transport American gas, these have encountered delays. Therefore, Mexico must turn to LNG to ensure domestic supply.

Big three of LNG received 41% of all shipments

Factors specific to American LNG make exporting to Asia particularly favorable. U.S. LNG contract prices are indexed to Henry Hub, while most LNG prices in Asia are benchmarked to crude oil. The rise in oil prices in 2017 combined with gas prices that slightly decreased to make importing American LNG very economic. The big three in Asian LNG, South Korea, China and Japan each extensively took advantage of this opportunity, as these countries consumed a combined 41% of American LNG.

While South Korea and China consumed similar volumes in 2017, the countries acquired their gas through different processes. Cheniere and its partner Shell have long-term contracts with the Korean gas-buying companies KOGAS and KEPCO, so this gas was purchased as part of these contracts. China, on the other hand, acquired U.S. LNG almost exclusively on a spot basis.

Long-term contracts do not keep gas off the spot market

Spot contracts accounted for 60% of all American LNG sales, despite the fact that all liquefaction capacity at Sabine Pass is fully contracted under long-term contacts. This is possible because most of these long-term contracts have flexibility in their destination clauses, allowing LNG to be shipped to any market in the world.

American LNG is still getting started, as additional capacity is on the way. The second new LNG export terminal in the country, Dominion’s Cove Point, began commercial operations in 2018, and shipments from the plant will boost export totals for 2018.

There are four projects scheduled to come online in the next two years, Elba Island LNG in Georgia and Cameron LNG in Louisiana in 2018, then Freeport LNG and Corpus Christi LNG in Texas in 2019. When these terminals begin operations, the U.S. will have 9.6 Bcf/d of export capacity, with even more capacity planned. Most projections suggest America will be the third-largest LNG exporter in the world by 2020, behind only Qatar and Australia.