In case you missed it, Alibaba Group (ticker: BABA), the China-based e-commerce group, commenced the world’s largest initial public offering (IPO) today. Its release was delayed hours due to demand imbalances before finally reaching the market. The end result: $22 billion raised in capital, the largest IPO in history, beating out Visa’s six year old record.

Oil and gas companies launching public offerings are climbing as rapidly as the oil and gas sector itself. The oil rig count in the United States reached a new record last week according to Bloomberg, and Barclays projected 2014 spending to exceed $700 billion in a June report.

More Players in the Oil Boom

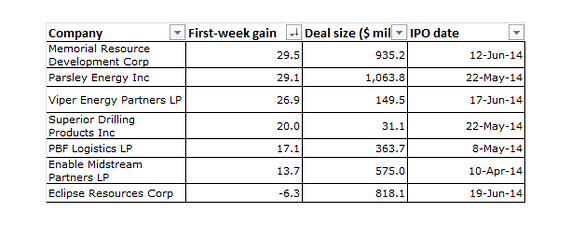

According to The Wall Street Journal, seven oil and gas companies listed U.S.-based IPOs in Q2’14. The share price of those companies climbed an average of 19% in the first week – the best quarterly performance for the sector since 2005. Shares of Memorial Resource Development (ticker: MRD), a presenter at EnerCom’s The Oil & Gas Conference® 19, jumped by 30% in its first week.

By comparison, the gains from oil and gas IPOs are second only to the technology industry, which averaged gains of 21% in Q2’14. On a grand scale, companies averaged gains of 11% in the first week following the IPO.

The results represent a growing trend. Two record breaking IPOs in the oil and gas sector occurred in Q4’13, starting with the offering of Antero Resources (ticker: AR) on October 10, 2013. AR raised $1.57 billion in its debut and watched its stock jump 18% in its first day of trading. The start was upstaged just days later by Plains GP Holdings (ticker: PAGP), a subsidiary of Plains All American Pipeline. PAGP claimed the title of 2013’s largest IPO, weighing in at $2.82 billion. AR ranked fifth overall for the year, but is the largest IPO for an E&P to date. The second largest E&P is Rice Energy (ticker: RICE), which launched in January 2014. Both AR and RICE either commenced or announced the intent to form Master Limited Partnerships (MLP) within six months of their respective IPOs.

Four U.S.-based E&P companies raised $2.4 billion in 2013. The total is the highest since 1998, a year buoyed by the $4.4 billion IPO of Conoco.

It Doesn’t Stop There: MLPs and Acquisitions are Everywhere

Companies are snapping up other organizations as quickly as others enter the market. In August, Dealogic (the source of The Wall Street Journal’s facts) reported 2014 global acquisitions at the time of writing were $79.4 billion via 294 deals on equity capital markets. The total is the highest on record and 79% greater versus the same period in 2013. The leading sector was Utility and Energy with $10.8 billion in 20 deals, followed closely by oil and gas, with $10.0 billion in 32 deals. Overall, energy-based takeovers have accounted for more than 25% of the world’s 2014 acquisitions based on dollar amount.

If mergers are factored into the acquisitions scale, the oil and gas sector was the most active of any of its competitors in 2012. A total of nearly $348 billion was involved in M&A deals, exceeding 2011 totals by 38%, thanks to 11-figure moves by industry giants like ConocoPhillips (ticker: COP) and Rosneft. E&Ps accounted for $252.2 billion (72%) of the sum and roughly $94 billion (27%) of all M&A capital was spent in North America.

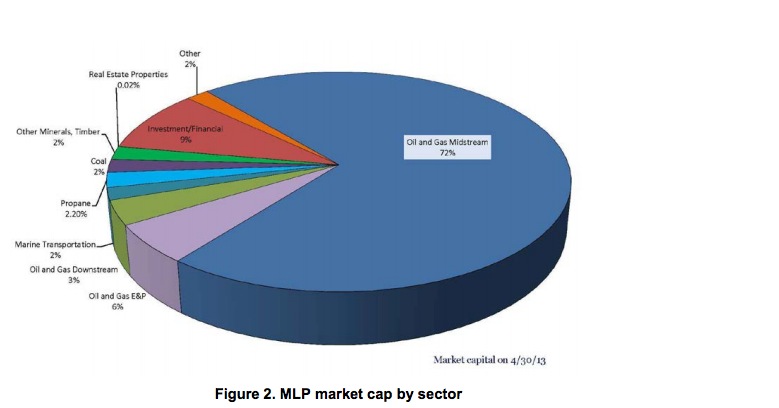

The popularity of MLPs has also skyrocketed due to tax advantages and high yields. In August, Forbes reported at least 17 E&Ps had announced the plan to form MLPs from their existing assets, most of which involve midstream segments. The MLP route is particularly attractive for companies aiming to avoid the volatility of the market.

In an interview with The New York Times, Deborah Byers, managing partner at Ernst & Young, said: “Everybody, whether big integrated players or independent upstream and midstream players, is making significant strategic bets. I’ve been in this business 27 years, and I’ve never seen as many alternative paths as companies seem to take today.”

MLP IPOs Signal “Sea Change”

Kinder Morgan (ticker: KMI), North America’s largest pipeline network, reacquired its subsidiaries in August as part of a $70 billion merger deal. The Kinder Morgan deal was met with surprise from the investment community, and KMI management essentially said it had outgrown the MLP structure. But that doesn’t mean large companies, or even supermajors, for that matter, should stray from the structure, says James Baker of Simmons & Company. Royal Dutch Shell appears to be heeding such advice, announcing in June of IPO plans for its midstream segment in what Baker described as a “sea change event.”

A Forbes article covering the MLP craze mentioned other giants like Occidental Petroleum (ticker: OXY), Hess Corporation (ticker: HES) and Bp plc (ticker: BP) announced interest in spinning off parts of their business. With an estimated $640 billion needed for infrastructure buildout through 2035, the MLP market is unlikely to fade any time soon. Mark Druscoff of Forbes says, “With so much growth potential, MLP insiders may still not get an answer to their question of how big the market can get, but that’s a pretty good problem to have.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom, Inc. has a long only position in Shell.