Algeria’s government owned energy company, Sonatrach, has announced plans to start producing gas from six new gas fields, with initial plans to drill four shale gas wells in 2014 in the basins of Ahnet (south of In Salah) and Illizi, according to an Algeria Press Service report.

“Sonatrach aims to renew oil and gas reserves of the country by mobilizing $102 billion of investment by 2018, 60% of which will be used primarily for the exploration and the production of hydrocarbons,” the report said.

The basins containing technically recoverable reserves are Mouydir, Berkin-Ghadames, Timimoun, Reggane and Tindouf. These fields could produce a total capacity of 74 million cubic meters per day in the next three years, the Algeria Press Service said.

A 2013 report by the U.S. Energy Information Administration said that Algeria had 707 trillion cubic feet (Tcf) of technically recoverable shale gas reserves, more than any country besides China and Argentina. A January 2013 Oil & Gas Journal report said that Algeria had 159.1 Tcf of proven natural gas reserves, the ninth largest natural gas reserves in the world.

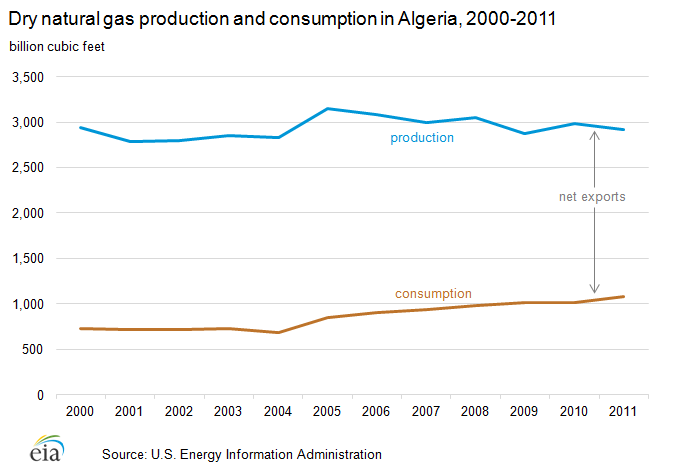

Though it has ample oil and gas supplies to exploit, its production has not yet recovered from a 2005 decline, when oil production was 2,000 BOPD and its natural gas production totaled 3.2 billion cubic feet.

The country’s council of ministers greenlighted the solicitation of foreign partners to help develop the resources, but foreign oil and gas companies have found little incentive to start projects or invest in Algeria due to increasingly severe contract terms. Companies with existing operations in Algeria have made no moves to expand, and the threat of violence thwarts international business interest as well. A terrorist group carried out a four day siege on the Tigantourine gas plant near Amens in January 16, 2013, resulting in 80 deaths after more than 800 people were taken hostage.

In January 2014, the government opened bidding for exploration rights on 31 plots, which Bloomberg said are the size of Germany when combined. The bids will close on August 6, 2014. Sonatrach is the majority partner, retaining a minimum stake of 51%. Rabie Khellafi, GlobalData’s lead analyst covering upstream oil and gas in the Middle East and North Africa, said, “Given the latest terms and other fiscal measures laid out in the amended law, such as cost recovery limits and an average government take of around 70%, the Algerian fiscal terms are not as unforgiving as previously portrayed. In fact, they are within world standards when compared to other countries with equivalent prospectivity.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.