Egypt is the largest non-OPEC oil producer in Africa and the third-largest dry natural gas producer on the continent, according to the EIA’s newest report on Egypt. In recent years, the country has seen political instability accompanied by growing power demand and a recovering energy industry.

Natural gas supply shortages often cause frequent blackouts in Egypt – and 2011’s political turmoil certainly didn’t help deliver any security for its energy picture. But the country has placed a priority on developing its energy resources, eliminating energy subsidies, strengthening its fiscal policy and growing its economy. And with gas supplies from the Zohr, Leviathan and Tamar fields, Egypt is securing the energy it will need for industrial and petrochemical plants, and expanding consumer electricity supply, for the next few decades.

Consumer demand shuts down one of two LNG export facilities

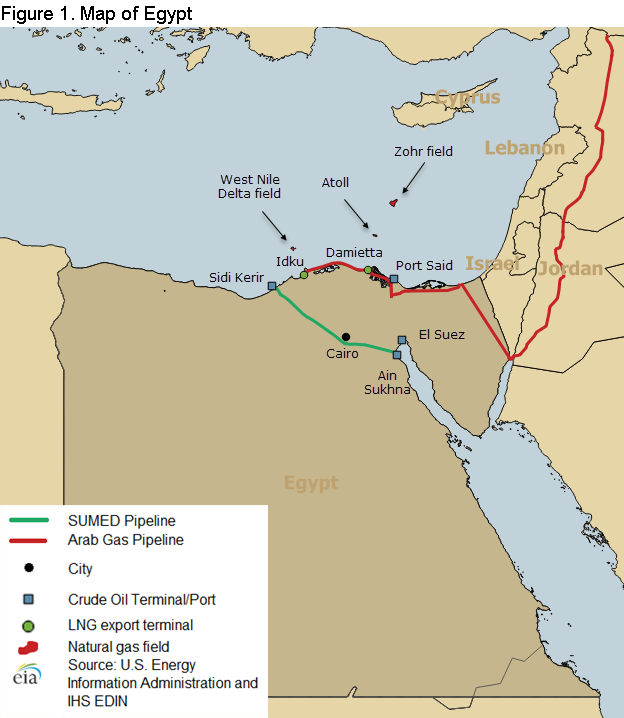

Egypt has two LNG export facilities with a combined capacity of 586 Bcf per year. The Spanish-Egyptian Gas Company (SEGAS) LNG facility in Damietta is a single LNG train with a capacity of 240 Bcf per year and is owned by Union Fenosa Gas (80%) and by EGPC and EGAS (10% each).

The SEGAS LNG facility began production in December 2004, but operated below its nameplate capacity until the plant closed in December 2012 as a result of growing domestic energy demands.

Egypt’s other LNG facility, the Egyptian LNG project (ELNG), is located at Idku and is a joint venture that includes Shell, Petronas, EGAS, EGPC and ENGIE. The facility has two LNG trains, each having a capacity of 172.8 Bcf per year.

ELNG began production in May 2005, but the facility was idle from late 2014 to April 2016 and exports have been sporadic.

In 2016, Egypt exported approximately 26 Bcf of LNG. Most of the exports went to the Asia-Pacific (61%) and the Middle East (24%), according to the 2017 BP Statistical Review of World Energy.

Consumption

Egypt is the largest oil and natural gas consumer in Africa, and it accounted for about 22% of petroleum and other liquids consumption in 2016. The country also consumed 37% of Africa’s natural gas in 2016. Energy consumption is expected to continue growing.

The rapid growth of oil and natural gas consumption has been driven by increased industrial output, economic growth, energy-intensive natural gas and oil extraction projects, population growth, an increase in private and commercial vehicle sales and energy subsidies.

Egypt’s total primary energy consumption was approximately 3.61 quadrillion BTUs in 2016, according to the 2017 BP Statistical Review of World Energy.

According to the EIA, natural gas supply shortages cause frequent blackouts in Egypt – and 2011’s political turmoil certainly didn’t help. The International Monetary Fund (IMF) said political instability caused a drop in foreign investment. However, within the general region, financial support from the United Arab Emirates, Saudi Arabia and Kuwait has improved Africa’s economic conditions.

Investors contribute to energy production by providing capital, which in turn allows foreign and domestic companies to drill new wells, build infrastructure and acquire modern technology offered by international majors.

Eliminating subsidies

The Egyptian government is implementing a reform program that will eliminate energy subsidies, thereby reducing spending and strengthening its fiscal position – these cuts are part of an IMF economic reform package. Energy subsidies are expected to decline to 2.4% of Egypt’s GDP in fiscal year 2017 – 2018 (ending June 30, 2018), from a peak of 5.9% of GDP in 2013 – 2014.

According to the EIA report, energy subsidies have contributed to Egypt’s large budget deficit and created financial challenges for its national oil company, the Egyptian General Petroleum Corporation (EGPC). Subsidies have also deterred foreign operators from investing in the sector. However, quicker-than-expected progress on implementing reforms and recent natural gas discoveries have led to renewed interest among foreign investors in Egypt’s energy sector.

New Zhor gas field

Eni S.p.A. (ticker: E) reported first gas from the Zohr field in late December 2017, marking one of the fastest development processes of an offshore field in recent years.

Discovered in August 2015, Zohr is a large gas field located in offshore Egypt, about 120 miles north of Port Said. Eni estimates the field has resource potential of more than 30 Tcf of gas, or 5.5 billion BOE. Eni announced FID on the field in February 2016, only six months after discovery.

Facilities began test production in late December at a rate of 350 MMcf/d. Bloomberg said that volumes from the field will reach 2.7 Bcf/d by the end of 2019. The project cost $12 billion, with a break-even cost equivalent to $30/bbl.

Noble Energy sells Egypt $14 billion of natgas

Noble Energy, Inc. (ticker: NBL) signed agreements in February 2018 to sell significant quantities of natural gas from the Leviathan and Tamar fields to Dolphinus Holdings Limited.

These agreements, one for natural gas from Leviathan and one for Tamar, each provide for total contract quantities of 1.15 trillion cubic feet of natural gas. The natural gas is anticipated to supply industrial and petrochemical customers as well as future power generation in Egypt, Noble said.

Sales volumes under the agreement associated with the Leviathan field are anticipated to begin at a firm rate of approximately 350 MMcf/d at the startup of the Leviathan project at the end of 2019.

For the Tamar agreement, sales volumes are anticipated to begin at an interruptible rate of up to 350 MMcf/d, dependent upon gas availability beyond existing customer obligations in Israel and Jordan. Noble Energy said it will have an option to convert the Tamar interruptible quantity to a firm-basis with a significant take or pay commitment. Both contracts are for a 10-year term.