Kinder Morgan and EagleClaw announce FID for Permian Highway pipeline project

Kinder Morgan (ticker: KMI) and privately held EagleClaw Midstream have announced a Final Investment Decision on the Permian Highway pipeline (PHP) today, as oil and gas producers and midstream companies continue to react to the massive production growth coming out of the Permian basin.

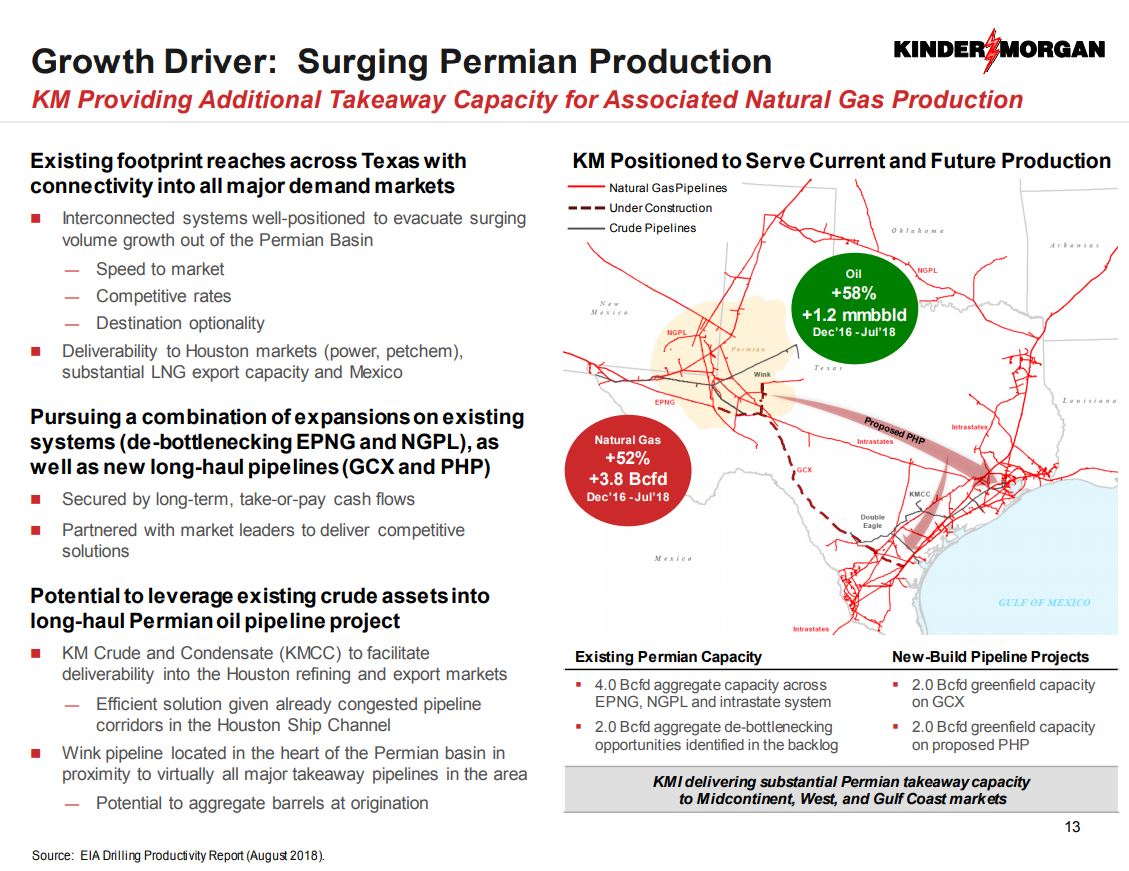

The PHP will provide relief for producers in the Permian, transporting 2 Bcf/day from the basin to Katy, Texas. The 42-inch line is expected to stretch 430 miles and cost $2 billion to construct. Assuming prompt regulatory approval, the line will come online in late 2020.

Capacity of 2 Bcf/day is a significant volume, and represents about 17% of the current output from the play. However, the Permian is still growing rapidly, and Permian-sized output can fill this takeaway capacity surprisingly quickly.

Permian has the fastest growing natural gas production of any basin

The EIA estimates the Permian added about 2 Bcf/d of gas production from December 2017 through August 2018, in only nine months. The Permian stands alone in gas production growth, no other basin grew this much over the past nine months.

Shippers that have already committed to the Permian Highway pipeline include EagleClaw, Apache and XTO.

Kinder Mogan and EagleClaw will each own 50% of the line, but Apache has the option to acquire a large equity stake. Apache has announced if it acquires a stake it will be through Altus Midstream, the venture recently announced between Apache and Kayne Anderson.

“We are very pleased to have reached this important milestone and to have secured the commitments required for all parties to proceed,” said Sital Mody, President of Kinder Morgan Natural Gas Midstream. “With a route identified and the project nearly fully subscribed, we expect to begin stakeholder outreach, environmental surveys and right-of-way activities in the coming months.”

Yesterday, EagleClaw announced its agreement to acquire Caprock Midstream Holdings from Energy Spectrum Capital and Caprock Midstream Management for $950 million plus pre-closing adjustments. The all-cash transaction is expected to close in 2018, the company said. EagleClaw’s current executive leadership team will lead the combined business, which retains the EagleClaw name, the company said in a press release.

EagleClaw Midstream is a portfolio company of Blackstone Energy Partners.