Mobius Intel Brief

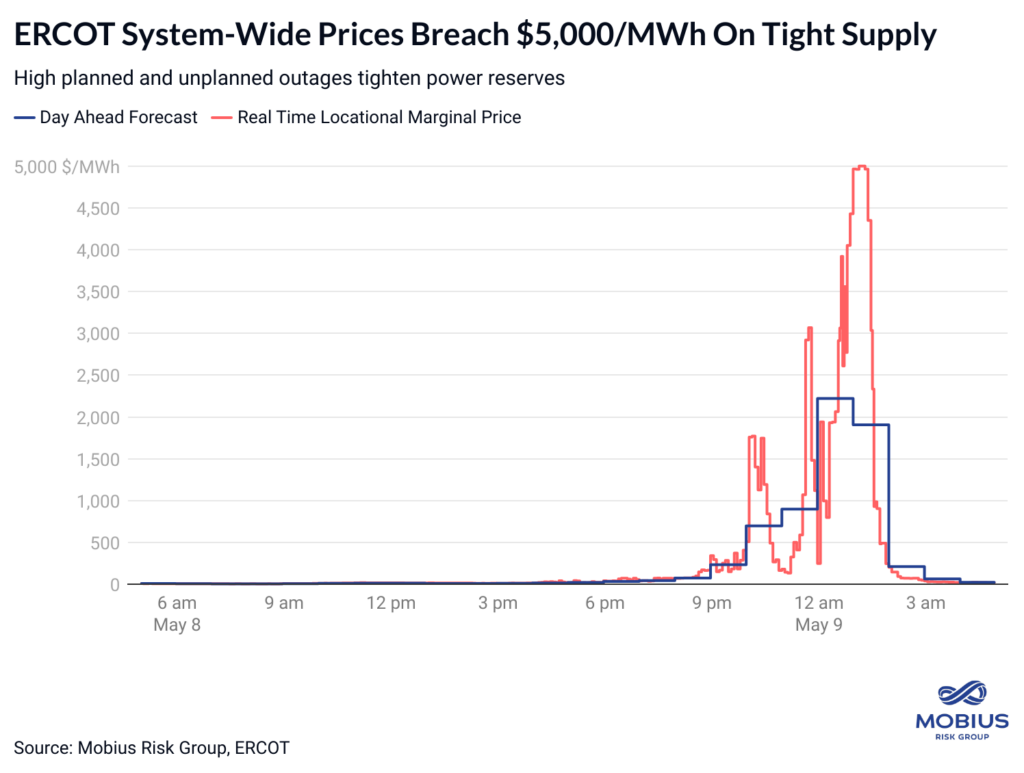

Texas power prices jumped from a high of less than $60/MWh on Tuesday (05/07) to over $5,000/MWh at peak net load on Wednesday (05/08) as record-warm May temperatures and high levels of generation outages combined to pressure system-wide supplies. Variable wind output showed its limitations as a power resource of the future as wind generation fell to its intraday trough at the same time ERCOT load peaked.

ERCOT Breaks $5,000/MWh

ERCOT real-time locational marginal prices set a 2024 high of $5,000/MWh on Wednesday, more than double the system operator’s day-ahead price forecast of $2,221/MWh, as warmer-than-normal temperatures met high levels of planned and unplanned generation outages.

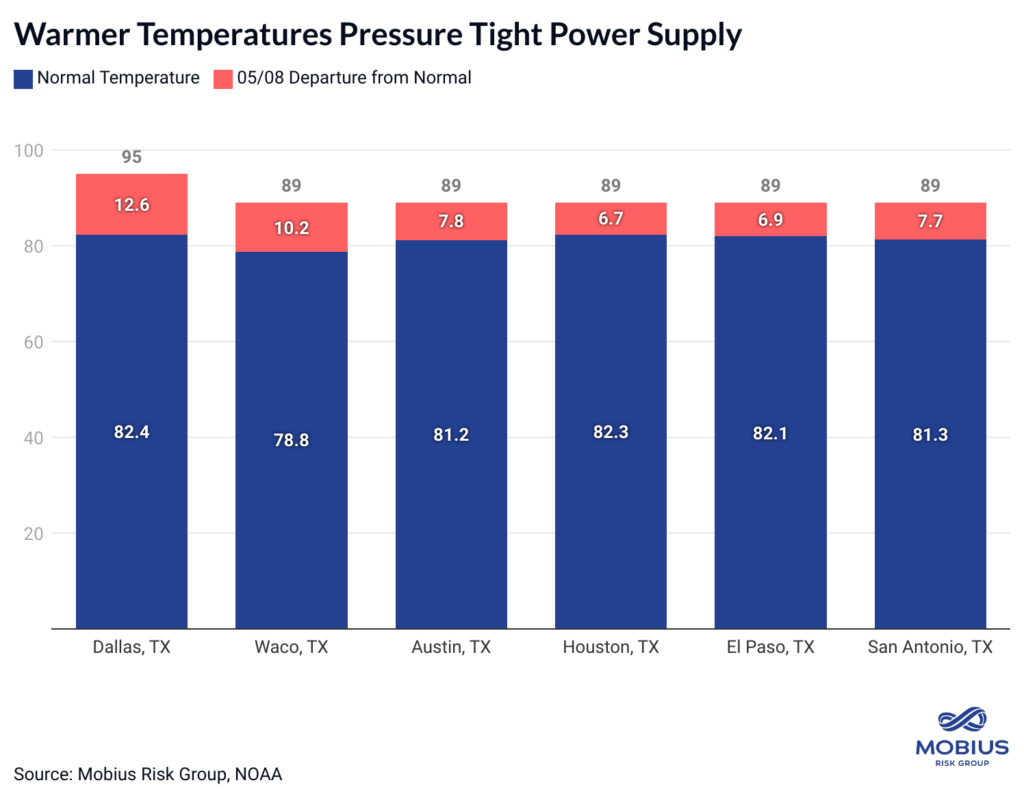

Temperatures in major metropolitan areas ranged from 6.7 to 12.6 degrees warmer than historical normals. Notably, the Dallas-Fort Worth Area posted an all-time high May 8th temperature of 95 degrees Fahrenheit according to data from 1898.

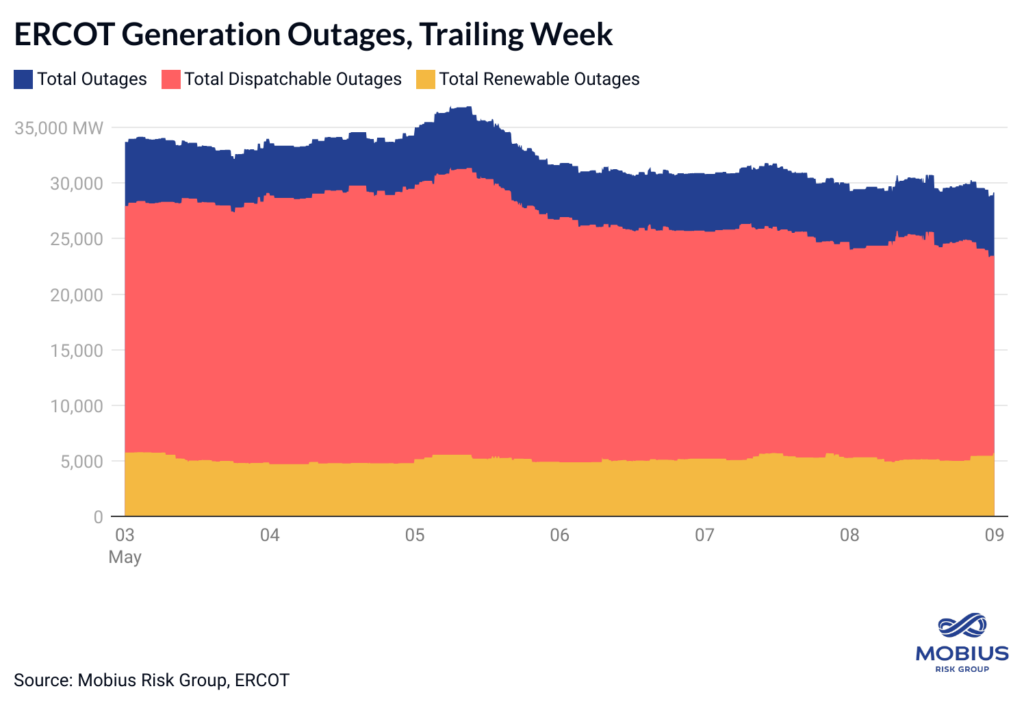

ERCOT issued a weather watch for Wednesday due to “high levels of expected maintenance outages during the spring shoulder months and the potential for lower reserves.”

As highlighted in previous research(1, 2, 3, 4, 5) grid operators are facing increasingly complex resource planning challenges as intermittent generation resources like wind and solar assume a higher share of the overall fuel mix.

Yesterday’s peak power prices of $5,000/MWh occurred when system-wide reserves fell below 5 GW due primarily to volatile wind speeds and declining solar irradiance.

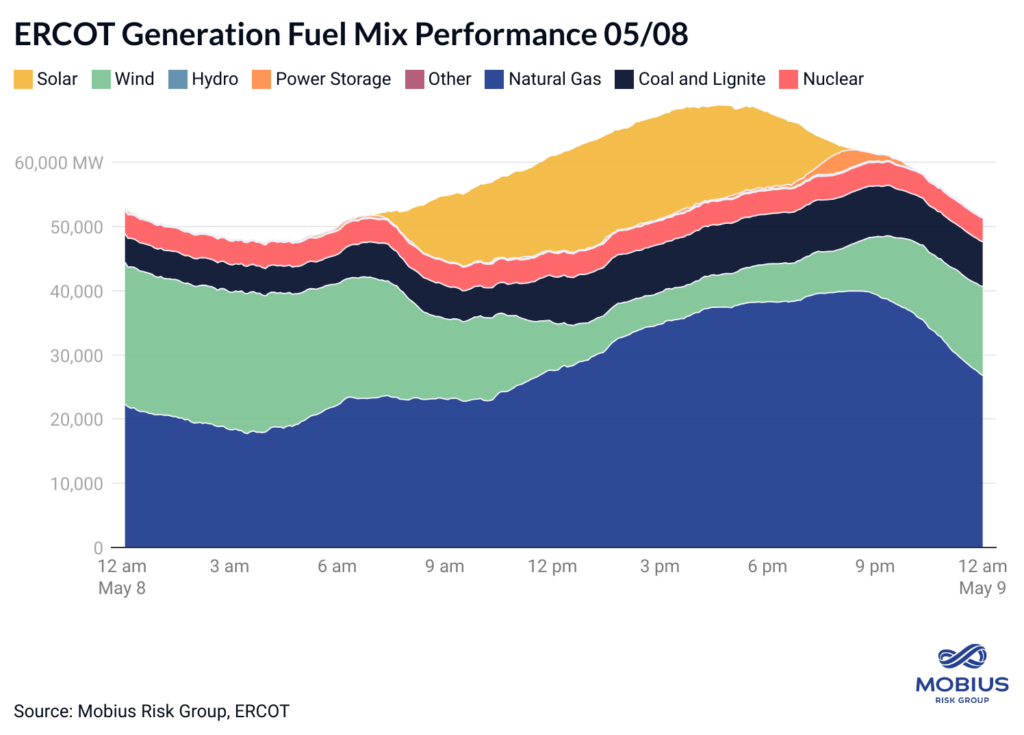

Wind output fell from an intraday peak of 22 GW to an eight-hour trough of sub-7 GW power generation during peak system-wide demand. Likewise, solar generation declined by more than 97% from an intraday peak of over 16 GW to 482 MW at 8:00 pm.

A closer look at ERCOT’s generation fuel mix performance on 05/08 shows the increase in dispatchable and reliable natural gas-fired power output compensating for the massive shortfall in renewable generation.

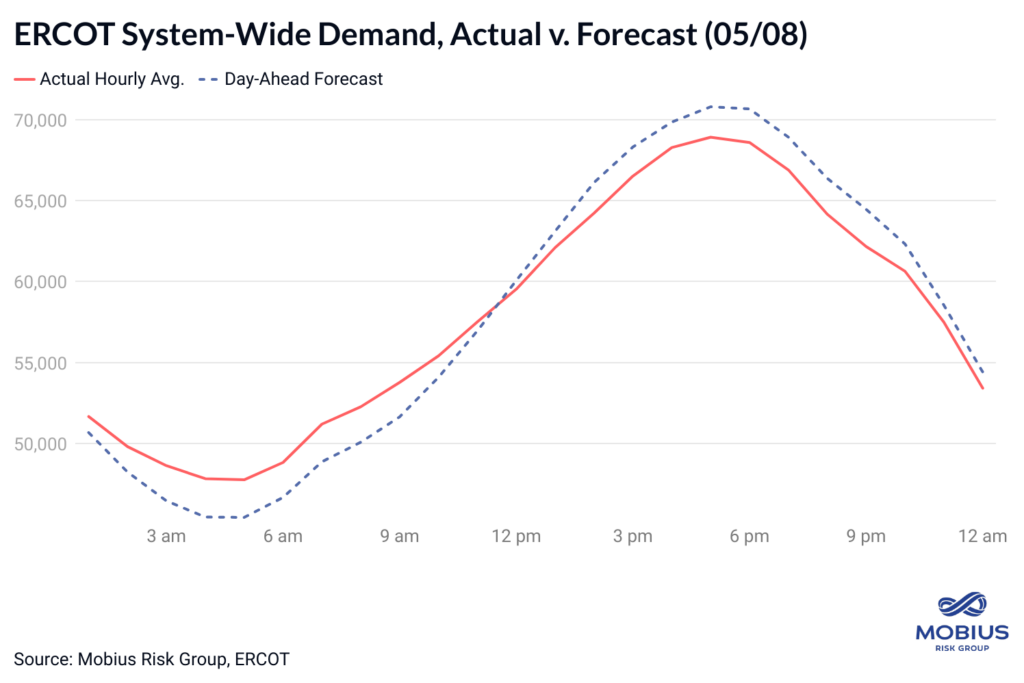

Energy-intensive industry stakeholders should note that yesterday’s spike in power prices occurred when peak load trailed day-ahead demand forecasts.

Furthermore, yesterday’s peak demand is far short of the levels seen during winter and summer when heating and cooling demand is at its highest — yesterday’s peak load reached 68.9 GW versus ERCOT’s summer 2023 peak demand of over 81 GW.

Takeaways:

- Power-intensive sectors will continue gaining exposure to volatile electricity prices as grid operators struggle to accommodate a higher share of intermittent generation resources in the overall fuel mix.

- Price and renewable volatility presents opportunities and risks for traditional energy industries. Opportunities are evident for midstream natural gas stakeholders to expand regional storage and transmission infrastructure in the new era of power demand. Meanwhile, producers will see increasing risks to cash flows as variable renewable output complicates revenue predictability.