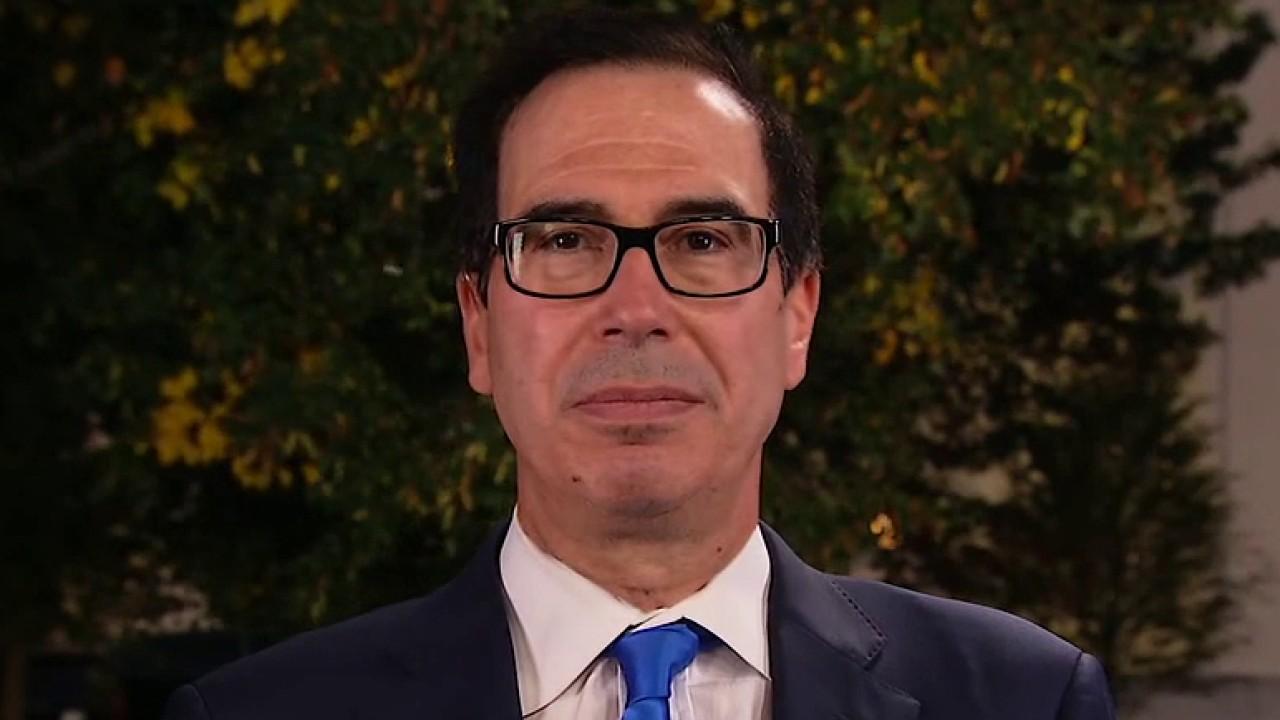

Stocks fell on Wednesday as investors took in another batch of bank earnings and Treasury Secretary Steve Mnuchin cast doubt that additional fiscal stimulus would happen before the election.

The Dow Jones fell 137 points or 0.5%, while the NASDAQ Composite and S&P 500 fell 0.9% and 0.7%, respectively.

Mnuchin said Democratic and Republican lawmakers were “far apart” when it came to deciding on how to support the embattled U.S. economy.

A spokesman for Speaker of the House Nancy Pelosi said Pelosi and Mnuchin had a “productive meeting” this morning and will continue to discuss further stimulus.

In the virtual speech to the Economics Club of New York, Trump promised a “big middle-income tax cut,” as well as reduced tax rates for businesses if he won a second term.

“The choice facing America is simple: it’s the choice between historic prosperity under my pro-American policies, or crippling poverty and a steep depression under the radical left,” Trump said in his speech.

“Under my continued leadership, we will continue our V-shaped recovery and launch a record-smashing economic boom,” he added.

BANK EARNINGS IN FOCUS

In the financial sector, Goldman Sachs was the early stand-out after posting the strongest quarterly results in nearly a decade earning $9.68 a share on $10.78 billion in revenue, compared to $5.57 a share and $9.45 billion that analysts were expecting.

Bank of America topped estimates by 2 cents a share, despite an 11% decline in quarterly revenue. Wells Fargo results also were mixed.

The additional insight into the health of the financial sector comes one day after JPMorgan Chase & Co. and Citigroup Inc. reported better-than-expected results.

Investors continued to eye healthcare names following Johnson & Johnson Inc.’s COVID-19 trial halt due to patient illness which was followed by Eli Lilly & Co.’s halt of the late-stage trial of its monoclonal antibody treatment over potential safety concerns following a recommendation from U.S. health regulators.

In other earnings news, UnitedHealth Group reported earnings that were 42 cents better-than-expected, while also generating more revenue than expected.

And later today United Airlines Holdings Inc. and Alcoa Corp., will both report results after the market closes.

ECONOMIC NEWS

On the economic front, the Producer Price Index (PPI) rose more than expected at 0.4% vs 0.2% a modest inflationary increase.

At 2 p.m., the Federal Reserve will release its Beige Book, providing a reading on the various economic regions throughout the country.

West Texas Intermediate crude oil rose by nearly 2% to $41.00 a barrel, while gold reclaimed the $1,900 an ounce level, up 0.3%.

European markets were slightly higher, shrugging off earlier losses after the U.K. government signaled it would continue to hold trade talks with the E.U. past the Oct. 15 deadline put forth by British Prime Minister Boris Johnson.

[contextly_sidebar id=”xu4x3Iwse9nqEGMFZDsqWSvo2axnT30Y”]