Oil & Gas Publishers Note: This is an excellent article by Nicholas Kunetz, and worth your time to read. He covers an excellent discussion of the carbon capture as a bi-partisan supported climate change discussion in the energy news. There are several key takeaways: (1) Exxon, BP, and other major oil companies have stated plans to move away from fossil fuels and enter into the renewables markets: (2) The majors have initiated plans to be “Carbon Neutral” with dates around 2030; (3) One of the key components in all of the plans include using carbon capture as a tax, and a carbon production “credit” against produced CO2 to assist with ESG scores; (4) The jury is out on the true, and possible harmful, effects of the carbon capture used by Exxon in this example discussed below; and (5) Follow the money. As a commitment to being a good steward of the natural resources on the planet, we all should ask the questions of carbon tax, and as an offset to CO2 production to obtain “Carbon Neutrality”.

The company sells the CO2 to other companies that use it to revive depleted oil fields and has relentlessly fought EPA oversight of the practice.

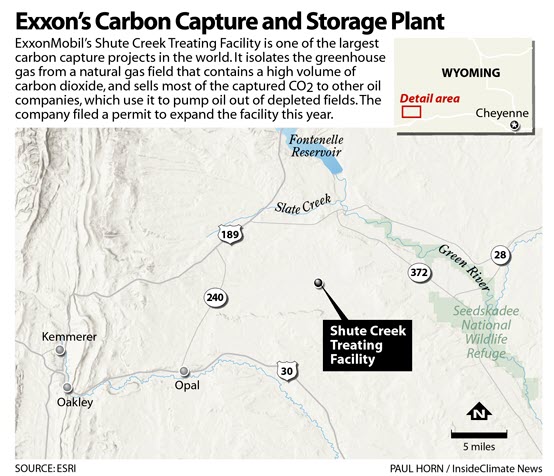

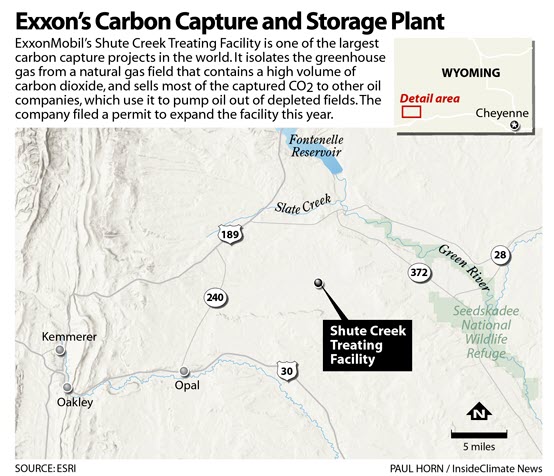

Sprawled across the arid expanse of southwestern Wyoming is one of the world’s largest carbon capture plants, a hulking jumble of pipes, compressors and exhaust flues operated by ExxonMobil.

The oil giant has long promoted its investments in carbon capture technology—a method for reducing greenhouse gas emissions—as evidence that it is addressing climate change, but it rarely discusses what happens to the carbon captured at the Shute Creek Treating Facility.

The plant’s main function is to process natural gas from a nearby deposit. But in order to purify and sell the gas, Exxon must first strip out carbon dioxide, which comprises about two-thirds of the mix of gases extracted from nearby wells.

The company found a revenue stream for this otherwise useless, climate-warming byproduct: It began capturing the CO2 and selling it to other companies, which injected it into depleted oil fields to help produce more oil.

In 2008, when concerns about climate change led Congress to pass a tax credit meant to encourage companies to capture and store carbon dioxide, Exxon was presented with another way to make money from the technology. The massive amounts of carbon dioxide captured at its Wyoming facility put the oil and gas giant in a position to claim more credits under the tax break than any other company.

In the ensuing years, Exxon may have claimed hundreds of millions of dollars in tax credits, according to estimates based on publicly available data from the Internal Revenue Service, the Securities and Exchange Commission, and a global think tank that tracks the technology.

Meanwhile, the company, through its lobbyists, has fought relentlessly to do away with a requirement that companies claiming the credit submit monitoring plans to the Environmental Protection Agency, oversight meant to ensure that the captured carbon dioxide does not escape into the atmosphere.

Environmental advocates say Exxon’s actions offer a prime example of how petroleum companies have used their adoption of carbon capture to deflect demands for more far-reaching action to combat climate change—like reducing fossil fuel production—while at the same time exploiting the technology for maximum profit. Such examples, they say, highlight the risks of relying on the carbon removal method to play a significant role in curbing global warming.

Carbon capture and storage, or CCS, is the rarest of policy breeds: a climate change solution with bipartisan support. Republicans promote the technology as a central piece of any GOP climate plan. Joe Biden, the Democratic nominee for president, has endorsed it, too.

But the most significant policy support for the technology is the tax credit, known as 45Q, for capturing emissions. The emissions, in almost all cases, are then used to increase oil production. Now, as the Trump administration is finalizing rules for an expanded version of the credit, advocates say the administration has capitulated to industry lobbying led by Exxon that would weaken oversight of the process. In June, the IRS proposed that companies be allowed to avoid being regulated by the EPA, a step that could also allow companies to avoid publicly disclosing details of their carbon capture operations.

Environmental advocates say there is good reason to require rigorous oversight: One depleted oil field that has received carbon dioxide from Exxon’s Wyoming facility, for example, repeatedly spewed unknown volumes of the gas to the surface, most likely through old oil wells. In 2016, a nearby school was forced to close after carbon dioxide was detected at dangerous levels inside the school.

………..

(Continued)

An Interesting Marriage

The technology behind carbon capture has been proven to work, but the economics have not. The original 45Q tax credit, enacted in 2008, turned out to be too low to spur much new investment. Most of the 21 large-scale CCS plants operating globally are in the United States and Canada, and all but five of them sell or send the CO2 to bolster oil production, according to the Global CCS Institute.

Many scientists and policy experts say that number has to increase dramatically if the worst effects of global warming are to be staved off. The International Energy Agency said recently that carbon capture capacity must soar to 840 million metric tons by 2030, up from about 40 million today. But the experts add that CCS can play an important role in capturing emissions from industrial processes like manufacturing cement and steel, which account for a significant portion of global emissions.

Attaching the technology to power plants burning fossil fuels is more controversial, because renewable sources have in many cases become a cheaper, emissions-free alternative. There are only two commercial-scale examples, and one of them, a coal plant in Texas, halted its capture of emissions earlier this year as oil prices tanked, because it could not earn enough from CO2 sales to support the plant’s operation.