Starting in mid-March 2020, transportation fuel demand in the United States decreased to record lows as a result of reduced economic activity and stay-at-home orders aimed at slowing the spread of the 2019 novel coronavirus disease (COVID-19). In response to low demand and decreased profitability, as measured by crack spreads, U.S. refiners decreased inputs of crude oil to atmospheric distillation units (ADUs) and decreased processing of fresh feed by downstream units in order to decrease output of certain products. Demand for gasoline and jet fuel fell faster than demand for diesel, and refiners decreased runs in units associated with gasoline production (such as catalytic crackers) more than they decreased runs in units focused on distillate production (such as catalytic hydrocrackers).

From March 2020 (when a national emergency was declared) to April 2020, U.S. demand for gasoline, jet fuel, and diesel fuel decreased. Jet fuel and gasoline demand (as measured by product supplied) dropped the most, decreasing by 50% and 25%, respectively. Diesel fuel demand decreased less than gasoline and jet fuel demand, falling 10% from March to April. Stay-at-home orders and travel restrictions affected gasoline and jet fuel demand more than diesel fuel demand. The decline in gasoline and jet fuel consumption was the result of consumers travelling less. But because diesel fuel is used extensively in trucking, increased demand for home delivery and distribution of necessary goods and services likely supported the volumes of distillate product supplied.

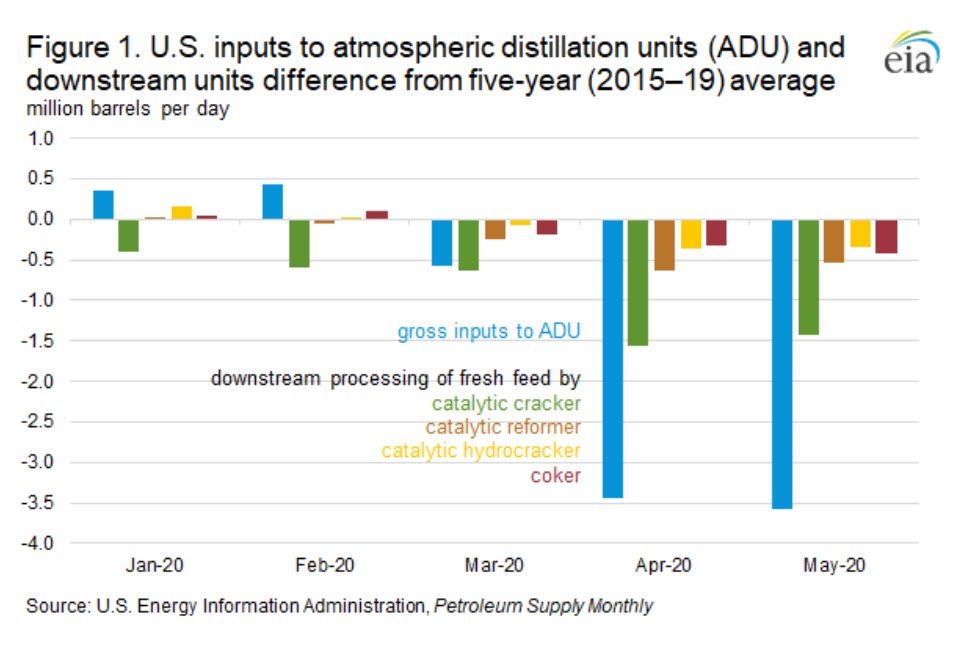

Refiners responded to the changes in transportation fuel demand by decreasing refinery runs, with the largest decreases seen in units focused on gasoline production. Gross inputs to ADUs in April 2020 were 3.4 million barrels per day (b/d) (21%) lower than the five-year (2015–19) average, and gross inputs to ADUs in May 2020 were 3.6 million b/d (21%) lower than the five-year average (Figure 1). Compared with ADUs and other downstream units, inputs to catalytic crackers, associated with gasoline production in a refinery, had the second-largest change on a volume basis from the five-year averages in April and May, averaging 1.6 million b/d and 1.4 million b/d lower, respectively. On a percentage basis, the decrease in inputs to catalytic crackers was the largest out of all units; inputs in April decreased 32% from the five-year average, and inputs in May decreased 29% from the five-year average.

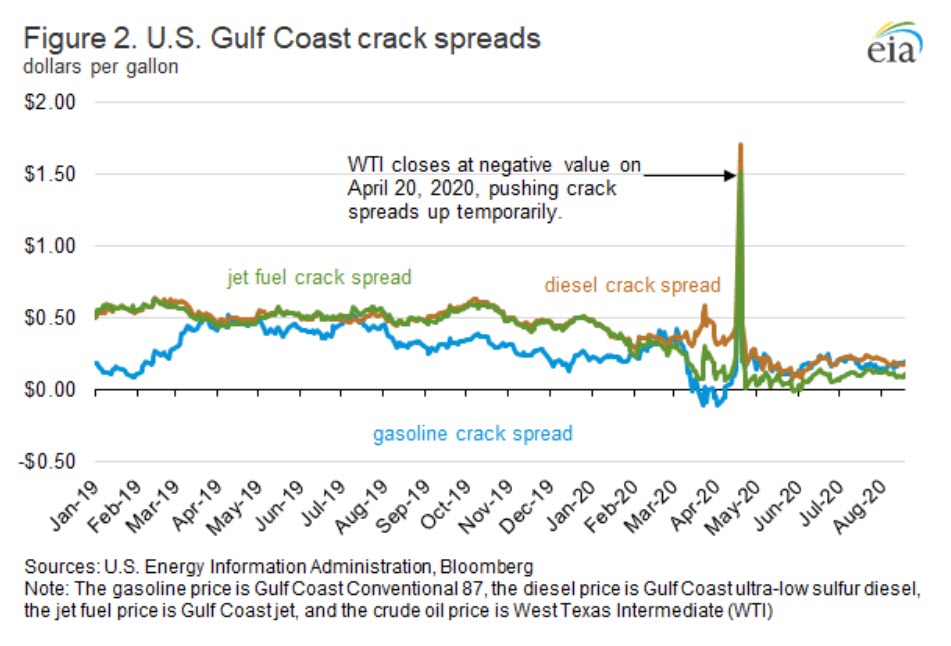

The relative strength in diesel fuel demand supported the diesel crack spread, while the jet fuel and gasoline crack spreads decreased in March and April (Figure 2). Although the jet fuel and diesel crack spreads in the U.S. Gulf Coast typically move together, they diverged in March when jet fuel demand started to decrease. Gasoline crack spreads crossed into negative territory during this time, while diesel crack spreads were steady. Since then, all three crack spreads have remained low compared with 2019, reflecting an overall decrease in demand since the beginning of the national emergency.

Although these crack spread changes coincided with an overall decrease in refinery throughput as refiners worked to accommodate swiftly declining transportation fuel demand across the country, refiners also made changes to their yield slate, or the distribution of refined products they produced, to meet shifting demands and in response to price signals.

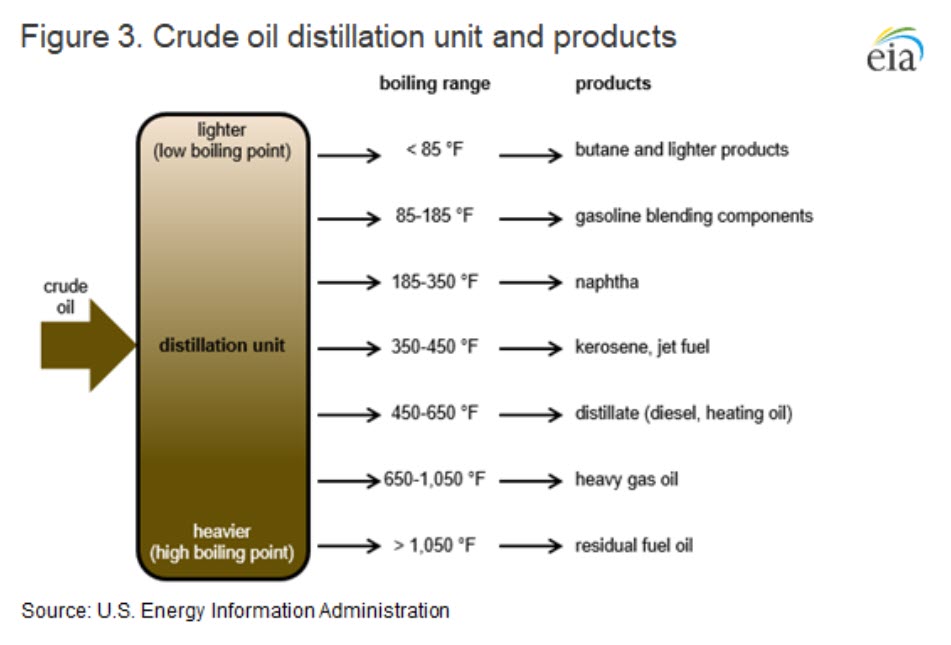

One way that refiners can accomplish a change in yield slate is by adjusting the operation of their distillation towers. For example, jet fuel has a boiling point between that of naphtha and distillate (Figure 3). By changing the process conditions in its distillation columns, a refinery can shift volumes of jet fuel into either naphtha or distillate, thereby reducing the volume of jet fuel produced and increasing the volumes of naphtha or distillate, or both, depending on demand and price signals such as crack spreads.

Refiners can also choose to use certain downstream units more than others to meet specific demand requirements. Given normal market conditions, a decrease in refinery throughput will generally be accompanied by a proportional decrease in the throughput of downstream processing units (that is, catalytic cracker, hydrocracker, and coker). As a result of reduced gasoline demand and low crack spreads, U.S. refiners opted to decrease catalytic cracker throughput more than other units. In April, catalytic cracking processing was approximately 32% lower than the five-year average, compared with a 21% decrease in overall ADU throughput.

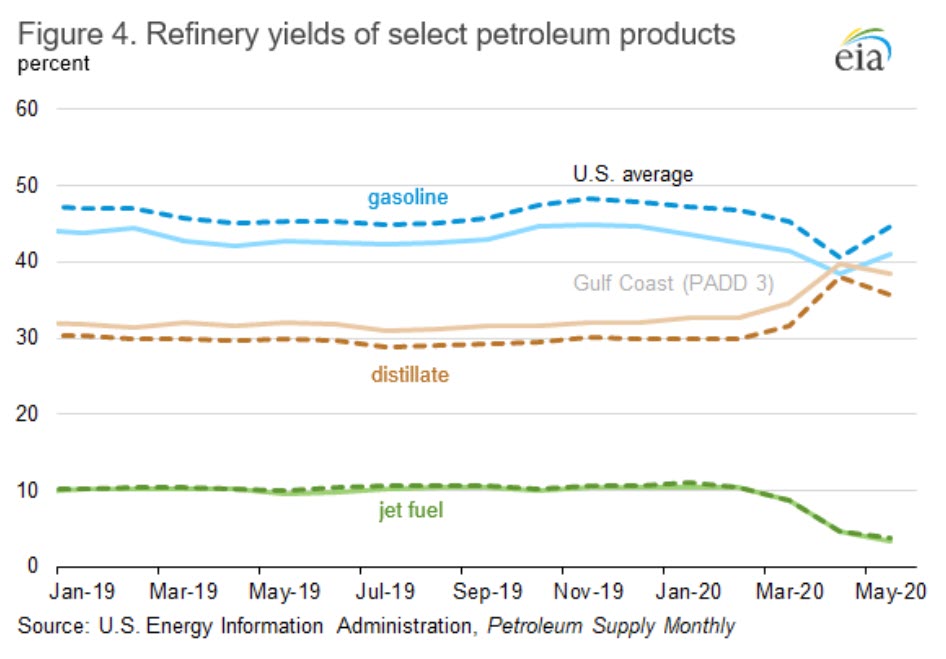

To compensate for the record decline in jet fuel and gasoline prices, U.S. refineries shifted their yield slate away from gasoline and jet fuel and produced more distillate fuel (Figure 4). In 2019, U.S. refinery finished motor gasoline yield was 46.2%, and distillate fuel yield was 29.7%. In April 2020, U.S. gasoline yield fell to 40.7%, a record low, while distillate yield rose to a record high of 38.1%. In the U.S. Gulf Coast (Petroleum Administration for Defense District, or PADD, 3), distillate yields were higher than gasoline yields in April for the first time on record. Compared with 2019 levels, jet fuel yields at the U.S. level and in PADD 3 decreased by more than 50% to 4.7% and 4.6%, respectively, in April. Jet fuel yields on the East Coast (PADD 1) decreased substantially compared with last year. East Coast refiners reported less than 0.1% jet fuel production in April and May, compared with a five-year average of approximately 7.6%. As demand for transportation fuels began to increase in May, refinery throughput and yields have begun to return to historical levels, although U.S. jet fuel production is still significantly lower than any other time since 1993.

U.S. average regular gasoline price steady, diesel price falls

The U.S. average regular gasoline retail price was unchanged from the previous week at $2.17 per gallon on August 17, 43 cents lower than the same time last year. The Gulf Coast price increased nearly 4 cents to $1.85 per gallon, and the West Coast price increased nearly 1 cent, remaining virtually unchanged at $2.83 per gallon. The Rocky Mountain price fell more than 2 cents to $2.34 per gallon, the Midwest price fell nearly 1 cent to $2.05 per gallon, and the East Coast price fell nearly 1 cent, remaining virtually unchanged at $2.09 per gallon.

The U.S. average diesel fuel price fell less than 1 cent, remaining virtually unchanged from the previous week at $2.43 per gallon on August 17, 57 cents lower than a year ago. The East Coast and Gulf Coast prices each fell nearly 1 cent, remaining virtually unchanged at $2.51 per gallon and $2.18 per gallon, respectively, and the Rocky Mountain price fell less than 1 cent, remaining virtually unchanged at $2.37 per gallon. The West Coast and Midwest prices each increased by less than 1 cent, remaining virtually unchanged at $2.96 per gallon and $2.31 per gallon, respectively.

Propane/propylene inventories decline

U.S. propane/propylene stocks decreased slightly last week, remaining virtually changed at 89.3 million barrels as of August 14, 2020, 8.3 million barrels (10.3%) greater than the five-year (2015-19) average inventory levels for this same time of year. Gulf Coast and East Coast inventories decreased by 0.4 million barrels and 0.3 million barrels, respectively. Midwest and Rocky Mountain/West Coast inventories increased 0.4 million barrels and 0.1 million barrels, respectively.