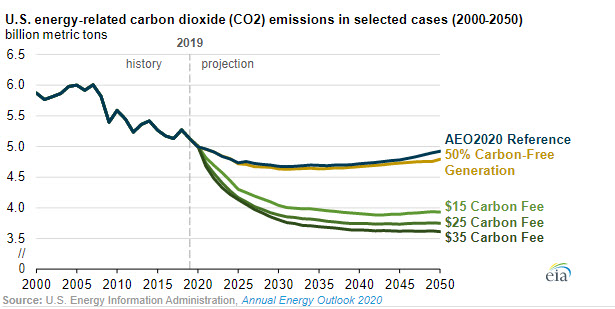

To explore the uncertainty associated with the assumption of current laws and regulations in its Reference case, the U.S. Energy Information Administration (EIA) will release an Issue in Focus article to its Annual Energy Outlook 2020 (AEO2020) later today. The AEO2020 Reference case generally assumes existing laws and regulations remain as enacted. However, policies that target emissions reductions have changed significantly over time. The EIA Issue in Focus article discusses results from sensitivity cases associated with four alternative policy topics, with varying effects on projected U.S. carbon dioxide (CO2) emissions in 2050.

50% Carbon-Free Generation case: This sensitivity case assumes that all states achieve at least 50% of electricity sales by 2050 from carbon-free generation sources, but this case results in only 3% lower energy-related CO2 emissions in 2050. In 2019, 40% of U.S. electricity sales were generated by carbon-free technologies. In this case, wind and solar photovoltaic (PV) generation remain unchanged until later in the projection period, when wind generation increases to 10% higher and solar PV generation increases to 17% higher than in the Reference case in 2050. Nuclear generation helps meet the carbon-free generation requirements, resulting in 19% higher nuclear generation in 2050 compared with the AEO2020 Reference case.

Renewable Portfolio Standards (RPS) Sunset case: This sensitivity case shows that eliminating current state RPS policies reduces renewable generation by 4% by 2050 compared with the AEO2020 Reference case. Total U.S. energy-related CO2 emissions would be 1% higher in 2050 relative to the AEO2020 Reference case, or 3% lower in 2050 than in 2019.

Carbon Fees: Three cases assume economy-wide implementation of fees to CO2 from fossil-fuel combustion for energy, resulting in somewhere between 20% and 27% lower energy-related CO2 emissions in 2050 than in the AEO2020 Reference case, depending on the fee. The three carbon fee cases assume fees of $15, $25, and $35 per metric ton (mt) of CO2 beginning in 2021, and these fees rise by 5% per year in real 2019 dollars through 2050. Carbon fees are not applied to other gases, such as methane. The cases show that energy-related CO2 emissions decline early in the projection period before leveling off in the late 2030s. The electric power sector is the most responsive to carbon fees, and coal loses market share to natural gas and renewables even faster than projected in the Reference case.

No Affordable Clean Energy Rule: This sensitivity case assumes the U.S. Environmental Protection Agency’s existing Affordable Clean Energy (ACE) Rule—which replaces the repealed Clean Power Plan—is not implemented and that all coal-fired power plants continue to operate at their current efficiency levels through 2050. This assumption results in slightly higher CO2 emissions in 2050 than in the AEO2020 Reference case. In this case, fewer coal-fired power plants retire, and coal-fired electricity generation falls at a slower rate relative to the Reference case. By the 2040s, less-efficient coal-fired capacity is either dispatched at lower operational levels or remains in service to satisfy reserve requirements rather than to meet growing electricity demand.

Utility Rate Structure: Varying assumptions regarding compensation of residential PV generation produces no significant change in energy related CO2 emissions in 2050 compared with the AEO2020 Reference case. The AEO2020 Reference case and main side cases assume residential PV generation is compensated at retail electricity rates. In these cases, residential PV generation is compensated using wholesale retail rates, which are lower. This assumption increases payback periods and leads to fewer installations and less residential PV generation. With less onsite electricity generation, electricity sales from utility-scale power plants increase slightly relative to their AEO2020 case counterparts.

The full Issue in Focus article provides detailed discussions of the assumptions and results. Future Today in Energy articles will discuss these cases in more depth.