$9.2 billion transaction close second to $9.5 billion CXO-RSPP deal

Diamondback Energy (ticker: FANG) continued the recent trend of consolidation in the Permian with the acquisition of Energen (ticker: EGN). This $9.2 billion all-stock deal adds to an active year for large M&A transactions. This deal is the second-largest Permian transaction ever, falling just short of Concho’s (ticker: CXO) $9.5 billion acquisition of RSP Permian earlier this year.

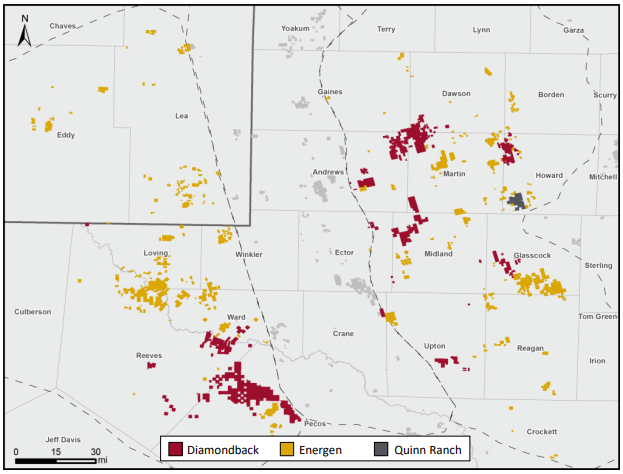

This deal will allow Diamondback to nearly double many of its key metrics. Energen currently produces 97.4 MBOEPD, compared to Diamondback’s 124.7 MBOEPD. Diamondback’s net Permian acreage will increase from 211,000 acres to 390,000 acres, an increase of 85%.

A significant portion of the added acreage is in the Central Basin Platform, but Diamondback’s “Tier One” acreage will still grow by 56%. The largest change for Diamondback will be its drilling inventory, which is expected to increase to roughly 7,100 wells, a jump of 123%.

$2.3 billion in total synergies forecasted

Diamondback expects to realize significant synergies from the deal, as the combined company can better optimize several facets of the business. Synergies in completions, G&A costs and interest expenses are expected to total around $250 million per year, with additional possible savings from lower operating expenses and complimentary acreage, among other synergies.

Diamondback will pay 0.6442 shares of Diamondback stock for each share of Energen stock, representing $84.95 per share at Monday’s closing prices. This is a premium of 19%. In total, Diamondback will pay about $8.4 billion in stock to Energen, and will also assume the company’s $830 million in net debt.

Upon closing, Energen shareholders will own about 38% of the company.

Somewhat unusually, however, Diamondback’s board and executive team will remain unchanged. In many such M&A deals between similarly-sized companies the resulting board and executive team becomes a combination of members from each company. When Concho acquired RSP Permian it added a board member from RSP’s board.

Diamondback estimates the sale will close in Q4 2018.

By comparison: deal is cheaper than Concho-RSP, more expensive than smaller transactions

Recent Permian deals mean there are several transactions that can be compared to Diamondback’s purchase of Energen. The most similar, of course, is Concho’s purchase of RSP Permian, as both are very large corporate deals. More recent deals are also relevant, as Diamondback’s acquisition of Ajax Resources and Carrizo’s purchase of bolt-on acreage from Devon, announced the same day.

In unadjusted price paid per acre this deal is remarkably comparable to Concho’s purchase of RSP Permian, both transactions valued acreage at about $103,300 per acre. The smaller Ajax and Carrizo deals involved much lower acreage valuations, $48,800 and $22,400, respectively.

If production is valued at $35,000 per flowing BOE, the acreage values in recent Permian deals diverge. The Diamondback-Energen deal has an adjusted value per acre of $67,800, compared to Concho’s $82,00, Ajax’s $32,200 and Carrizo’s $13,300.

| FANG-EGN | CXO-RSPP | FANG-Ajax | CRZO-DVN | |

| Total Value | $9.2 Billion | $9.5 Billion | $1.245 Billion | $215 Million |

| Acreage | 89,000 | 92,000 | 25,500 | 9,600 |

| Production (MBOEPD) | 90.4 | 56 | 12.1 | 2.5 |

| Value/Acre | $103,371 | $103,261 | $48,824 | $22,396 |

| Adjusted Value/Acre | $67,820 | $81,957 | $32,216 | $13,281 |

If the transaction is simply valued based on production and reserves, Diamondback’s purchase price equates to $94,456 per flowing BOE, or $20.72 per proved BOE. These metrics can be used to evaluate other Permian players, as they are clearly a price one company is willing to pay in M&A in the basin.

Many Permian players are valued below the price Diamondback paid for production, with only a few companies exceeding this level. Both Jagged Peak and Parsley have enterprise values above $100,000 per BOE, but most other Permian companies are near $50,000 per BOE. The price paid for reserves is much more in line with current valuations in the basin, as Permian companies are currently valued at an average of $22.67 per BOE. Companies with low valuations may become a target for further M&A, as the industry continues to consolidate.

Diamondback CEO Travis Stice commented, “The size and scale that the transaction brings forth will further improve Diamondback’s long-term strategy of return on, and return of, capital. Our industry has transformed into a manufacturing business and the operator that converts resource into cash flow at the lowest cost will win in the long run. This transaction adds critical mass for Diamondback and enables us to achieve more efficient operations through multiple, clearly defined, deliverable synergies.”

Q&A from FANG-EGN conference call

Q: Jumping into it, just on by the activity and then looking at just rig-wise, you had about 13, Energen has about 10 running. So I’m wondering now, when you see this deal close towards the end of the year, are you going to be running around the same amount of rigs? And if so, really what’s the driver? Is it going to be cash flow? Or what really is driving that plan?

FANG: While we’ve not provided a lot of detail on what 2019 looks like, I think it’s reasonable to assume we’ll just continue activities that both companies are currently running as you look into 2019. The driver next year is going to be the same driver it’s been for the last couple of years. We’re going to look at cash flow and we’re going to allocate capital, including dividend to match that cash flow, that’s been a pretty consistent message of ours. And we’ll continue to be consistent on the go-forward plan.

Q: So probably wouldn’t jump the amount of rigs because of the synergies or anything like that, you don’t see yourselves going from 23 to 30 or anything like that initially?

FANG: No, I think Energen had spoken about being cash flow neutral in 2020. I think with our operating metrics on a five-rig Midland program, that certainly allows that cash flow breakeven to move into 2019 or almost right away. So with the synergies that we’re talking about here, I think the pro forma plan at 23 rigs or so at the start is where we’ll start and assess the growth as cash flow allows.

Q: Regarding your assessment of Tier One acreage for Energen, could you comment on the data and the process used in your analysis as it seems a touch overcritical on first blush? And, Travis, what we’re looking at is our quick math simply based on six counties would suggest at least 120,000 net acres in the core fairways in the Midland and Delaware.

FNAG: We took an approach that we wanted one zone with a 50% IRR at today’s realized prices. It’s not a perfect science, but this is the first time we’ve disclosed this at the Diamondback level as well, Tier One acreage perspective. So, obviously, there’s upside from zone delineation and testing new areas, but this is what we knew today and we took our best guess and wanted to disclose as much as we could in this deck.

Q: I understand you guys commented rig count pro forma is probably not going to change plus or minus that much, if at all. But in terms of development approach and pad sizes and that sort of thing given the pro forma asset base should be better able to withstand longer cycle times in the larger pads, is that something you guys are thinking about early on here? I guess can you talk about how the pro forma development approach might change, if at all?

FANG: We signaled the market during our exploration of Ajax that that asset was going to start off with 12 well pads. And while we’ve not made a lot of pomp and circumstance about our migration to larger multi-well pads, that’s what we’ve been doing now for multiple quarters now.

Energen is really probably one of the first companies in deploying large multi-well pads, and we plan to continue accelerating our transition from four-well pads to greater than four-well pads, and instead of single zones, more than single zones.