Utica sale values assets at 4.4x EBITDA

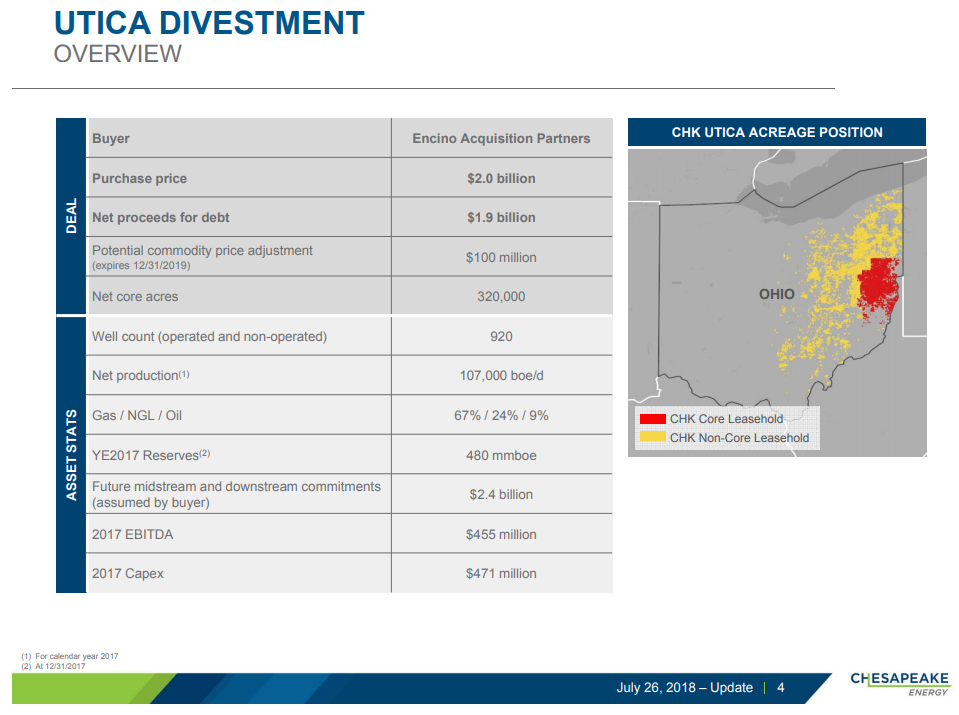

Chesapeake Energy (ticker: CHK) announced a major divestiture last week, selling its Utica assets in a $2 billion transaction.

Chesapeake will sell all of its acreage in Ohio to privately-backed Encino Acquisition Partners for $1.9 billion cash and $100 million contingent on natural gas prices. In total Chesapeake divested more than 900,000 net acres, though the company reports about 320,000 net acres are core. There are 920 gross wells on this acreage, producing a net 107 MBOEPD. The divested assets had 480 MMBOE of reserves in 2017.

Chesapeake estimates it will save significant funds through this transaction, as future midstream and downstream commitments total $2.4 billion. The company’s gathering and transportation spending is also expected to fall by $450 in 2019 due to the sale.

Chesapeake reports its Utica properties produced about $455 million in EBITDA in 2017, meaning the sale valued the assets at 4.4 times EBITDA. Essentially all the purchase price can be attributed to paying for production, assuming standard valuations for flowing gas, NGL and oil production.

Chesapeake intends to pour all proceeds from the sale into debt reduction, significantly reducing its overall debt load. The company’s leverage will drop from roughly 4.1 times EBITDA to 3.5x after the sale, a large change for a company with $9.5 billion in debt. While this is in line with Chesapeake’s strategic goals as announced in its 2018 annual meeting, the company is ultimately targeting net debt to EBITDA of 2.0x, so more sales will be needed.

Powder River Basin production to double in 2019

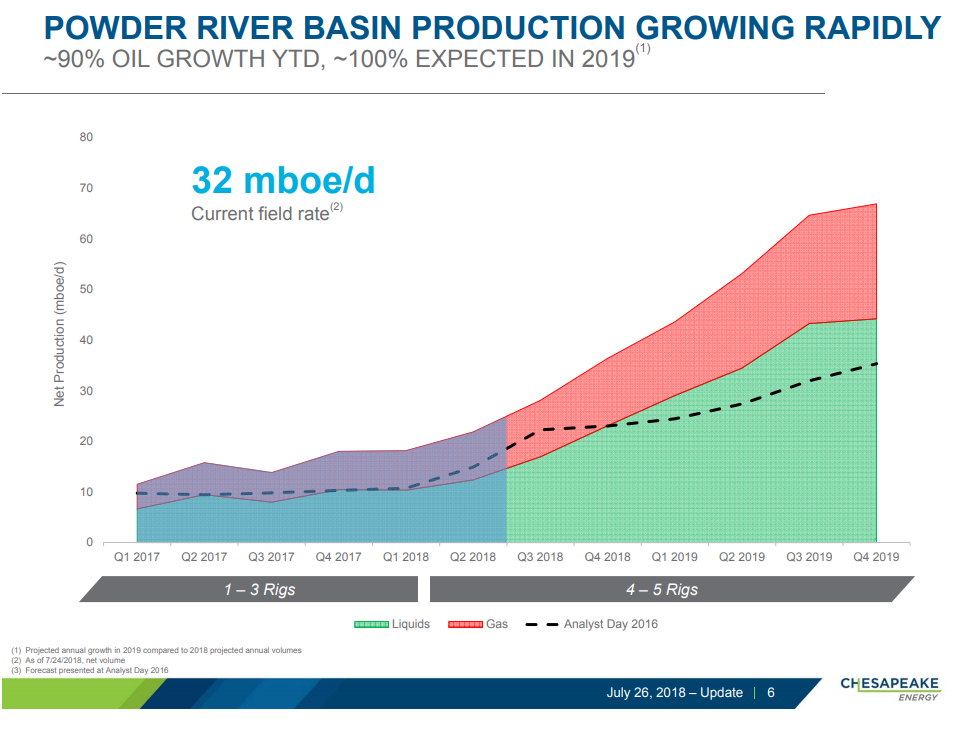

Chesapeake also announced major plans to replace the divested EBITDA, as the company is ramping up its Powder River Basin activity significantly. Chesapeake recently added a fifth rig to its PRB drilling program and is predicting massive growth in the basin over the next two years.

Powder River production is already growing quickly this year, as Chesapeake produced 32 MBOE from the basin immediately before this sale. This represents growth of over 75% compared to Q4 2017 output. Production is expected to reach 38 MBOEPD by the end of 2018.

Even more robust growth is expected in 2019, as Chesapeake predicts doubling Powder River Basin output in the year. This growth is expected to replace the divested $455 million in EBITDA within one year.

Chesapeake President and CEO Doug Lawler commented on the sale, saying “By divesting our position in the Utica and using the proceeds for debt reduction, we will not only significantly improve the health of our balance sheet, but we will also accelerate progress toward our strategic goals of reducing our debt, improving our margins and reaching sustainable free cash flow neutrality.”

“Moving forward, we will continue to target our long-term goal of improving our leverage ratio to two times net debt to EBITDA. We remain committed to generating higher returns on invested capital by directing our investments to the highest-return opportunities across our five diverse, multi-zone basins. With the addition of a fifth rig earlier this month, we believe our position in the PRB will lead our organic oil volume growth, driving further leverage reduction, enhancing our margins and improving our free cash flow. As a result, we anticipate growing overall oil production approximately 10% year over year in 2019, adjusted for asset sales, with additional growth forecasted for 2020.”