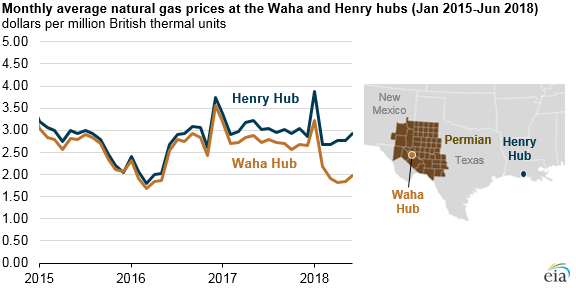

According to the EIA’s most recent Drilling Productivity Report, the natural gas spot price spread between the Permian Basin, as priced at the Waha Hub in western Texas, and the U.S. national benchmark Henry Hub in Louisiana has grown dramatically thanks to increased Permian production.

Natural gas prices at Waha are approximately one dollar per MMBtu lower than Henry Hub prices and will continue to widen due to the takeaway bottleneck in the Permian.

June’s average natural gas production was up 2.1 Bcf/d from last June to 10.4 Bcf/d, which was largely just a byproduct of increased crude oil production. Average crude oil production YOY for June also increased 0.9 million barrels per day to 3.3 million barrels per day.

As these price differentials continues to grow more companies will be forced to flare more and more gas or even worse. Shut in wells.

There is a glimmer of hope on the horizon with several new pipelines currently under development:

- Gulf Coast Express Pipeline (2.0 Bcf/d capacity)

- Permian to Katy Pipeline (1.7 to 2.3 Bcf/d capacity)

- Pecos Trail Pipeline (1.9 Bcf/d capacity)

The Gulf Coast Express is the only project of the three that is currently under construction with an expected in-service date of October 2019.