Oil & Gas 360® takes a look at three companies with operations in the Permian:

- Halcón Resources Company (ticker: HK)

- Approach Resources Company (ticker: AREX)

- Apache Corporation (ticker: APA)

Halcón Resources

Production for the first quarter of 2018 averaged 10,967 BOEPD for Halcón, comprised of 70% oil. This production rate represents a 75% growth rate from the fourth quarter of 2017.

The company has planned its 2019 program, with five rigs scheduled for most of the year. Drilling completion CapEx, at this time, is estimated to be less than $550 million, producing 35,000 BOEPD. Halcón plans to exit 2019 with over 40,000 BOEPD.

Halcón conference call Q&A, production excerpts

Q: About the rigs, effectively three running in Monument Draw, effectively the rest of this year and one kind of bouncing back from West Quito and maybe going to Hackberry a bit, is that correct? And then as you look at 2019, how should we kind of think about positioning?

Halcón CEO Floyd C. Wilson: Most likely, once we start at West Quito, we’ll keep that rig there. So, one rig might bounce a little bit between Monument and Hackberry, but we don’t have too many wells planned.

I don’t know the exact number; two right away and then another couple later in the year. So, primarily at two to three rigs at Monument and one rig at West Quito.

We’re receiving some 3-D seismic down in Hackberry, which we think will help us fine-tune. We’re getting great results down there, but we think they can be improved with a little help from the seismic. So, we’re using this pause to finish that work.

Q: Your Q4 guidance implies that your production trajectory is going to be picking up steam as you enter 2019. And I just would love to get a sense for how you think you’re set up for next year.

Wilson: We’re looking to produce about 35,000 barrels a day now for 2019 on average and exit the year well over 40,000 barrels a day.

This is just driven by the mix of more Monument Draw wells, more West Quito wells. And we’re making great wells at Hackberry, but a fewer of those and five rigs.

So, yes, we’re expecting our path, which is slightly back-end weighted this year, to be a fairly smooth upward trajectory in terms of production. And we’ve got the rigs on hand and we’re already experiencing that, as you know.

We were basically a startup about a year ago with 3,000 barrels a day or 3,500. So, we’re moving mountains to make our numbers.

Approach Resources

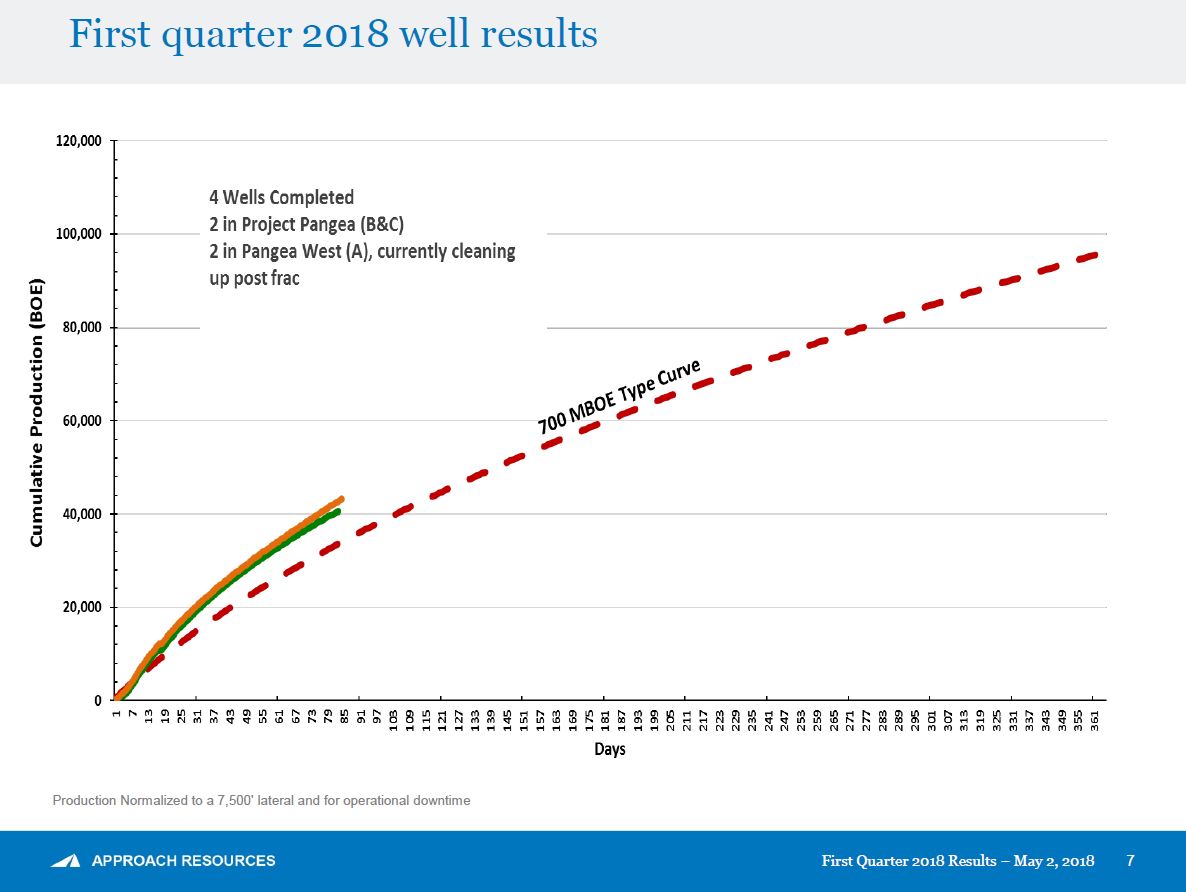

Production for Q1 2018 averaged 11.3 MBOEPD. Approach completed four wells in the quarter, two in the Pangea area and two in the Pangea West area. Of the four wells, two targeted the Wolfcamp A bench and the other two wells were in the Wolfcamp B and C. As of March 31, 2018, Approach had six horizontal wells waiting on completion.

Two wells in the Pangea area are performing above the company’s 700 MBoe type curve by ~22%.

“The two Pangea wells are performing above our 700 MBoe type curve,” Approach CEO Ross Craft said. “The two Pangea West wells are in the post-frac flowback and clean up stage… We continue to experiment with our completion techniques and are pleased with the solid results we are realizing.”

According to the company’s Q1 presentation, one completion technique involves pumping metal oxide nanoparticles throughout the stimulation treatment.

105% better

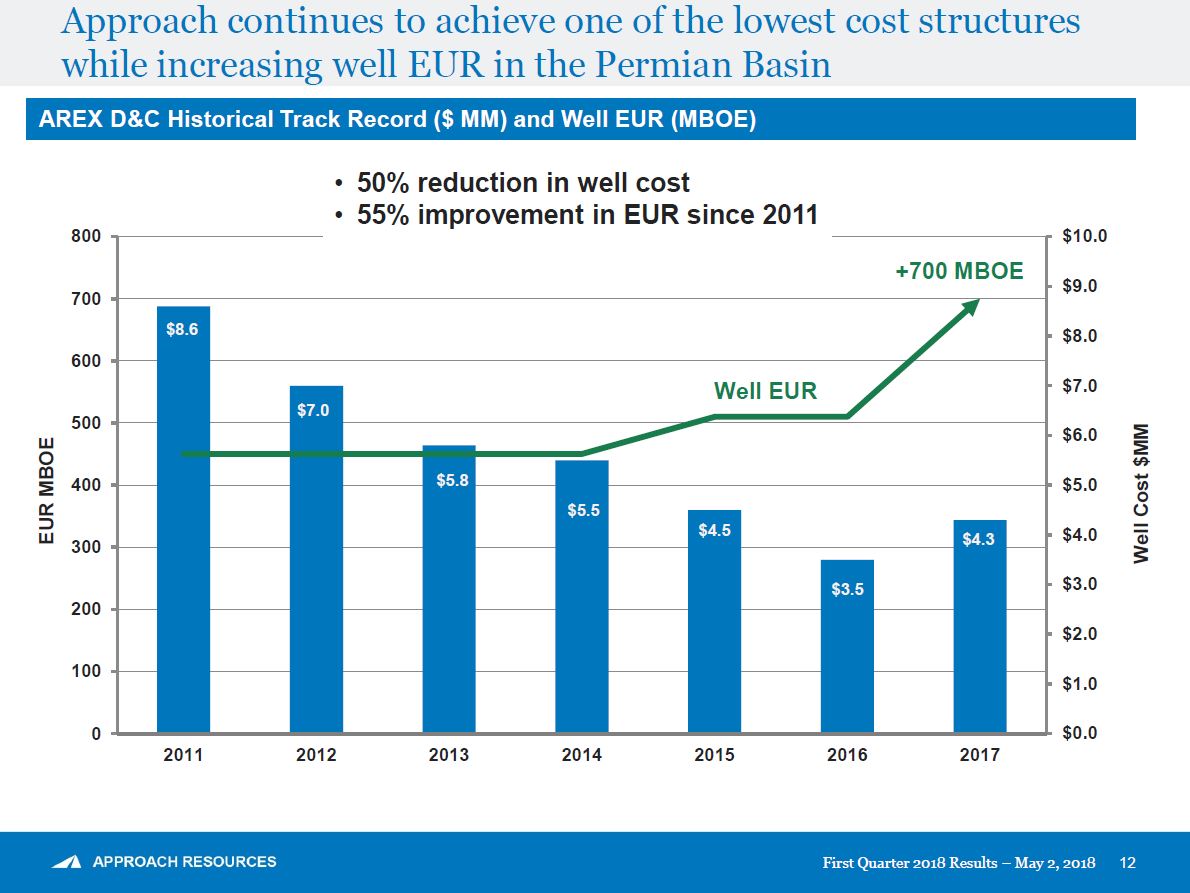

Since 2011, well costs for the company have gone down ~50% while EUR has gone up ~55% – in 2011 the cost per well was $8.6 million with a EUR of a little under 700 MBOE. In 2017, the cost per well was around $4.3 million with a EUR of 700~ MBOE.

Apache Corporation

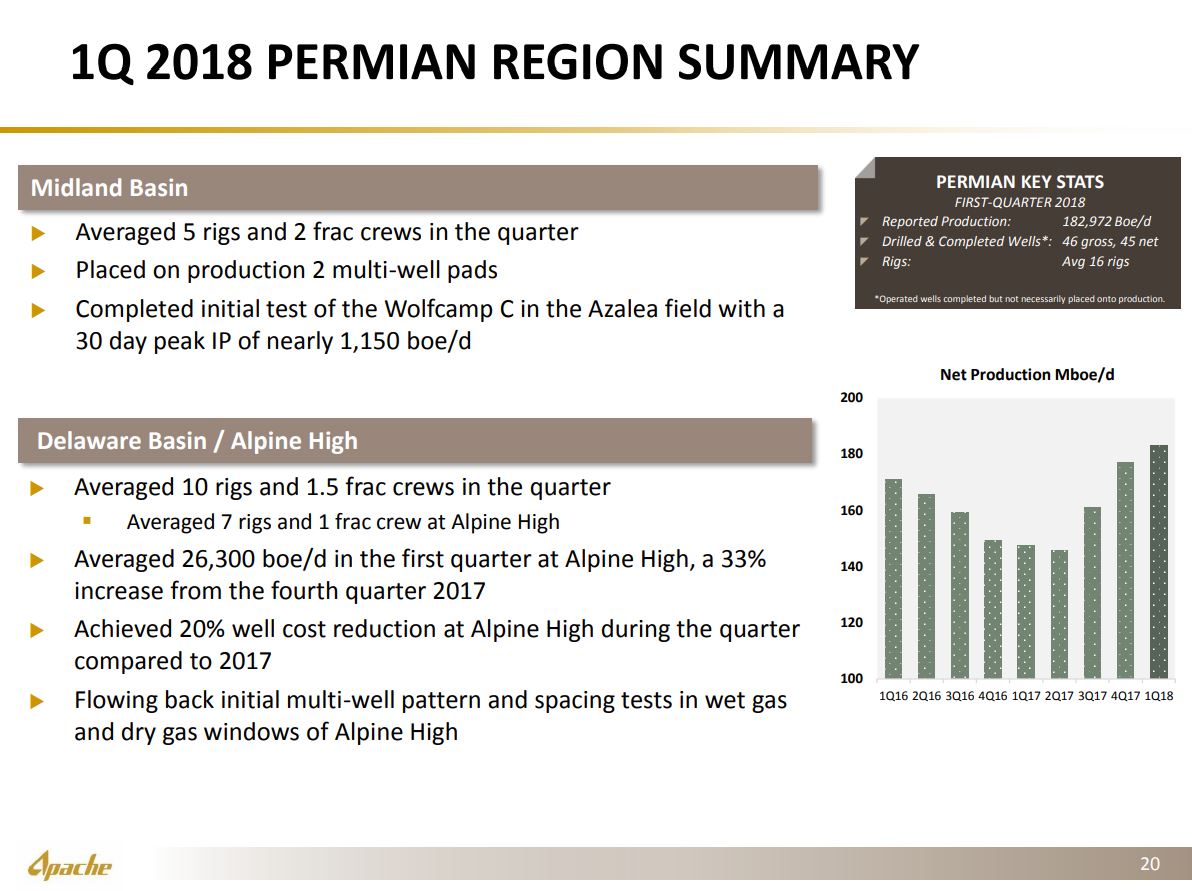

In the Permian, Apache delivered 183,000 BOEPD Q1 2018 production. The company averaged 16 rigs, drilling and completing 46 gross (45 net) wells. Apache noted that not all of the completed wells are on production yet.

Oil and gas capital investment was $857 million during the quarter, with $115 million for Alpine High midstream. Apache said that more than two-thirds of the capital spend was focused on the Permian Basin.

Overall U.S. production average 232,000 BOEPD, with 17 rigs and 60 drilled and completed gross operated wells.

Midland – Wolfcamp C could be a potential hotspot

In the Midland Basin, Apache has transitioned primarily to multiwell pad development, utilizing optimized pattern and spacing configurations.

Across three pads, the company placed 12 wells on production in the Wolfcamp formation with an average peak 30-day IP rate of 173 BOEPD per 1,000 lateral feet, consisting of 75% oil. Notably, Apache tested its first Wolfcamp C producer, which achieved a 30-day IP of 196 BOEPD per 1,000 lateral feet (70% oil). Based on conservative early-stage assessments, Apache said this result could lead to the addition of several hundred Wolfcamp C locations.

The company has implemented a new completion design with more optimal stage and cluster spacing, which is contributing to improved early-time well performance. Apache is fracture stimulating more lateral feet per day, completing wells faster and more efficiently and realizing cost savings.

Delaware

In the Delaware Basin, the company averaged 10 rigs and drilled and completed 29 gross-operated wells.

At Alpine High, production averaged 26,000 BOEPD, a 33% increase over fourth-quarter 2017. Apache has begun the transition to pattern and spacing testing, as well as development drilling on multiwell pads.

Pad operations and well design changes are driving increased efficiencies and lower well costs, Apach said. The company made significant progress toward its cost reduction target during the first quarter, with well costs down 20% over 2017 average well costs.

During the quarter, Apache brought online its first multiwell test in the wet gas window of the play – the four-well Chinook pad, which contains 1,350 BTUs of wet gas and oil. The average 30-day IP rates for these wells was 1,366 BOEPD.

Apache conference call Q&A, production excerpts

Q: In regards to Alpine High, what benefits have you experienced? Any surprises compared to your initial expectations?

Apache CEO John Christmann: I think it’s just a matter of moving into pads, I mean the drilling analytics, and the things we’ve been able to do. We’ve originally said we thought we could get down to $4 million to $6 million.

So getting to the $6.2 million target this year, we knew we would be able to achieve it. And I think probably just being able to get there as quickly as we have, given the inflation we’ve had on some of the small services.

So I’m really pleased with where we are. I can tell you we see pacesetters daily coming out of there with all the analytics and technical tools we’re applying. And I expect us to continue to drive those costs down. So it’s a great story and is going to only get better.

Q (continued): Can you give me an idea how the Alpine High ratio of rigs to frac crews you could see changing in 2019 and beyond?

Christmann: We’re at a period right now where you’re working both your frac crews and your rig counts, and they will be dynamic. We’ve actually got two crews in that region, one of them kind of bounces back and forth between there and the Delaware. So it’s really not just directly, I would say, one. A lot of that’s a function of the pad and the timing and how we’re scheduling that.

So over time, we would expect both. We’ve seen significant efficiencies on the completion side in the Midland. And I think you in general are going to see ratios similar to what we have, but probably in that same line.

Q: In the Permian, what’s the long-term balance of optimally developing the resource, managing inventory levels and also appropriately capitalizing when it comes to infrastructure?

Christmann: We like our pace in both places. We’ve done some strategic tests at the half section level in the Midland Basin. And you’re seeing the results of those that we’re now integrating into the wells we’re drilling now. So it’s making a big impact by being able to incorporate the learnings and the data in the work we’re doing.

Ultimately it boils down to, how do you develop these sections? And we’ve got to get the completions fully optimized. You’ve got to get your patterns right, numbers of wells and those things.

And so taking the time to do it, taking the time to analyze the data, and then coming back, because you can always drill more wells, but you can’t take away any that you drill.

So we like the pace we’re on there. I think we’re going to be able to accelerate into that as time progresses.

The second thing we’re doing is you’ve seen, by getting out and testing the Wolfcamp C, we’re testing other benches. And we’re also testing other portions of our acreage that – when we’ve given our location counts in the past, we’ve been very conservative.

We’ve got a lot of acreage in the southern Midland Basin there that’s highly prospective and others would consider core, so some of that’s continuing to test those.

So you’ll see us continue to ramp that activity over time. We can handle many, many more rigs than we’re running there today, but we like the pace.

And similarly at Alpine High. What’s unique about it is we’ve got 6,000 feet of rock over a 70-mile area. And obviously we’re doing what we need to do to earn and hold the acreage, as well as build the infrastructure. And a lot of that pace has been driven by the wet gas side early on, because that’s what we need the infrastructure for, to process the wet gas. The oil is easier, and it’s also in the shallower zones.

So from a pace standpoint, we like where we are. I think when we get something done with the midstream, which we’re confident we will do, it’s going to give us some more flexibility. So we like the balance we have and what the whole portfolio brings.