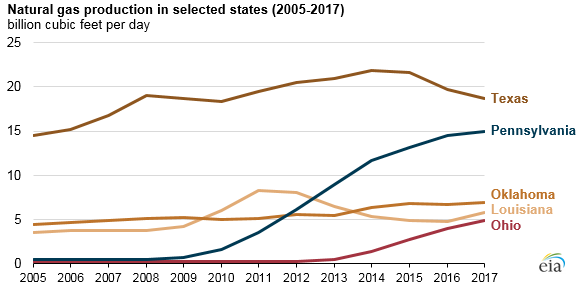

Pennsylvania natural gas production has been on an upward curve since 2009.

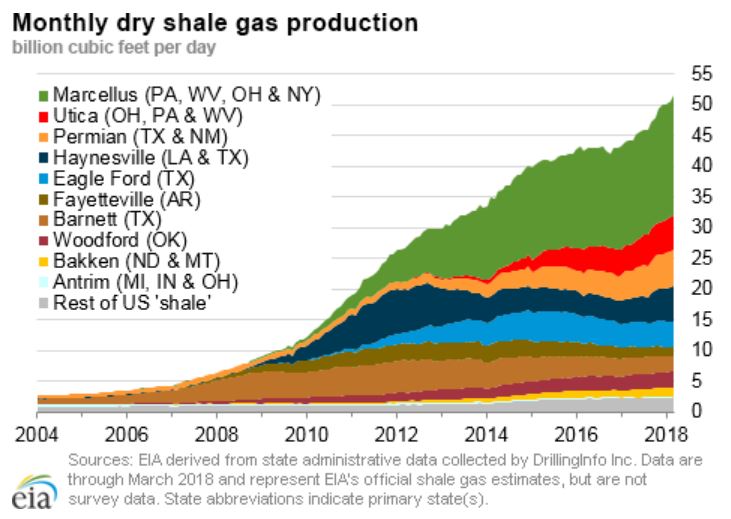

According to the EIA, Pennsylvania averaged a record 15 Bcf/d in 2017. Producers have the Appalachian Basin to thank – Pennsylvania accounted for 19% of total U.S. marketed natural gas production.

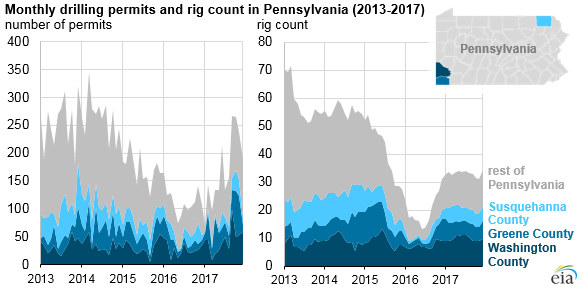

Increased permitting and drilling activity, combined with the expansion of regional pipeline capacity has helped Pennsylvania’s natural gas industry. According to the Pennsylvania Department of Environmental Protection, the state issued 1,352 natural gas drilling permits in 2016 and another 2,038 in 2017.

The drilling rig count in the state has also increased, averaging 20 rigs in 2016 and 33 in 2017, based on data from Baker Hughes.

Recent permitting and drilling activity in Pennsylvania is been concentrated in opposite corners of the state. Washington and Greene counties in southwestern Pennsylvania, and Susquehanna County in northeastern Pennsylvania have the highest number of permits and rigs.

According to the EIA, natural gas produced in Washington and Greene counties have a high natural gas plant liquid (NGPL) content. This content enhances the value of gas extracted from these counties and drives production. By comparison, natural gas production in Susquehanna County is relatively dry, the EIA said, meaning the natural gas there has less NGPL content.

In Susquehanna County, the estimated ultimate recovery (EUR) of wells has increased over the past five years, encouraging further drilling activity. In 2016 and 2017, the three counties combined accounted for slightly more than half of the total permits and two-thirds of the active rigs in Pennsylvania, the EIA said.

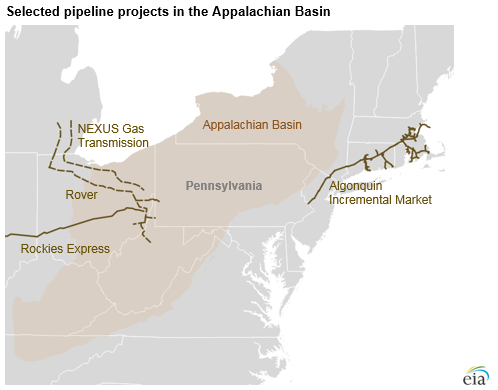

In recent years, several projects have alleviated takeaway constraints. Projects such as the Rockies Express Zone 3 Expansion (October 2016), Algonquin Incremental Market Pipeline (December 2016) and the Rover Pipeline Project and the NEXUS Gas Transmission Project are both slated to begin operations in the upcoming months.