The oil and gas sector in Texas remained strong through March according to the Dallas Fed’s new report. Prices for WTI crude oil rose slightly in March, staying close to $63 per barrel and oil production in the Permian Basin and Eagle Ford rose again. Employment spiked up in February and is at its highest level since late 2015, while U.S. LNG exports are at an all-time high and projected to increase further this year.

Prices up, dry gas production hits all-time high

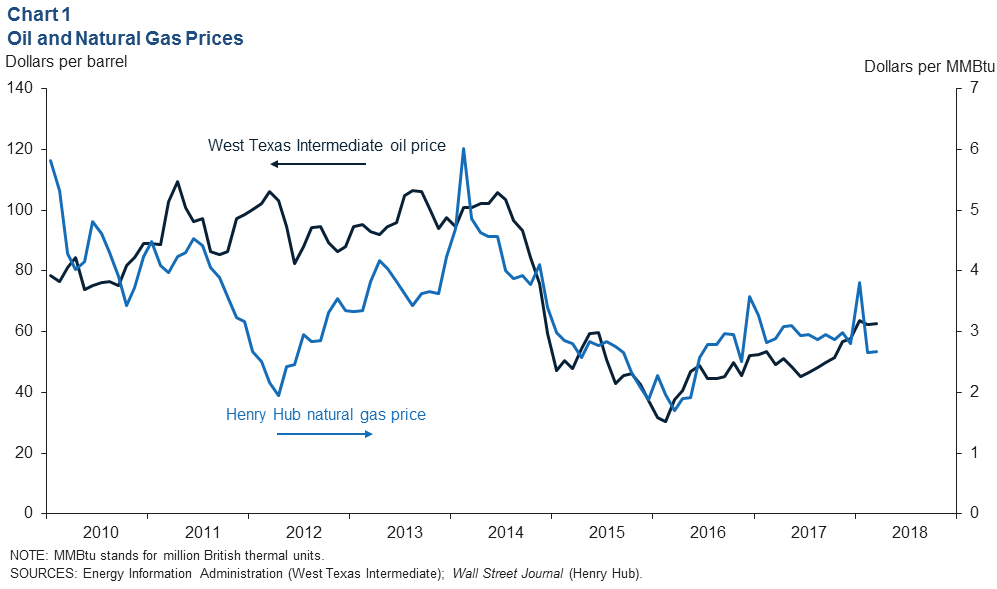

The average WTI spot price edged up from $62.23/barrel in February to $62.72 in March. Continuing declines in total U.S. crude and refined product inventories, coupled with ongoing strong OPEC compliance, provided support for prices of WTI in March, the Dallas Fed said.

U.S. dry gas production in March was 11% higher than a year ago, hitting an all-time high of 79.2 Bcf/d.

Despite current U.S. natural gas inventories being below the five-year average, prices continue to remain subdued as market participants anticipate there will be ample supply to meet demand this year.

More employment

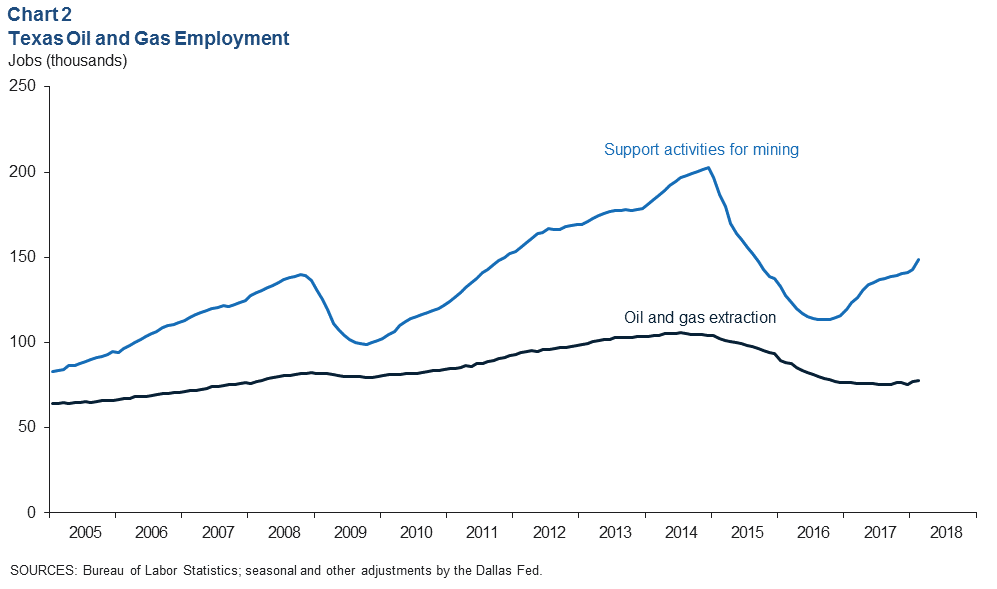

Employment increased by 6,600 jobs in February to roughly 226,300. According to the Dallas Fed, this marks the 15th consecutive monthly increase in Texas energy-sector employment. Support activities for mining added 5,800 jobs and payrolls in oil and gas extraction increased by 700.

In the latest Dallas Fed Energy Survey, 51% of executives expect the number of employees at their firm in 2018 to increase from 2017.

Texas keeps getting bigger

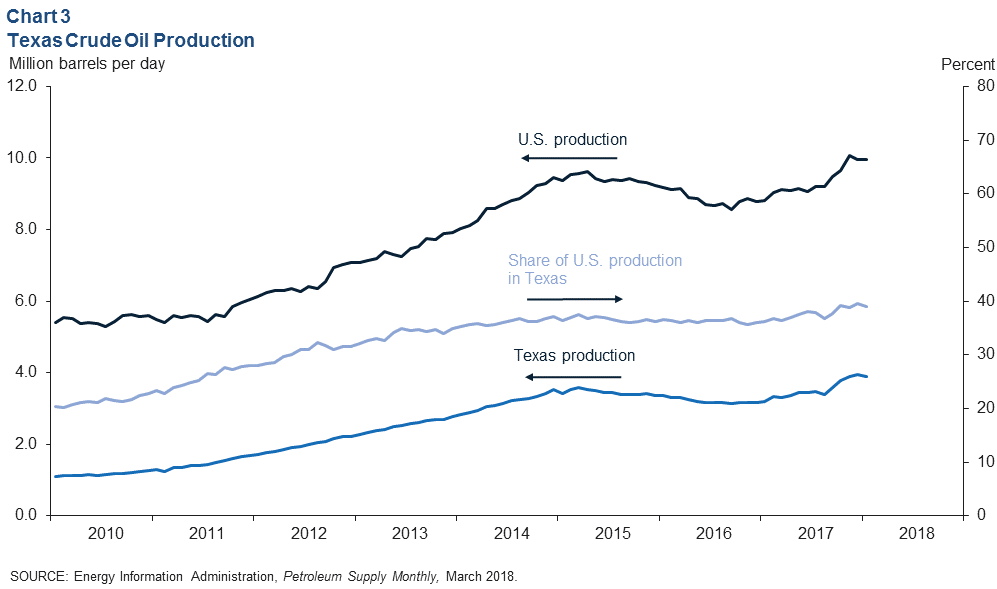

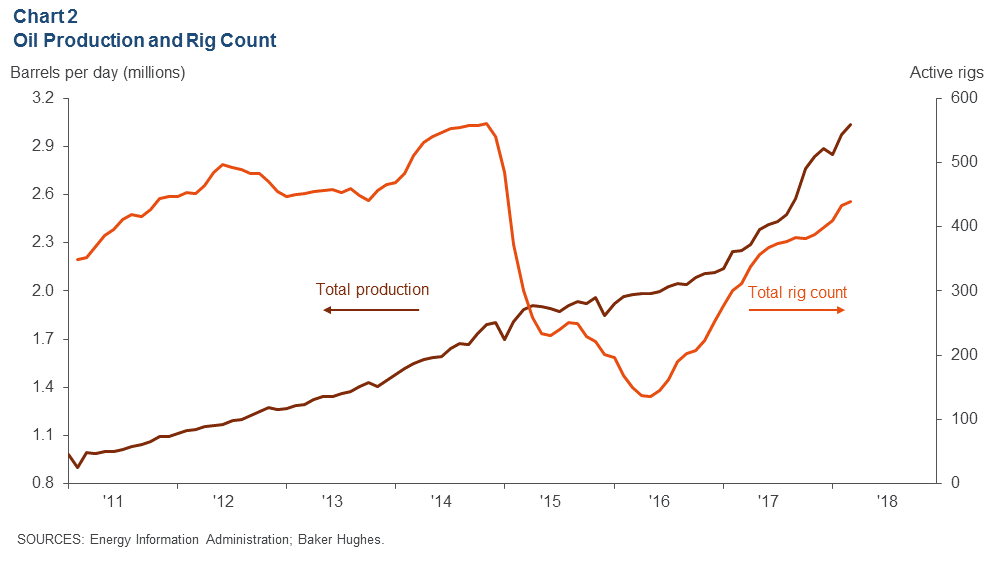

Texas produced 3.9 MMBOPD in January, while total U.S. production was slightly below 10.0 MMBOPD.

The share of Texas production has steadily increased from 20% at the start of 2010, to 39% in January 2018, the Dallas Fed said, driven primarily by rising production in the Permian Basin.

U.S. production is expected to average 10.7 MMBOPD in 2018.

Zeroing on the Permian

Estimated Permian Basin production rose in March by 64,600 BOPD to 3.04 MMBOPD. Eagle Ford production was also up 11,400 BOPD to 1.30 MMBOPD. Operating rigs numbered 443 in the Permian Basin and 72 in the Eagle Ford at the end of March.

Permian DUCs

The number of DUCs in the Permian increased by 122 to 3,044 between February and March. The number of DUCs in the U.S.—minus the Permian—fell for the fifth straight month to 4,648.

LNG exports steadily increasing

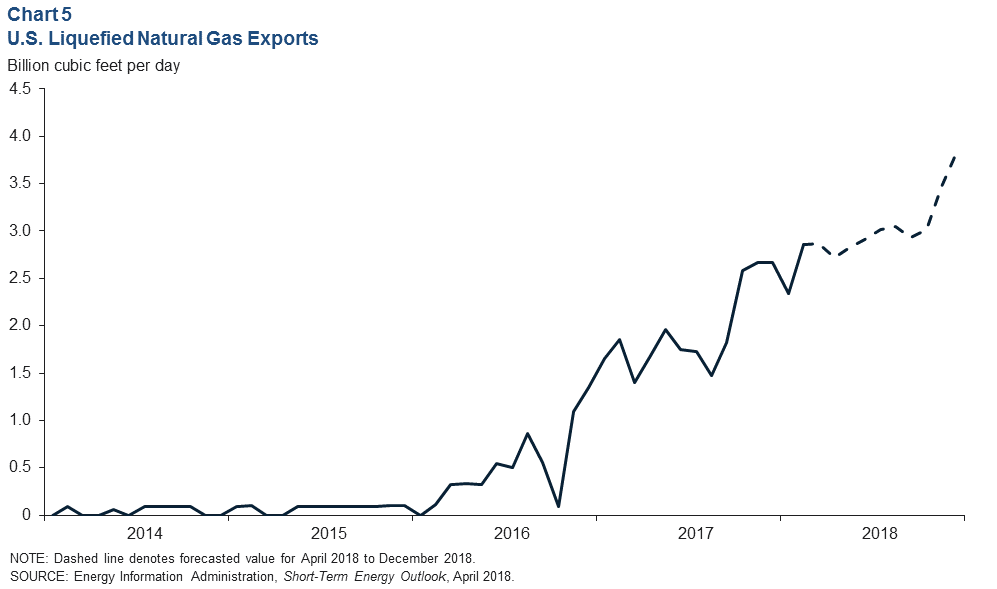

U.S. LNG exports inched up to 2.9 Bcf/d in March. The Dominion Cove Point LNG facility in Maryland exported its first cargo in early March, helping bump up U.S. export volumes.

The EIA projects U.S. LNG exports will end the year at 3.8 Bcf/d as additional export facilities are completed. In Texas, the first export facility projected to come online is the Freeport LNG, which is scheduled for fourth quarter 2018.

Business is good

Activity in the Eleventh Federal Reserve District’s energy sector expanded robustly in first quarter 2018, according to the Dallas Fed Energy Survey.

The business activity index—the survey’s broadest measure of business conditions—climbed roughly three points to 40.7, driven by the oilfield services side of the industry.

Special questions in this quarter’s survey found that firms need on average $52/barrel to drill a new well and $35/barrel to cover operating expenses for existing wells.