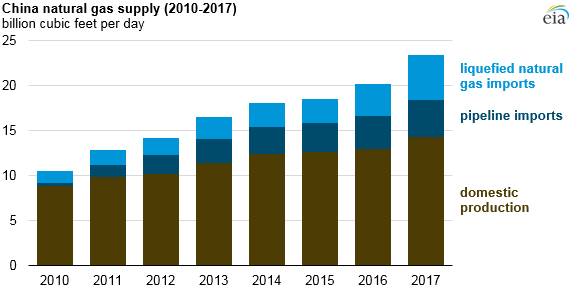

In 2017 China surpassed South Korea to become the world’s second-largest importer of LNG, according to data from IHS Markit and official Chinese government statistics, the EIA said. Driven by government policies designed to reduce air pollution, LNG imports increased by 1.6 Bcf/d in 2017, with monthly imports reaching 7.8 Bcf/d in December 2017.

China has been striving to transition away from dirty coal-fired electricity – natural gas is a cleaner alternative and the recent hike in worldwide production has lowered prices. China has also implemented policies in the colder northern provinces to use natural gas-fired boilers, this heats residential households while reducing air pollution.

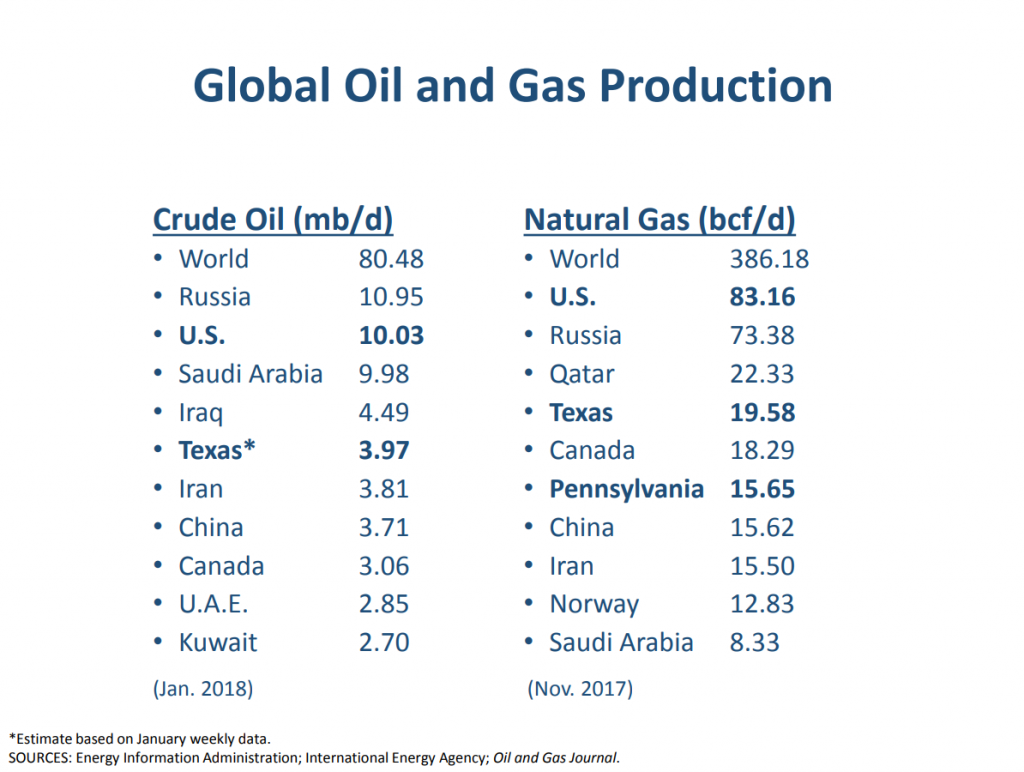

Source: Federal Reserve Bank of Dallas

Natural gas storage capacity in China is relatively limited and is estimated at just 3% of total natural gas consumption, the EIA said. During seasonal peaks for high demand, the supply of natural gas is sourced either via pipeline from Central Asia, or by LNG shipments. While domestic production and pipeline imports have increased in 2017, natural gas shortages throughout the country have led to record LNG imports in the winter of 2017.

In 2017, natural gas imports accounted for 40% of China’s supply, and over half of the natural gas imports were made up of LNG.

Terminals and statistics

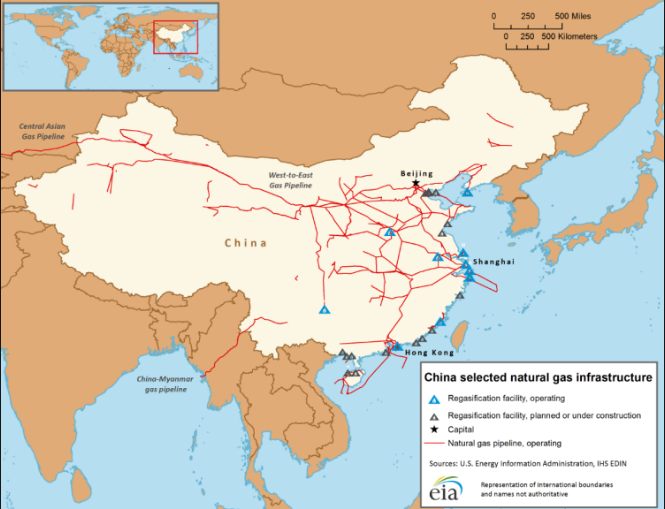

China has a total of 17 LNG import terminals at 14 ports along its coastline. While the utilization rate at the LNG import terminals was approximately 50% from 2013 through 2016, the rate skyrocketed to 69% in 2017. According to the EIA, natural gas consumption is expected to continue to increase, with import capacity expected to reach 11.2 Bcf/d in 2021. In addition, natural gas imports via pipeline are expected to increase, especially when the Power of Siberia pipeline from Russia comes online by the end of 2019.

The United States saw a dramatic increase of LNG exports to China in 2017 from previous years, jumping from roughly 17.2 Bcf in 2016 to 103 Bcf in 2017. In November 2017, China and the U.S. signed several preliminary agreements for U.S. LNG exports to China, including exports from Sabine Pass on the Gulf Coast of Louisiana, Delfin LNG’s offshore export project off of Louisiana’s coast and the proposed Alaska LNG project.