250-275 gross wells expected to be on production in the Permian Basin in 2018

$2.6 billion 2018 Permian-focused CapEx

Pioneer Natural Resources (ticker: PXD) placed 64 horizontal wells on production in the fourth quarter of 2017. In the Permian, 43 wells were in the northern area and 21 wells were in the southern Wolfcamp joint venture area. For the full year, 224 wells were placed on production, of which 184 were in the northern area and 40 wells were in the southern Wolfcamp joint venture area.

Pioneer produced 305 MBOEPD in the fourth quarter of 2017, an increase of 29 MBOEPD, or 11%, compared to the third quarter of 2017. Fourth quarter production was above the top end of Pioneer’s production guidance range of 292 MBOEPD to 302 MBOEPD. As for fourth quarter oil production, it was up 18 MBOPD, or 11%, compared to the third quarter of 2017.

The company’s Permian Basin horizontal drilling program continues to drive production growth, with total Permian Basin oil production increasing by 14 MBOPD, or 9%, in the fourth quarter of 2017 compared to the third quarter of 2017.

The company produced 272 MBOEPD in 2017, an increase of 38 MBOEPD, or 16%, compared to 2016. Oil production was up by 25 MBOPD, or 19%, compared to 2016. 2017 production growth was due to the company’s Permian Basin horizontal drilling program, with total Permian Basin oil production for 2017 increasing by 26% compared to 2016. Full year production for 2017 was 102 MMBOEPD.

Pioneer’s forecasted 2018 oil production growth rate for the Permian Basin ranges from 19% to 24%.

Drilling like a pioneer – 20 Permian Basin rigs

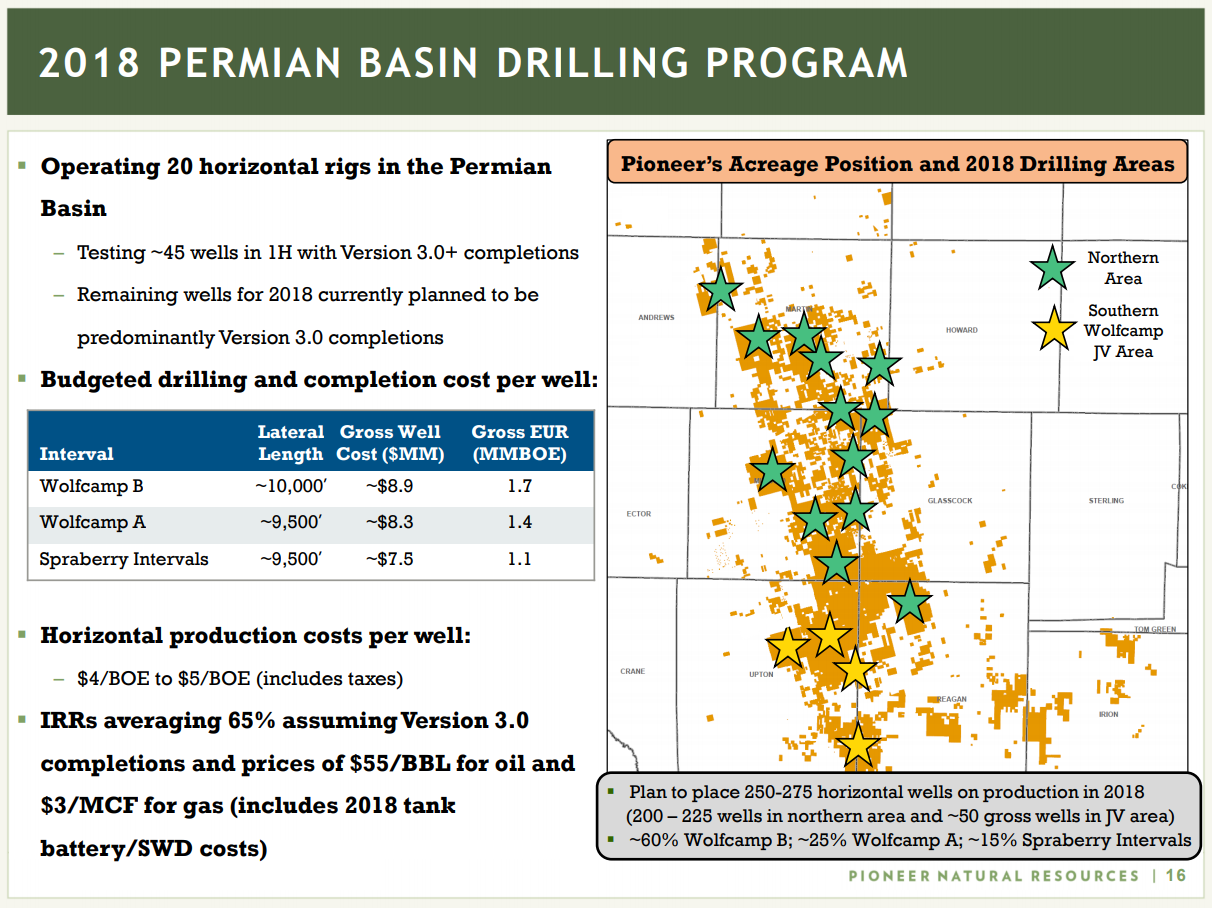

The company plans to operate 20 horizontal drilling rigs in the Permian Basin during 2018. Sixteen rigs are currently operating in the northern part of Pioneer’s acreage, with two rigs focused on increasing the DUC inventory to improve operational flexibility. Once an adequate DUC inventory is built, Pioneer said, the two rigs will focus on production growth with incremental production volumes not expected until early 2019 as a result of pad drilling.

Four rigs will continue to operate in the southern Wolfcamp joint venture area, with activity focused in the northern portion of this area (Pioneer has a 60% working interest). Pioneer expects to place 250 to 275 gross wells on production in the Permian Basin during 2018. Of these wells, approximately 200 to 225 wells will be in the northern area and 50 wells will be in the southern Wolfcamp joint venture area.

Approximately 60% of the wells will be in the Wolfcamp B interval and 25% in the Wolfcamp A interval. The remaining 15% will be a combination of wells in the Spraberry Shale intervals (Jo Mill, Lower Spraberry and Middle Spraberry) and a limited appraisal program for the Clearfork and Wolfcamp D intervals.

Acreage, EURs and costs per well

Pioneer holds approximately 550,000 gross acres in the northern portion of the Midland Basin play and approximately 200,000 gross acres in the company’s southern Wolfcamp joint venture area. According to the company, Pioneer’s contiguous acreage position and resource potential will allow for decades of drilling horizontal wells, with lateral lengths of 7,500-14,000 feet.

The budgeted costs to drill and complete planned wells in 2018 are:

- Wolfcamp B – $8.9 million for a 10,000-foot lateral well

- Expected ultimate recovery (EUR) of 1.7 MMBOE

- Wolfcamp A – $8.3 million for a 9,500-foot lateral well

- EUR of 1.4 MMBOE

- Spraberry intervals – $7.5 million for a 9,500-foot lateral well

- EUR of 1.1 MMBOE

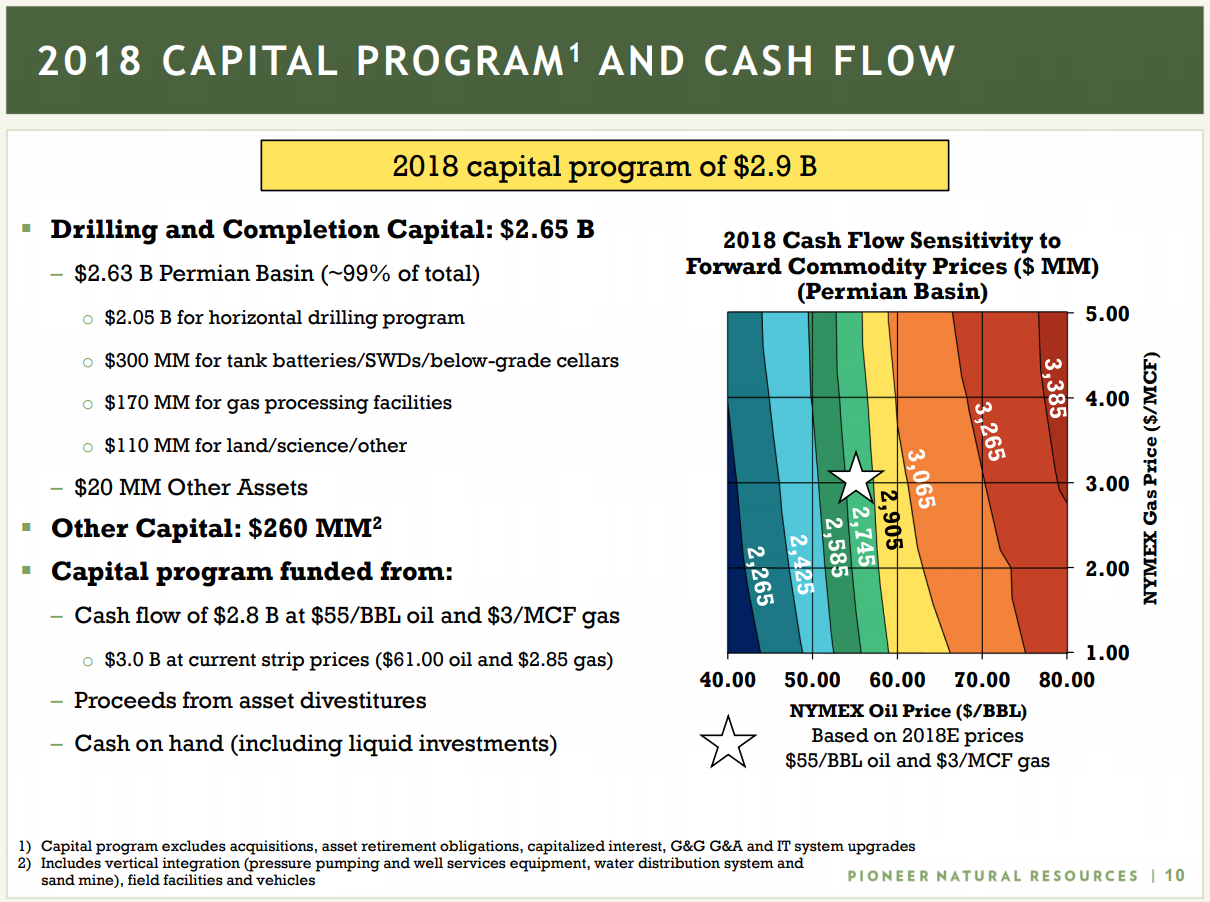

2018 CapEx

The company’s capital budget for 2018 is $2.9 billion – of which, $2.63 billion will go towards the Permian Basin. This allocated amount includes $2.05 billion for the horizontal drilling and completion program, $300 million for tank batteries/saltwater disposal facilities/below-grade cellars, $170 million for gas processing facilities and $110 million for land, science and other expenditures. Other assets are projected to receive $20 million.

Capital spending for 2018 is expected to be funded from forecasted operating cash flow of $2.8 billion (assuming average estimated prices for 2018 of $55.00 per barrel for oil and $3.00 per MCF for gas), proceeds from asset divestitures and cash on hand (including liquid investments).

Wagons full of cash

Pioneer reported fourth quarter net income attributable to common stockholders of $665 million, or $3.87 per diluted share. Without the effect of noncash mark-to-market (MTM) derivative losses of $169 million after tax, or ($0.99) per diluted share, and a noncash benefit related to the reduction in Pioneer’s deferred tax liability resulting from the Tax Cuts and Jobs Act of $625 million, or $3.64 per diluted share, adjusted income for the fourth quarter was $209 million after tax, or $1.22 per diluted share.

For the twelve months ended December 31, 2017, the company’s net income was $833 million.

The company’s total costs incurred during 2017 were $2.8 billion, including $136 million for acquisitions (principally for undeveloped acreage additions).

YE 2017 proved reserves

The company added proved reserves totaling 314 MMBOE during 2017 from discoveries, extensions and technical revisions of previous estimates (this excludes positive price revisions of 52 MMBOE, proved reserves divested of 7 MMBOE and proved reserves acquired of 1 MMBOE).

These proved reserve additions equate to a reserve replacement of 309% of Pioneer’s full year 2017 production of 102 MMBOE, which includes production used for field fuel of 2.5 MMBOE.

As of December 31, 2017, all of Pioneer’s proved reserves were in the United States, and 92% were proved developed reserves. Approximately 49% of the company’s proved reserves are oil, 21% are NGLs and 30% are gas. In the Permian Basin, approximately 59% of the company’s proved reserves are oil, 22% are NGLs and 19% are gas. Pioneer’s total proved reserves have a total reserves-to-production ratio of ten years and a proved developed reserves-to-production ratio of nine years.

The table below shows Pioneer’s year-end 2017 proved reserves by asset in MMBOE:

| Permian Basin | 763 | ||||

| Raton | 96 | ||||

| Eagle Ford Shale | 80 | ||||

| Other | 46 | ||||

| Total | 985 | ||||

The commodity prices used to determine proved reserves for 2017 resulted in an after-tax present value of the future net cash flows discounted at 10% (PV-10) of $8.2 billion. The after-tax present value of the proved reserves includes the benefit of the lower federal income tax rate enacted with the Tax Cuts and Jobs Act.

A Permian pure-play in the making: PXD plans to divest South Texas, Raton and West Panhandle assets

Pioneer’s predominant asset in South Texas is its Eagle Ford Shale acreage where the company holds approximately 70,000 net acres. All of this acreage is held by production, the company said. The Eagle Ford assets being sold represent all of Pioneer’s 46% working interest in the play, including its producing wells and associated infrastructure.

Net production from this asset averaged approximately MBOEPD during the fourth quarter of 2017, consisting of approximately one-third oil, one-third NGLs and one-third gas. In addition, Pioneer will separately divest its acreage in the Sinor Nest Wilcox field.

The Raton assets being sold represent all of Pioneer’s interests in the field, including all of its producing gas wells and all other associated infrastructure. Net production from Raton averaged approximately 86 MMcf of gas per day during the fourth quarter of 2017.

The West Panhandle properties are located in the panhandle region of Texas. The assets being sold represent all of Pioneer’s 100% working interest in the field, including its producing wells and associated infrastructure. Net production from this asset averaged approximately 7 MBOEPD during the fourth quarter of 2017, consisting of oil (20%), NGLs (55%) and gas (25%).

President and CEO Timothy L. Dove said, “After these divestitures are completed, Pioneer’s operations will be solely in the Permian Basin.”

$100 million 2018 stock repurchase program

Pioneer’s board of directors approved an increase in the company’s semiannual cash dividend from $0.04 per share to $0.16 per share on Pioneer’s outstanding common stock (equivalent to $0.32 per share on an annualized basis). The dividend is payable April 12, 2018, to stockholders of record at the close of business on March 29, 2018.

Pioneer’s board of directors also approved a common stock repurchase program to offset the impact of dilution associated with annual employee stock awards. The stock repurchase program allows for up to $100 million of common stock to be repurchased during 2018.