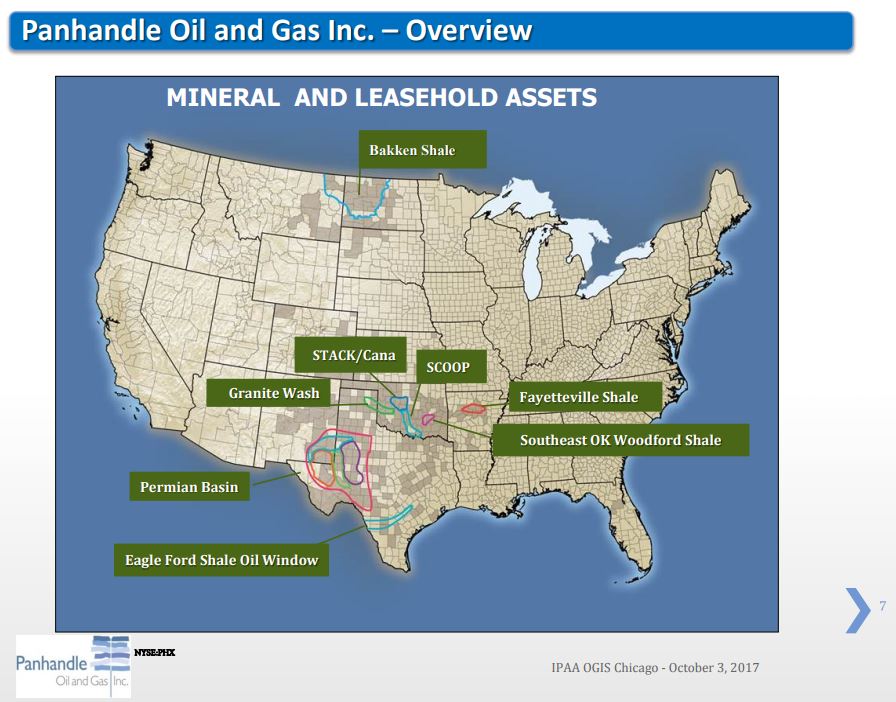

Panhandle Oil and Gas Inc. (ticker: PHX) is headquartered in Oklahoma City, Oklahoma. Panhandle has approximately 255,000 net acres of perpetually owned mineral rights spread across Arkansas, Oklahoma and Texas.

Panhandle leases its properties to oil and gas operators and does not have the burden of paying to operate productive leases, but instead acts as a royalty interest holder. As of October 2017, the company held 56,818 net mineral acres producing, 14,559 net mineral acres leased and 183,627 net mineral acres open.

Q4/FY2017 results (Fiscal Year ends Sept. 30)

Highlights for the periods ended September 30, 2017

- Recorded a fourth quarter 2017 net income of $1,039,134, $0.06 per share, compared to a net income of $737,190, $0.05 per share, for the 2016 fourth quarter

- Recorded a fiscal year 2017 net income of $3,531,933, $0.21 per share, compared to a net loss of $10,286,884, $0.61per share, for fiscal 2016

- Generated cash from operating activities of $20.8 million for the year, as compared to capital expenditures of $25.8 million

- Collected lease bonus proceeds of $5.2 million in fiscal 2017

- Generated 2017 fourth quarter and twelve-month EBITDA of $7,250,826 and $24,556,609, respectively

- Year-end 2017 proved reserves increased 36% to 168.6 Bcfe as compared to year-end 2016 proved reserves

In December 2017, President and CEO Paul F. Blanchard Jr. commented, “The company invested $25.8 million in drilling activity in 2017, with the vast majority in the core areas of the STACK, Cana, SCOOP, SE Oklahoma Woodford, and the Eagle Ford Shale. The average finding cost for the wells from this program, which began production in 2017, is estimated at an attractive $0.92 per Mcfe. This activity materially grew the company’s production as these wells began to produce in the third and fourth quarters of 2017. As a result of this investing activity, the company’s fourth quarter 2017 production exceeded second quarter 2017 production by approximately 40%.

“In 2017, the company leased 2,473 acres of its mineral holdings, primarily in the expansion areas of STACK and SCOOP, for $5.2 million in lease bonuses and an average royalty of 21%. Our analysis suggests that the lease bonus plus royalty received from this leasing will exceed the value the company would have generated from taking a working interest participation, thereby maximizing value while minimizing drilling risk.

“In October 2017, the company renegotiated and extended its credit facility with very favorable terms and a new maturity date of Nov. 20, 2022. The borrowing base was maintained at $80 million and on Nov. 30, 2017, our debt was $49.9 million.”

For detailed Q4/FY2017 results, please click here.

EnerCom Dallas conference presenter

Panhandle Oil and Gas Inc. will be presenting at the EnerCom Dallas investment conference, Feb. 21-22 at the Tower Club in downtown Dallas. Institutional investors, portfolio managers, financial analysts, CIOs and other investment community professionals who invest in the energy space should register now.