Growth achieved without any reserves from recent acquisitions

Permian-based Rosehill Resources (ticker: ROSE) announced year-end reserves, the first reserves data published by the new company.

Rosehill was formed through a merger of KLR Energy Acquisition and Tema Oil and Gas, a transaction that closed in April 2017. The company has established a position in the Permian, in the core of the play.

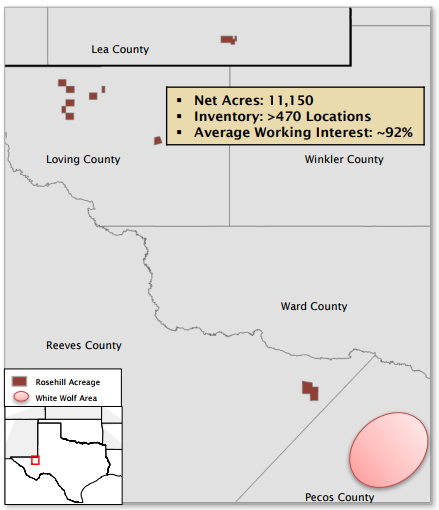

In October, Rosehill announced a significant acquisition, doubling in size in one stroke. The company purchased 4,565 net acres in northwestern Pecos County for $77.6 million, with the option to buy another 4,535 acres for the same acreage cost. The company elected to buy 1,940 net acres in the area for $39 million. Rosehill paid $17,000/acre, which was well below the basin average of $26,500/acre.

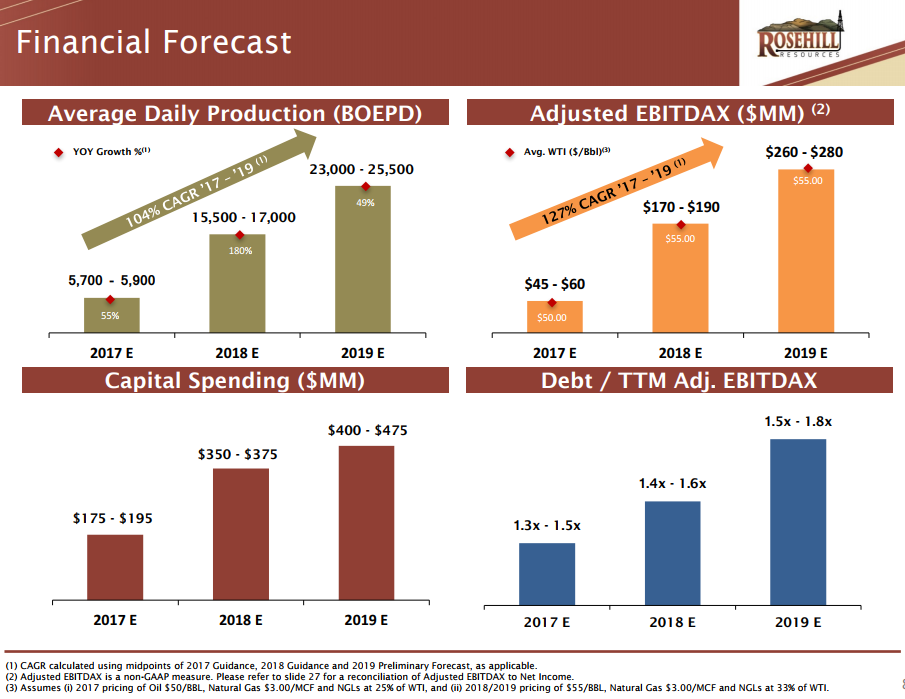

The company has grown from 4,655 acres to 11,150 in one year, growth of 140%. The company’s reserves have seen similar growth, according to Rosehill’s recent announcement. The company now holds 31.1 MMBOE of reserves, up from 13.2 MMBOE at year-end 2016. Proved reserves grew by 21.1 MMBOE, giving a reserve replacement ratio of nearly 1,000%. These reserves do not include any volume attributable to the company’s recent acquisitions, meaning reserves are likely to increase further as Rosehill begins to drill in the area.

The company holds acreage in Loving, Lea, Reeves and Pecos counties, in the heart of the Delaware Basin. Rosehill reports it has over 470 drilling locations in inventory. In the coming year, Rosehill intends to fully implement its improved completion design in loving county, test multiple horizons in its acquired acreage and grow production by 50% by mid-year.

EnerCom Dallas conference presenter

Rosehill Resources will be presenting at the EnerCom Dallas investment conference, Feb. 21-22 at the Tower Club in downtown Dallas. Institutional investors, portfolio managers, financial analysts, CIOs and other investment community professionals who invest in the energy space should register now.