Yearly, quarterly, monthly production records going up

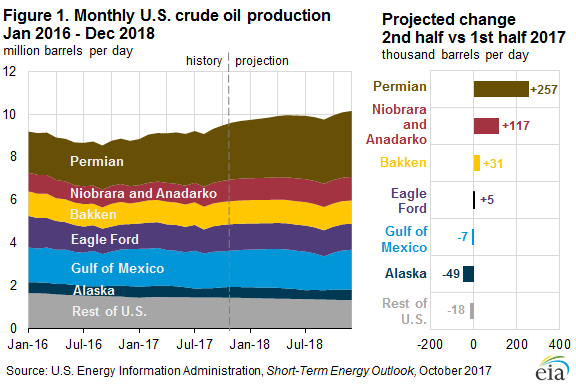

U.S. crude oil production remains on track to break records next year, according to a note from the EIA today. Current forecasts call for crude production of 9.4 MMBOPD in the second half of 2017. This represents 340 MBOPD of growth from the first half of 2017, and this growth is expected to continue.

The EIA predicts that oil production in 2018 will average 9.9 MBOPD, which would be a new record for yearly production. The current high was set in 1970, when the U.S. produced 9.6 MMBOPD.

Growth coming from Permian, Niobrara, Anadarko

Unsurprisingly, most of this new growth is projected to come from the Permian. The current issue of the Short-Term Energy Outlook predicts that production in the Permian will be 257 MBOPD higher in the second half of 2017 than in the first half, by far the largest growth of any basin in the U.S. Other significant increases are expected in the Niobrara and Anadarko basins, which are predicted to add a combined 117 MBOPD.

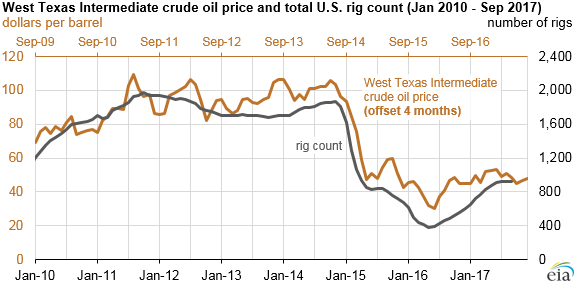

The EIA’s forecasts are driven by the WTI oil price, and how that price is likely to affect current activity. It typically takes about four months for a change in oil price to result in a change in rig count, based on the last seven years of activity. A change in rig activity takes about two months to translate to a change in production, so a meaningful change in oil price should result in a change in production six months later.

EIA foresees a commodities price rise in 2018

The EIA currently predicts that oil prices will gradually rise in 2018, from $49.50/bbl WTI in Q1 to $52.45/bbl WTI in Q4. This suggests that production will rise further in the year. The current forecast calls for 10.08 MMBOPD of production in Q4, which mean U.S. crude oil production would also break the record for monthly and quarterly production. The current records for monthly and quarterly production are 10,044 MBOPD and 10,000 MBOPD, respectively, set at the end of 1970—decades before the shale boom was a reality.

EIA predictions criticized recently

The EIA has held to its prediction of rapidly growing production, despite criticism in recent months. Harold Hamm, Continental Resources (ticker: CLR) president, refuted the EIA’s estimates in a recent interview.

The EIA projection is “just flat wrong,” failing to take into account a new discipline among U.S. drillers, Hamm said in an interview Thursday on Bloomberg TV. “We have capability of producing a whole lot, but you have to get a return on investment,” he said, adding, “that’s where people have been this last quarter and this year.”

Hamm believes that once it becomes clear the government’s estimate is off base, oil prices could rise to $60 a barrel. Today WTI traded between $51.40 and $52.40.