Production approaching 2 Bcfe per day

During its second quarter of 2017, Range Resources (ticker: RRC) reported a net income of $70 million as compared to a net loss of $225 million a year ago. The company’s cash margins grew to $1.09 per Mcfe up from $0.70 per Mcfe in Q2, 2016.

Range reached a new record in production at an average of 1.945 Bcfe per day—37% higher than the production for Q2, 2016. The company highlighted a seven-well pad in the liquids-rich portion of the Marcellus with an average initial production of approximately 29.1 Mmcfe per day, 73% liquids.

The company also highlighted a dry gas four-well pad on the eastern edge of the Marcellus with average production rates averaged 30.0 Mmcfe per day.

Range’s second quarter capital expenditures totaled $280 million for drilling and completion operations for 35 (32 net) wells. The company also spent $8.6 million on acreage, $1.4 million on gas gathering systems, and $7.1 million on seismic—on target with its projected $1.15 billion capital budget for 2017.

Production summary

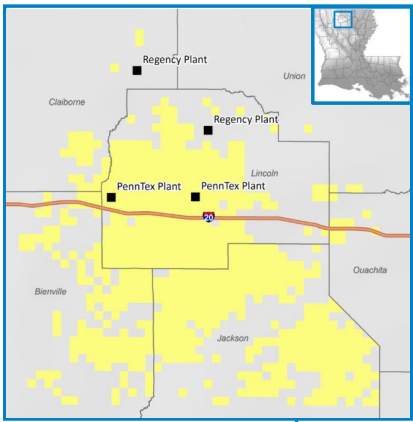

In the second quarter Range turned 23 wells in line in the Marcellus—where it holds 610,000 net acres—and 6 in its northern Louisiana acreage—where it holds 220,000 net acres. The company intends to turn in line another 68 wells in the Marcellus and another 23 in northern Louisiana, during the third and fourth quarters of 2017. The company intends to turn in line a total of 169 wells by the end of 2017—it has already turned in line 78 wells.

The majority of Range’s production was sourced from its Marcellus acreage—which averaged 1.5 net Bcfe per day. The majority of the Marcellus production came out of the southwest Marcellus properties—which produced 1.344 Bcfe per day. The remainder—155 net Mmcf per day, was sourced from the northeast properties.

Range averaged 416 net Mmcfe per day out of its north Louisiana acreage, where it is developing its Terryville assets.

Looking into the remainder of the year, Range anticipates that its average production will increase to 1.970 Bcfe per day in Q3, and to 2.170 Bcfe per day in Q4. Range believes that the introduction of new takeaway capacity in the form of the Rayne/Leach Express, Southwest, and Rover Phase 2 lines—which are expected to be in service before 2018—will grant improvements in the company’s gas differential.

Range is utilizing $16 million for the use of 3-D seismic operations to delineate the western portion of its north Louisiana assets. In Range chairman, president and CEO, Jeff Ventura’s words, “unlocking the potential across 220,000 net acre of stacked-pay requires a certain amount of time and well repetitions in order to establish a predictable economic development program.”

In Q1, Range drilled two expansion wells in north Louisiana, one in the east portion, one in the west. Two offset horizontal wells are planned for both areas, following promising results from the expansion wells. Range expects that the offsets will be spud in a month, as of August 1st.

Range Resources Q2, 2017 Conference Call Q&A

Q: Could you talk about the delineation plan in the north Louisiana assets?

Ray Walker, executive vice president and COO: Well, the second half of the year is pretty well lined out and like we’ve talked about the I think it was 23 wells that I mentioned in my prepared remarks and I think it was 12 Upper Reds and 5 Lower Reds and 3 Deep Pinks, and then 3 more wells in the extension area. Most of the focus this year still remains on Terryville, and I think going into 2018, that won’t change. We’re still looking at delineating the edges of Terryville, in other words we’ve kind of taken tiers of wells south from the existing development, we see a lot of potential there. There is still potential for stack pay and in-fill potential inside Terryville, it’s been taking some time to build the reservoir models and determine that, so we’ll be working on that also.

And then, like Jeff mentioned and I talked about a little bit, the extension wells, we’ve had some pretty exciting results, early results but pretty exciting to the east and west of Vernon Field, so we’re going to continue some work there with some additional offsets. We’ve got some science work going on the east side of Vernon Field to try to determine just how much potential was there and what’s going to be the best way to develop that.

One of the things we’ve learned in the Marcellus in the stack pay position that we have in southwest Pennsylvania, that it takes years and you need to be very thoughtful and strategic about how you develop and stack those laterals and what that program is going to look like. We’re taking all of that learning and we’re basically going to take our time, we’ll be very strategic in the same way throughout that whole 220,000 acre position.

We have a big 3D that’s going to be coming in later this year, that is going to open up a lot more of that extension area to the south of Terryville. So all of that said, the primary focus is still going to be drilling development wells in and around Terryville, but we’re still going to have a pretty steady program, pretty consistently but strategically, delineating that acreage around to the south. But I think it’s going to take some time to do that, because we are going to be very scientific, strategic database and really develop some long-term plans around that.

Samson Oil & Gas Limited is presenting at EnerCom’s The Oil & Gas Conference® 22

Samson will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.