Tamarack Valley Energy’s (ticker: TVE) prominent producing areas are the Cardium, Viking, and Penny Barons oil plays—located in Alberta and Saskatchewan.

Tamarack Valley reported an average production of 17,796 BOEPD during Q1, 2017—nearly twice the average production for Q1, 2016, which was 9,582 BOEPD.

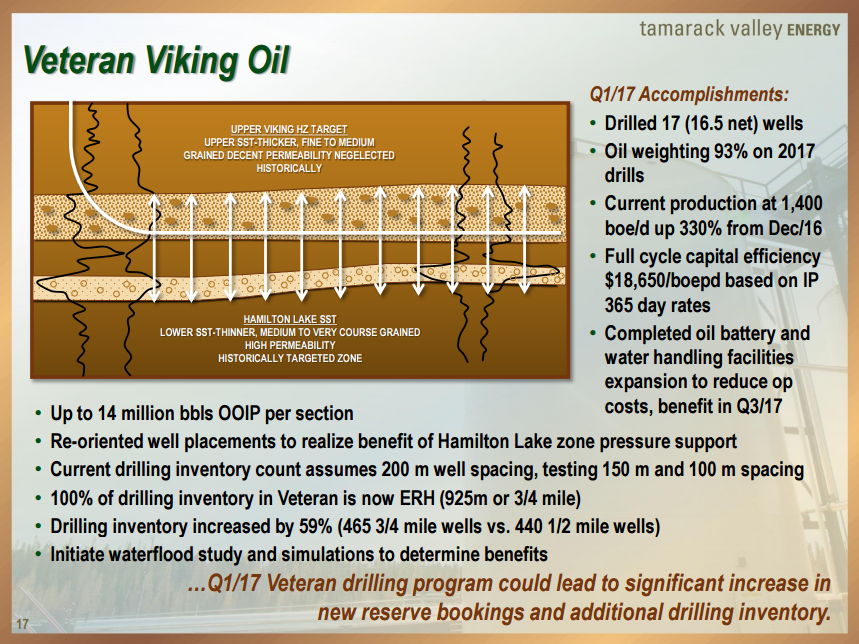

Key acquisition of the Viking assets

In January, 2017, Tamarack Valley finalized the acquisition of Spur Resources Ltd. and, through that acquisition, gained all of Spur Resources’ Viking assets. Tamarack paid $57.3 million for Spur and its Viking assets, as well as 90.1 million common shares of Tamarack.

Following the acquisition of the Viking assets from Spur, Tamarack Valley’s average production leapt to 17,786 BOEPD from its 11,453 BOEPD in Q4, 2016—an increase of 55%. Of the 6,343 BOEPD increase in production, 5,376 BOEPD can be directly attributed to the Viking acquisition, with a 358 BOEPD gain attributed to the company’s drilling program in the Wilson Creek/Alder Flats assets. The company’s drilling program in its existing Viking acreage accounted for an additional 376 BOEPD.

In Q1, the company drilled 16.5 net wells in the Veteran Viking field, 10.6 net wells in the Milton field, and four net wells in the Hoosier.

Total funds from operations increased 141% to $32.4 million in Q1’17 ($0.15 per share basic and diluted), excluding transaction costs, from $11.1 million in Q1’16 ($0.11 per share basic and diluted), and increased 58% compared to Q4’16. Production expense fell 6% per BOE quarter-over-quarter, which, combined with the improved funds flow per BOE, helped the company achieve earnings of $2.3 million in the first quarter compared to a $5.8 million loss in the first quarter of last year.

Further into 2017

Tamarack Valley expects that its annual average production will rise to approximately 19,000-20,000 BOEPD, with a 55% to 60% liquids weighting. The company also plans for its capital expenditure to fall between $165 and $175 million—of which approximately $65 to $75 million was targeting the first half.

Within the second half of 2017, Tamarack Valley anticipates that it will drill 44 extended range horizontal Viking wells in the Veteran and Milton fields. In the Wilson Creek/Alder Flats acreage, eight wells are planned for the Cardium formation and three wells for the Mannville formation. Four wells are also planned for the Penny acreage.

“We’re currently testing a few concepts in the Viking from reduced well spacing to re-orientating the direction of our wells,” Tamarack Valley CFO Ron Hozjan told Oil & Gas 360®. Tamarack believes that by reducing its well spacing to 100-150 meters from its current 200 meters, the company will be able to add 100-200 well locations to its drilling inventory.

Tamarack Valley Energy presenting at EnerCom’s The Oil & Gas Conference® 22

Tamarack Valley will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.