Mexico awards 10 shallow water GOM blocks in successful 2.1 bid round

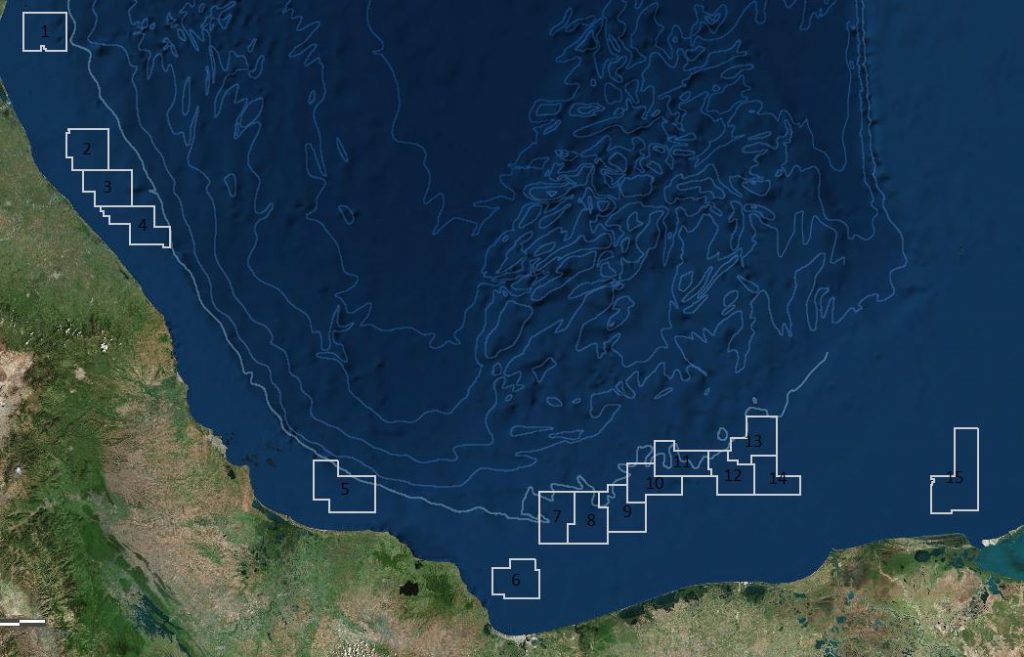

The National Hydrocarbon Commission of Mexico awarded 10 out of the 15 exploration blocks that were in its Round 2.1 lease auction this week. The awarded leases cover prospective oil and gas acreage in Mexico’s shallow waters in the Gulf of Mexico.

According to Haynes and Boones’ Mexico energy group, the punchlist from Round 2.1 looks like this:

- 9 additional exploration wells were committed.

- ENI was the company who won more blocks (3) than any other company.

- Repsol participated for the first time.

- Pemex won 2 blocks in consortia.

- Most of the interest was on light crude oil and less in heavy crude oil and gas areas.

- Average participation of the State (utilidad operativa) is 57.3%

- The government take average was 77.4% (including income tax).

- New players like Repsol, Ecopetrol, DEA Deutsche participated.

- Shell won a block for the first time.

“This was good news for Mexico, considering that Mexico was competing with many other countries bidding out 42 PSC blocks, like China, India, Malaysia, Indonesia, Egypt, and others,” said Haynes and Boone’s Ricardo Garcia-Moreno. “This round showed a lot of interest from majors around the world. Mexico is offering competitive terms and contracts, and people are responding.”

Reuters reported that Russia’s Lukoil also took a block in this latest auction, as did a consortium of France’s Total SA and Royal Dutch Shell Plc.

Energy Minister Pedro Joaquin Coldwell said in a press conference that the potential output from the blocks auctioned could total 170,000 BOEPD, and investments could eventually reach $8.2 billion, according to Reuters.

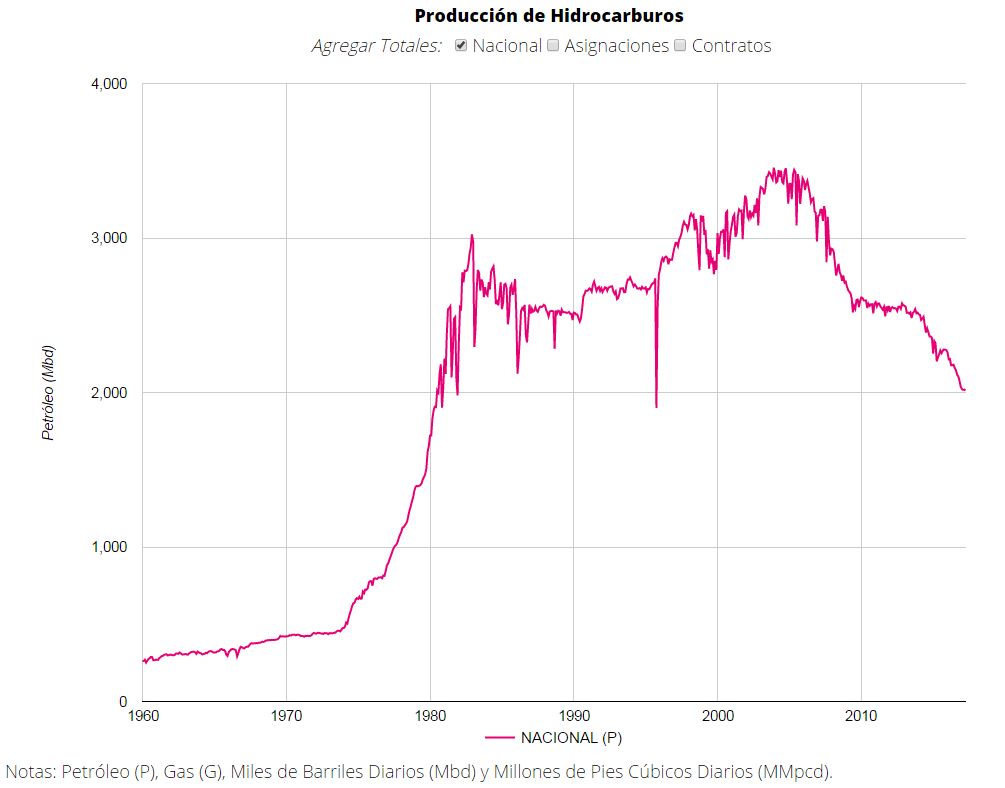

Mexico’s energy reform aims to reverse waning production

Mexico’s oil and gas production, once prolific, has waned in the recent decade. The country’s leadership initiated a program to open development of its oil and gas fields in partnership with outside companies in order to attract investment that would jumpstart the development of its oil and gas resources. The lease auctions that began in 2015 have attracted international attention and have been increasingly successful.

Mexico’s reported oil production was 2,013 thousand barrels per day in April 2017, according to the Mexican government’s National Hydrocarbons Commission (NHC).

The NHC said the main oil producing fields in Mexico are Maloob, Zaap, Xanab, Ku and Xux. Those fields reached an aggregated production of 1,056 MBOPD, on average during April 2017. The fields with the main oil production are located in shallow water of the Gulf of Mexico, the commission said.

Referring to its successful Round 2.1 bid in partnership with Mexico’s national oil company, Pemex, Juan Manuel Delgado, President of Germany’s Deutsche Erdoel (DEA) Mexico said,“The award is an important first step to build a portfolio in the country. The Tampico-Misantla is a prolific basin and offers significant undiscovered resource potential. With Block 2, DEA obtains access to material prospective resources.”

DEA holds a 30% share, with Pemex holding the remaining 70% as operator. Block 2 comprises 549 sq. km and is located in the South-Western Gulf of Mexico in water depth ranging from 40 to 260 m. The initial four-year exploration phase includes drilling of one commitment well, DEA said in a press release.

Pemex was awarded two blocks: Block 2, as a consortium with Deutsche Erdoel AG (DEA), and Block 8, as a consortium with Colombian company Ecopetrol. In Block 8 Pemex is the operator with 50% participation. This area is located in the Southeastern Basins and spans a surface of 586 km2, Pemex said in a statement.

The National Hydrocarbon Commission of Mexico offers an interactive mapping and data portal on its website.

CNH-R02-L01/2016 Shallow Waters BIDDING PROCESS RESULTS June 19, 2017

| AREA | COMPANY | MAIN

HYDROCARBON |

GOVERNMENT

OPERATING PROFIT % |

ADDITIONAL

INVESTMENT FACTOR |

WEIGHTED

ECONOMIC OFFER |

PROSPECTIVE

RESERVES MID-POINT (MMBOE) |

| AREA 1

(Tampico Misantla) |

Contractual area

was declared deserted |

Light oil and dry gas |

– |

– |

– |

138.6 |

|

AREA 2 (Tampico Misantla) |

Winner – DEA

Deutsche in consortium with Pemex

2nd Place – ENI México in consortium with Lukoil International |

Light oil and dry gas |

57.92

55.14 |

1.0

1.5 |

63.493

63.261 |

280.4 |

| AREA 3

(Tampico Misantla) |

Contractual area

was declared deserted |

Light oil and dry gas |

– |

– |

– |

385.3 |

| AREA 4

(Tampico Misantla) |

Contractual area

was declared deserted |

Dry gas |

– |

– |

– |

403.9 |

| AREA 5 (Veracruz) | Contractual area was declared

deserted |

Wet gas |

– |

– |

– |

466.1 |

|

AREA 6 (Cuencas del Sureste) |

Winner – PC

Carigali in consortium with Ecopetrol Global

2nd Place – Murphy Sur in consortium |

Light oil |

65.19

64.75 |

1.0

1.0 |

71.178

70.173 |

217.4 |

| with Talos Energy

and Ophir México |

||||||

|

AREA 7 (Cuencas del Sureste) |

Winner – ENI

México in consortium with Capricorn Energy and Citla Energy

2nd Place – Repsol Exploración in consortium with Premier Oil and Sierra Perote |

Light oil |

75.00

69.58 |

1.5

1.0 |

84.825

75.819 |

66.2 |

|

AREA 8 (Cuencas del Sureste) |

Winner – Pemex

in consortium with Ecopetrol |

Light oil |

20.10 |

0.0 |

20.100 |

162.7 |

|

AREA 9 (Cuencas del Sureste) |

Winner –

Capricorn Energy in consortium with Citla Energy E&P

2nd Place – ENI México |

Light oil |

75.00

75.00 |

1.5

1.5 |

84.825

84.825 |

252.5 |

|

AREA 10 (Cuencas del Sureste) |

Winner – ENI

México

2nd Place – DEA Deutsche in consortium with |

Light oil |

75.00

68.73 |

1.5

0.0 |

84.825

68.730 |

209.4 |

| Diavaz G and P | ||||||

|

AREA 11 (Cuencas del Sureste) |

Winner – Repsol

Exploración in consortium with Sierra Perote

2nd Place – China Offshore Oil Corporation E&P México |

Light oil |

62.28

35.00 |

0.0

0.0 |

62.280

35.000 |

426.2 |

| AREA 12

(Cuencas del Sureste) |

Winner – Lukoil International Upstream Holding |

Heavy oil |

75.00 |

1.0 |

81.550 |

409.1 |

| AREA 13

(Cuencas del Sureste) |

Contractual area

was declared deserted |

Heavy oil |

– |

– |

– |

212.9 |

|

AREA 14 (Cuencas del Sureste) |

Winner – ENI México in consortium with Citla Energy |

Heavy oil |

37.27 |

0.0 |

37.270 |

207.3 |

|

AREA 15 (Cuencas del Sureste) |

Winner – Total E&P in consortium with Shell |

Heavy oil |

30.11 |

0.0 |

30.110 |

188.4 |

| COMPANY | NUMBER OF

BLOCKS |

BLOCKS AWARDED | CONSORTIUM |

|

ENI México |

3 |

7

10 14 |

· Capricorn Energy and Citla Energy

· Individual · Citla Energy |

|

PEP |

2 |

2

8 |

· DEA Deutsche

· Ecopetrol |

| Citla Energy | 1 | 9 | · Capricorn |

| DEA Deutsche | 1 | 2 | · PEP |

| PC Carigali | 1 | 6 | · Ecopetrol |

| Capricorn Energy | 1 | 9 | · Citla Energy |

| Repsol Exploración | 1 | 11 | · Sierra Perote |

| Lukoil International

Upstream |

1 | 12 | · Individual |

| Total E&P | 1 | 15 | · Shell |