13,000 non-core acres sold for $600 million

Occidental Petroleum (ticker: OXY) announced a series of transactions in the Permian with a total value of $1.2 billion. These transactions are a series of purchases and sales that in total require no net cash spending by Oxy and will add about 3,500 BOEPD to the company’s production.

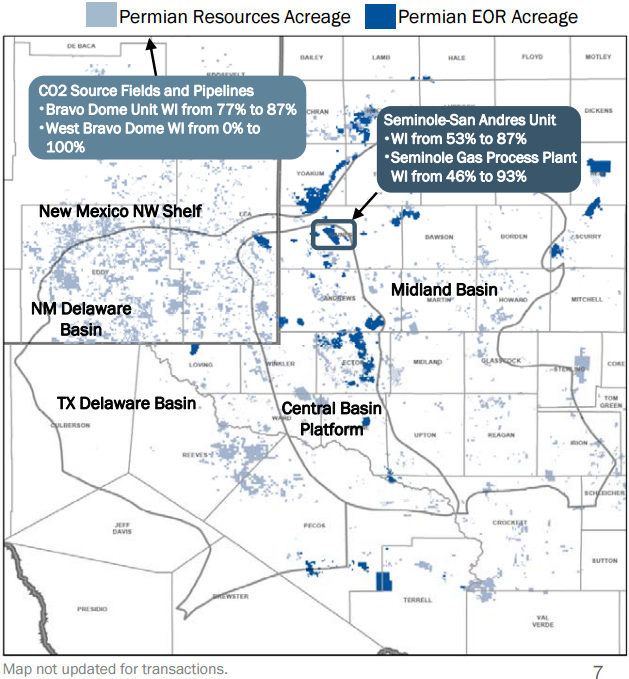

Oxy is divesting about 13,000 net acres in the Permian, with 4,700 BOEPD of production. These assets are in Andrews, Martin and Pecos counties, in several portions of the greater Permian basin. This acreage is not in any of Oxy’s focus development areas and the company had no significant near-term development plans for the locations.

In addition to the acreage sale, the company is adding additional acreage in Glasscock County, which will be a future core development area. In total, the acreage transactions have combined net proceeds of $600 million to Oxy.

EOR assets acquired for $600 million

Oxy also announced the purchase of several enhanced oil recovery properties in the Permian region from Hess (ticker: HES) for $600 million. Oxy is acquiring stakes in a total of four different properties, the Seminole-San Andres unit, the Seminole Gas Processing plant, the Bravo Dome unit and the West Bravo Dome CO2 field. Oxy already had interests in all but the West Bravo Dome CO2 field, and now has majority stakes in each. The properties add about 8,200 BOEPD to Oxy’s portfolio. The EOR transactions are expected to close in August.

Oxy already has extensive EOR assets in the Permian

In 2016, the company reports that its Permian EOR properties produced 145,000 BOEPD, primarily from fields undergoing CO2 flooding. It is important to note that these properties produce from different formations than those targeted by the current Permian shale boom. Enhanced oil recovery in shale formations is still in the early stages, with only a few operators currently using enhanced recovery on shale plays.

Oxy President and CEO Vicki Hollub remarked on the motivation for these purchases and sales. “These transactions support our pathway to breakeven at $50 after dividend and production growth and our long-term, returns-focused value proposition. The combined results accelerate cash flow and enhance our future returns by exchanging low-priority development acreage for low decline, low capital intensity EOR production that has significant opportunity for value improvement.”