Venture develops WPX’s Stateline properites

WPX Energy (ticker: WPX) announced today the formation of a joint venture with Howard Energy Partners to develop midstream capacity in the Delaware basin.

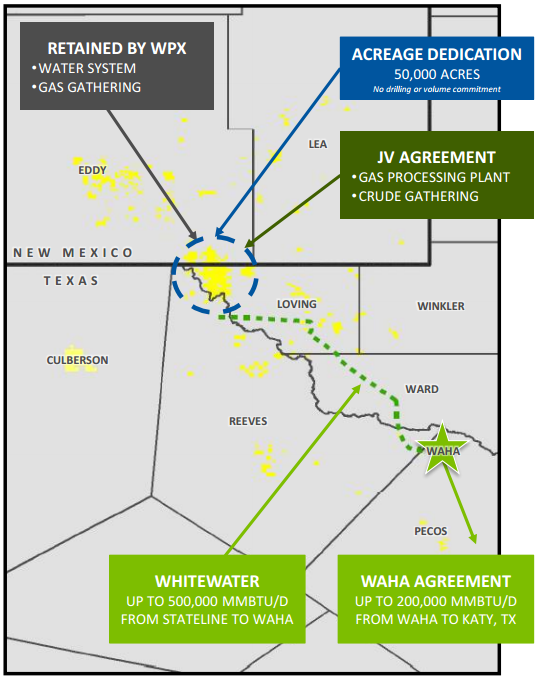

This venture will support WPX’s operations in the Stateline area, on the border of New Mexico and Texas. In total, the agreement will cover about 50,000 acres, or 37% of WPX’s total Delaware acreage. The JV will build a crude gathering system supporting WPX’s development in the area, with an estimated capacity of 125 MBOPD. Additionally, the JV will construct a cryogenic natural gas processing complex with a planned initial capacity of 400 MMcf/d.

Howard Energy Partners will construct and operate the JV assets, and will pay WPX $300 million upfront. Howard will also fund the first $263 million of JV capital expenditures, including a $132 million carry for WPX. WPX reports the transaction implies a value of $863 million for its Stateline oil and gas gathering and processing business. The transaction is expected to close in Q3 2017.

$563 million in spending expected

Howard Energy Partners announced that it will pay for its share of the JV through its partnerships with Singapore’s sovereign wealth fund, Alinda Capital Partners and Alberta Investment Management Company. Howard reports that the partnership is committed to spend initially $563 million on the venture. This represents Howard’s first foray into the massively popular Delaware Basin.

WPX plans $500 million, ~85 wells in Delaware in 2017

WPX is focusing on its Delaware Basin assets this year, and expects to spend about $500 million in the area in 2017. The company brought 14 wells on sales in Q1, and plans to add nearly 80 more by the end of the year.

Several takeaway agreements signed

WPX has also recently secured takeaway capacity for its Delaware basin activities. The company reports that it has just signed a long-term agreement with Whitewater Midstream for natural gas processing. The basic agreement gives WPX 300,000 MMBTU/d of gas capacity from the Stateline area to the Waha gas hub. WPX will also own 10% of the Agua Blanca Pipeline. The agreement gives WPX the opportunity to increase its capacity to 500,000 MMBTU and its ownership stake to 20%.

The company also recently agreed to ship up to 200,000 MMBTU/d of gas from the Waha hub to Katy, TX, which will begin in November.

“Our approach to supporting our growth plans in the Delaware Basin uniquely differentiates WPX,” said WPX Chairman, President and CEO Rick Muncrief. Munchrief said the midstream JV provides his company a “well-defined path for our expected volumes. … We’re looking at the bigger picture and how to extend value creation beyond the drill bit by creating a premier Delaware midstream service provider,” Muncrief said. “We believe the Howard team has the right skills, capabilities and focus to make this joint venture a success and we’re excited to work with them.”

“Historically, producer-backed midstream companies have performed well given the strong alignment of interests,” Howard Energy Chairman and CEO Mike Howard commented. “We are confident that our midstream operational expertise, coupled with strong financial support and WPX’s production track record, will make for a successful partnership in the Delaware.”