Canadian junior Razor Energy, (ticker: RZE) began operation on January 31, 2017 after combining with Vector Resources. After the amalgamation with Vector, Razor Energy completed the acquisition of the Swan Hills asset for $17.1 million.

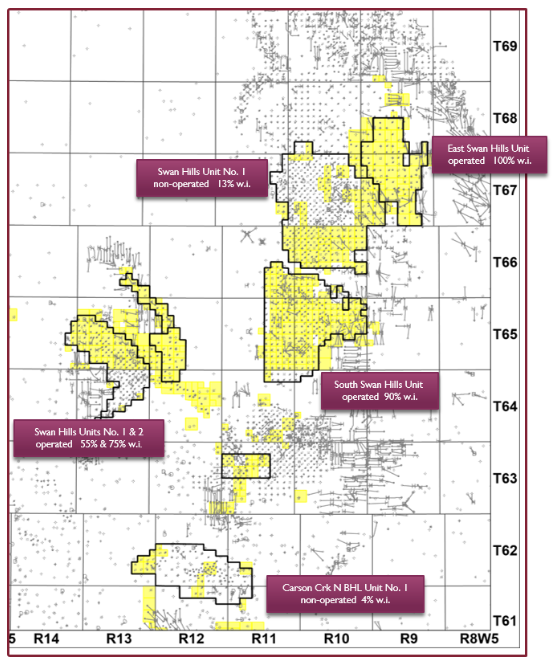

The Swan Hills asset itself is a light-oil, low decline field totaling 111,728 net acres of land. The acquisition has abundant infrastructure present, and Razor Energy will be focusing on reactivation and the optimization of primary and secondary recovery methods for the field.

As of Q1, 2017 and since the closure of the acquisition on January 31st, 2017, Swan Hills produced a daily average of 3,075 BOEPD. Of the total production, 2,032 BPD was oil, 1,932 Mcf/day was natural gas, and 721 BPD were NGLs.

In a show of continuing growth, Razor agreed to the purchase of the Kaybob asset, which totals 33,542 net acres. Razor expects the Kaybob asset to add approximately 760 BOEPD to existing production, 77% of which is expected to be oil and NGLs.

Razor expects that the Kaybob asset holds potential for additional reactivations and re-entries, as well as future horizontal and vertical drilling opportunities. The asset itself is situated in the Montney shale.

During its first quarter, Razor invested in reactivations, pipeline, and facilities costs which translated to an addition of 219 BOEPD to average production, the company said.

At EnerCom Dallas in March, Oil & Gas 360® spoke with Razor CEO Doug Bailey, a founder of Canadian Phoenix, which sold to Renegade Petroleum, and Hyperion Exploration. Most recently, Bailey co-founded Striker Exploration Corp., which amalgamated with Gear Energy Ltd. in July 2016.

Bailey discussed the company’s Swan Hills asset. “We’re producing about 70% light oil from an asset that has been undercapitalized up until now,” Bailey told Oil & Gas 360. “We have already discovered years of new opportunities that stem from reactivating old wells in the play. There are about 2.2 billion barrels of oil in place.”

“We have access to capital, and access to deal flow, and we’re looking for a lot of organic and inorganic growth,” explained Bailey. “We want to bring a more aggressive mindset to these assets.”

Razor Energy will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.