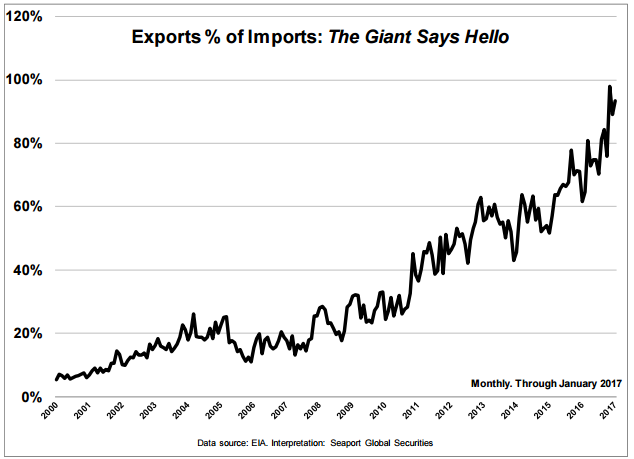

December gas export volumes 98% of import volumes, highest ever

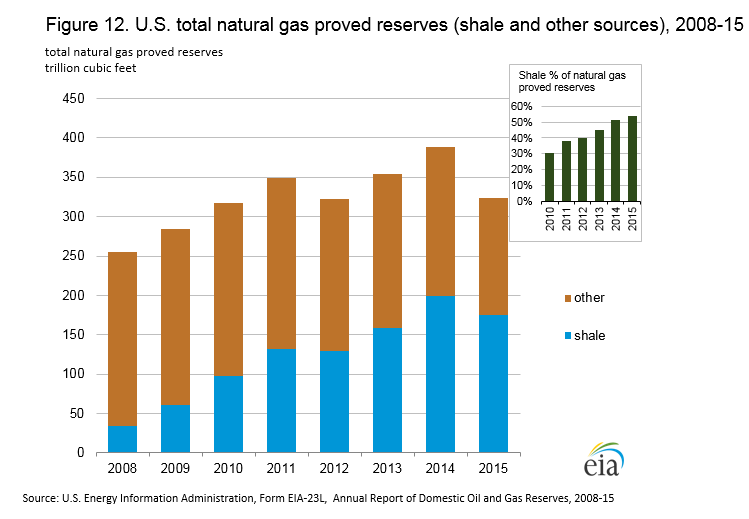

The U.S. unconventional boom has fundamentally changed the natural gas supply situation in the U.S. with plentiful gas easily available. This has changed not only the nation’s gas markets, but the world’s.

Once a major gas importer, the U.S. is now poised to be a net exporter of natural gas. Seaport Global outlined U.S. gas production, consumption and exports in a report released today. In January, export volumes were 93.51% of import volumes, only slightly below an all-time high of 97.96% in December.

Historically, the U.S. has imported far more than it has exported. From 1973, the first data available from the EIA, through 2000, U.S. export volumes were just over 6% of import volumes. While exports started to increase in 2001, they began growing rapidly in 2008. In the eight years since then, export volumes have grown from one fifth of imports to nearly equal import volumes.

This trend will only continue, as U.S. LNG exports begin to become a major factor. According to Seaport Global, LNG exports via tanker have essentially no history prior to summer 2014. Since then, LNG exports via tanker have grown to nearly 20% of all gas exports in January 2017.

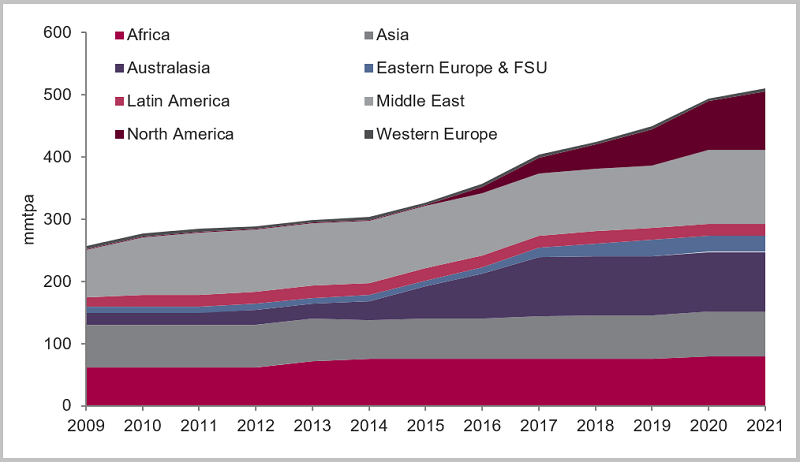

Global LNG capacity increased 230% since 2000

The global production of LNG has increased sharply since 2000. Global liquefaction capacity increased from 15.9 Bcf/d in 2000 to 35.5 Bcf/d in 2010, and is estimated to reach 52.6 Bcf/d by the end of this year. Multiple massive projects, each costing tens of billions of dollars, have been completed in this time. Additional projects are planned, particularly in the U.S.

According to Douglas Westwood, several factors give the U.S. a competitive advantage in LNG.

- Abundant natural gas reserves and substantial volumes of associated gas produced in oil extraction

- The ability to produce these reserves at highly economical wellhead prices

- The presence of Henry Hub and a highly liquid and transparent gas trading market

- Less capital intensive brownfield LNG export infrastructure, predominantly along the Gulf Coast

Douglas Westwood believes that the LNG market is currently oversupplied, but supply disruptions in several locations have somewhat moderated this problem. The massive Gorgon project in Australia has had several production interruptions since starting up in March 2016, and this week Chevron announced that Train 2 would be suspended to allow modification works to be undertaken to “enhance reliability.” In Egypt and Trinidad and Tobago, supply shortages are making exporting LNG difficult. In fact, Egypt became a net importer of gas in 2015 due to declining production.

Shell’s take on LNG

On the other hand, Shell (ticker: RDS.A) does not believe the LNG market is currently oversupplied. According to Shell, LNG spot prices as a proportion of oil prices were very similar in 2016 and 2015, suggesting that LNG maintained its competitive position.

Shell’s LNG Outlook, released Feb. 20, also predicts a tremendous increase in LNG supply over the next 15 years. Shell projects that by 2020 the global LNG trade will have grown by 50%, compared to levels in 2014. Demand for LNG will grow by 4% to 5% per year through at least 2030, according to the report.

World governments, seeking to decrease power sector CO2 emissions, are increasingly turning to natural gas for fuel, in many cases using natural gas for generation capacity additions. China and India have significantly increased their LNG demand, increasing imports by a combined 1.5 Bcf in 2016, according to Shell.

While U.S. natural gas reserves wax and wane with commodity price adjustments annually, and with advances in extraction technologies, U.S. supply is strong and export capacity is increasing.