“We’re not just a one project developer, developing our asset and then clipping coupons from it”

Cheniere, Tellurian and U.S. LNG

If you go all the way back to the pre-shale boom days when the U.S. was forecasting a shortage of natural gas to meet its domestic needs, the idea of importing liquefied natural gas (LNG) was seen as the solution to assuage the coming supply shortage, and several groups began permitting and building LNG import facilities.

Cheniere Energy (ticker: LNG), which was founded by and run by U.S. LNG pioneer Charif Souki, was one of the groups that came to the rescue when it began to develop an import facility on the Louisiana Gulf coast to do just that. But Cheniere’s business model was disrupted by the shale boom.

Part way through the plant’s development stage, over on the E&P side of the industry, horizontal drilling into shale layers and stimulation of the impervious rock formations with hydraulic fracturing soon became the “holy grail” that resulted in the shale boom. The industry had found a repeatable method to allow it to economically extract hydrocarbons from shale plays.

Massive plays like the Barnett shale and the Marcellus in the Appalachian basin were discovered and they began to produce large volumes of natural gas. Suddenly there was going to be more natural gas supply coming out of the ground than the U.S. ever expected. It no longer had a need to import LNG.

Cheniere did an immediate U-turn with its business plan and began converting its Sabine Pass plant to an LNG export facility. Sabine Pass was the first U.S. LNG liquefaction project to go into operation and export cargoes of LNG.

Ironically, Souki missed seeing his vision come to fruition at Sabine Pass in his post as Cheniere’s chief executive when he was dismissed by the board of directors in December 2015—two months prior to Sabine Pass shipping its first cargo of LNG in Feb. 2016.

But within a few weeks after leaving Cheniere, Souki had partnered with former BG chief operating officer Martin Houston who left BG after the $54 billion acquisition of BG Group by Shell (ticker: RDSA).

Beginning of Tellurian

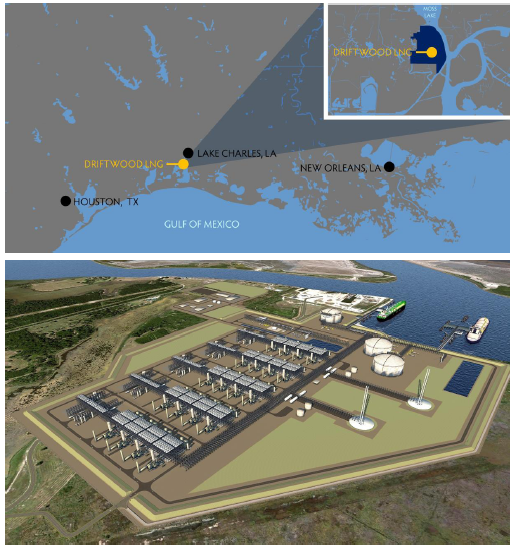

Souki and Houston created privately held Tellurian Investments, which would be the second LNG startup for Souki. Tellurian says its goal is to deliver low-cost LNG to customers from Driftwood LNG, its 26 million tonnes per annum liquefied natural gas export facility that it expects to become operational in 2022. Driftwood is now in permitting and planning/development. Tellurian completed a reverse merger with Magellan Petroleum in February 2017, changed the name of Magellan to Tellurian Inc., which now trades on Nasdaq under the ticker symbol: TELL.

Reporting on LNG from at the CERAWeek conference, Bloomberg reported that the chief executive officers of Canadian energy giant Enbridge Inc. (ticker: ENB) and nascent LNG exporter Tellurian Inc. (ticker: TELL) said that the U.S. may surpass Australia and Qatar and become the world’s largest supplier of liquefied natural gas. “The U.S. will be the cheapest source of new LNG, so we believe a lot of that 100 million tons will come from the U.S.,” according to Tellurian CEO Meg Gentle.

Gentle, a former Cheniere executive, was recruited by Souki last August to manage Tellurian and the development of its Driftwood LNG project.

Tellurian Inc. President and CEO Meg Gentle, joined Oil & Gas 360® by telephone from Houston to discuss the future prospects for U.S. LNG exports, global LNG markets, look at details about Driftwood, and find out how Tellurian compares to Cheniere.

OAG360: How would you compare Tellurian’s Driftwood LNG to Cheniere’s Sabine Pass?

Tellurian President and CEO Meg Gentle: Sabine Pass is on the Sabine Channel, Driftwood is on the Calcasieu Channel which is maybe 40 miles east of Sabine Pass. We’re on the same channel as Cameron LNG and the Lake Charles import terminal. We have about 1,000 acres there. That’s roughly the same as Sabine Pass. We’ve always believed that you need a very large site to minimize all the logistics and costs of construction.

We are well interconnected with the gas grid and the electricity grid so unlike Sabine Pass, we will not need to spend capital to self-generate power. We will just buy from a combination of Entergy and Jeff Davis. They are actually already interconnected with the site because prior owners used some of that land and the port had some facilities there. So it already has some power lines that are at the site.

We will be designing this facility for 26 MTPA, and we are using a little bit different design. Sabine Pass is Bechtel constructed ConocoPhillips refrigerators and GE turbines. We have Bechtel-constructed Chart Industries refrigerators and GE turbines.

The design that has been evolving in the LNG business is making economies of scale in liquefaction from building very large refrigerators, between four and seven MTPA. Each about six refrigerant compressors which generally use either GE turbines or Siemens turbines attached to the refrigerator. What we’ve said is “is that actually the most efficient?” When you get into operation even if you only have to service one of those compressors you have to bring the whole five MTPA of LNG production down in order to do maintenance.

So [we asked] what if we took the largest class of GE turbines, currently the LM 6000, and size the refrigerator for one turbine?

That way we increase our reliability, reduce our maintenance and make it so we don’t need to have as much redundancy or spare parts and that will all reduce our construction costs. So that resulted in a refrigerator that is only 1.3 MTPA in size. So we’ll have 20 trains, each 1.3 MTPA, which makes the total design 26 MTPA.

So people have started talking about small-scale and mid-scale and we’ve sort of chuckled at that. As you would imagine, there is nothing small scale about LNG. It’s just making the refrigerator component itself a little bit more modular, repeatable and standardized.

But we’re still using the largest GE turbines, the largest storage tanks ever built—and 26 MTPA is a very large facility in and of itself. You still have to get economies of scale to make the CapEx work.

OAG360: How do you think Tellurian compares with Cheniere?

MG: I think that Tellurian is similar to Cheniere when we started Sabine pass, with a couple exceptions. Cheniere’s balance sheet by the time we were working on liquefaction had gotten fairly complicated, just because we were financing a different business then. We were going to be an import business with a small asset that was perfect for the MLP market. When we were working on liquefaction we had to work within that capital structure which provided a little bit of constraint.

So that’s one thing that is very refreshing this time, we have a very simple, clean balance sheet. Just one corporate umbrella entity that is now, as of February 10 publically traded on the NASDAQ and two project companies, one for the LNG terminal and one for the interconnecting pipeline. We have no debt and so all of this will be helpful when we get to the financing stage.

The other improvement is that when we were starting Sabine Pass we had LNG experience on the team, but quite frankly we were breaking the model apart and going day by day.

By now we’ve learned so many lessons and we’ve been able to combine that with the lessons learned from decades of constructing liquefaction. I think we’ve brought together a team with a lot more experience than when we were starting Sabine Pass, and with the ability to move a lot faster. We had the first mover advantage [at Cheniere] and now we have the fast mover advantage [at Tellurian].

OAG360: Where do you think the U.S. LNG markets will be going in the next 5 to 10 years?

MG: U.S. LNG, by the end of this construction round, will have roughly 70 MTPA of liquefaction capacity. We do expect those plants to be running at around their nameplate capacity, sometimes slightly more, sometimes slightly less due to maintenance. There are two trains, roughly 10 MTPA that have come online in Sabine Pass without any impact on U.S. natural gas price. That helps confirm what we have long believed, which is that liquefaction will come on kind of a phased, slow fashion. It won’t provide a shock to the gas markets and there are ample reserves to sustain production at $2.50-$3.00/MMBTU for the foreseeable future. So we think it is a very healthy gas market and frankly the lowest cost supply for the future of the LNG business.

So then with that we look to what is the call on LNG going forward. It’s really the market that’s going to determine what additional liquefaction is needed from the U.S. If you look at the global gas market, about 350 Bcf/d of demand worldwide, that grows at about 1.8%-2% per year. That requires about 7 Bcf/d of new gas per year or about 52 MTPA per year.

We generally expect that the call on LNG will be for roughly a third of that growth and then two thirds will be provided by pipeline gas. So that means that we need to bring about 15 MTPA to 20 MTPA of LNG into the market per year, which concludes that as an industry we have to be reaching FID on about 100 MTPA for the next five years or the market is going to be short. From a construction standpoint we actually view ourselves as slightly behind meeting growth and demand by 2022 and 2023.

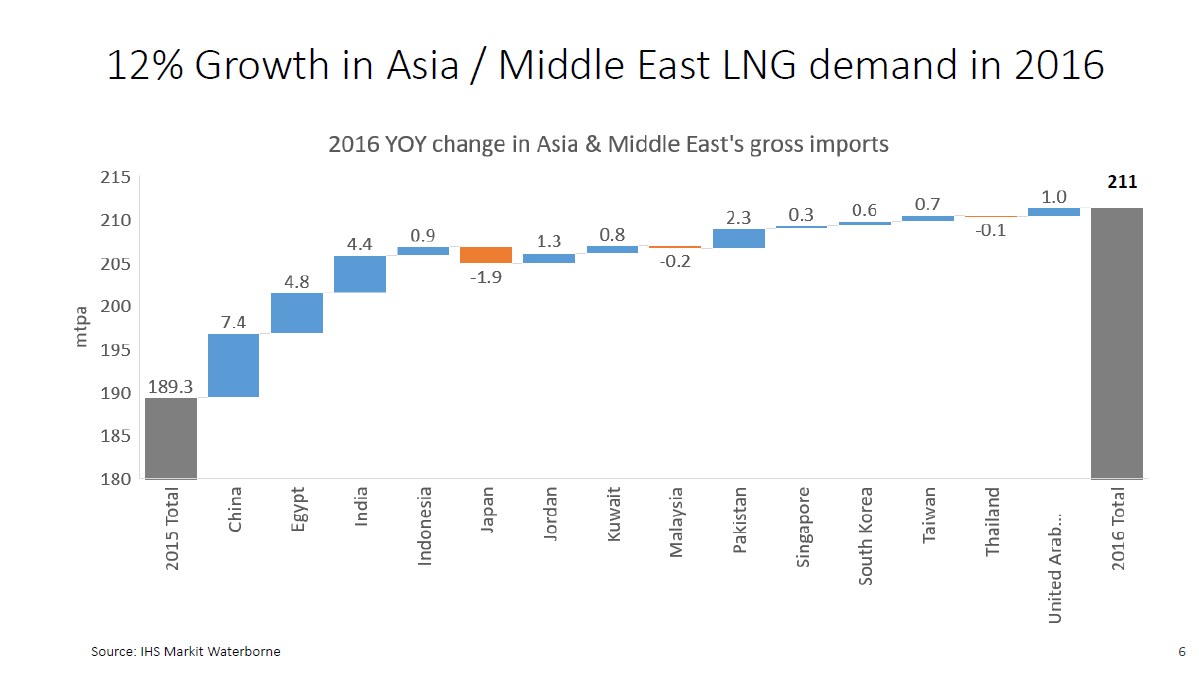

We fully expect that the market will absorb the LNG that’s coming online today and through 2020. There’s a little bit of pain in the price, especially in the summer, but it is happening. All of the LNG produced last year was consumed, which represented a 6% growth in the global LNG market. It definitely was produced and cargoes got sent to market and there were some big surprises in the market.

The leader in demand growth was China, which consumes more than their contractual obligations, which exceeded expectations. People generally talk about China being over-contracted and sending cargoes back on to the market but for the full year that was not the case.

India’s consumption increased from about 14 MTPA to about 19 MTPA and that was all of their regasification plants running at 100% capacity. So that’s an indication that the Indian market is actually constrained by infrastructure. There’s another 15 MTPA to 20 MTPA of regasification capacity that is coming online in India, so some of that constraint will be alleviated over the next couple years.

There were also unexpected places. Pakistan’s government talks about being a 30 MTPA buyer when two years ago they didn’t buy anything. Overall we may not be able to predict the place but low prices encourage demand growth. I’m actually really encouraged about the market and I think that Driftwood LNG is really well timed.

We’re going to file our full FERC application this month, so we’ll have a year of permitting. We’ll be finished with the EPC contract by this summer so that will hold a guaranteed price until we’re through permitting. We have all of our banker friends interested in provided bank debt for the project, so we’ll be hiring a financial advisor and moving forward on structuring the financing. We were in close contact with all the customers and asking them to be patient until we got our commercial team in place, which we now have. There’s staff in Houston, London and Singapore and we’ll see everyone in Tokyo in April at the conference there. I think that we’re pretty well timed to meet a 2018 beginning of construction and a 2022 first LNG.

OAG360: With the new administration we may be seeing some changes in energy policy. Do you have any expectations for effects on your operations?

MG: I think we meet a lot of the policy goals that they have been talking about so far. It’s a construction project in the U.S., it’s adding 4,000 construction jobs, there is manufacturing that will occur in the U.S. for some of the equipment components, exports that will help the balance of trade, and energy development. All of these things are supportive of the policies that have been discussed.

There’s been a little more talk about ending globalization, though, and I find that very strange. I think globalization is inevitable, should not end and ending it would not be positive for the economy.

OAG360: How does the location of U.S. gas supply affect your decision making?

MG: There is more than adequate natural gas near the facility. One of Kinder Morgan’s pipelines is almost on the property. We will build a 96 mile pipeline that will interconnect us with about 14 different pipeline interconnects in Louisiana. That will give us access to about 35 Bcf/d of flowing gas. When we reach our peak we will be purchasing about 4 Bcf/d to 5 Bcf/d, so there’s about seven times the amount of gas that we need that we’ll be accessing with our pipeline.

The question then will be “where are places in the U.S. that we may gain access to gas cheaper then we access at our liquidity point?” Either because there is lower cost production than the price at the Henry Hub or there is other production that is significantly below the marginal molecule that we can access by contracts with other producers. We would then own pipeline capacity to get it to the plant.

Marcellus/Utica is really interesting. It’s probably the lowest cost of production in the U.S. but it’s not necessarily the cheapest to deliver to us in Louisiana because pipeline transport can be rather expensive. If we can encourage more pipeline development from the Northeast down to the Gulf coast, though, then a lot of that gas which is somewhat stranded behind pipe can access the wider market.

OAG360: LNG plants require a long lead time due to permitting and construction. With that in mind, where do you think you’ll locate your next plant?

MG: We’re not just a one project developer, developing our asset and then clipping coupons from it. We have all been developing the LNG business and that is our mission here, to develop an LNG business where the first asset is Driftwood LNG. After that we want to build a network of assets that continues to meet the growth of the market. We don’t know where the next generation asset will be but we definitely intend to build a portfolio.

OAG360: Driftwood isn’t the only asset Tellurian owns. You also have the rights to a block in offshore Australia, the Bonaparte basin. Are you looking to develop that or focus on Driftwood for the near future?

MG: We merged with Magellan Petroleum when we went public. They were a 60 year old E&P company that was doing CO2 floods in Montana. When oil prices went down those were not economic anymore so they sold all their U.S. assets to pay down the debt they had. They then started looking for a buyer because they knew they couldn’t survive on one asset in the U.K. and one asset in Australia. So that’s how we got those assets.

We’re not particularly focused on having a big discovery in Australia. However, we have some commitments that we have to honor to the Australian government. We have to run seismic data to assess what to do next with that asset. We’re going to honor those obligations and when we see the results of the seismic we’ll know what to do. In general we’re planning to divest that asset but it is in the middle of the supply to the Darwin LNG facility and Total’s Icthys plant so you never know.

OAG360: What’s it like to work with LNG legends like Charif Souki and Martin Houston?

MG: I’ve worked with Charif for almost 14 years and known Martin for many years. We were working with Martin at Cheniere to encourage the contractors to arrive at a lower cost design. We had kind of started this research project together with him years ago and in fact we had hired Martin as a consultant because he had so much experience operating large companies and large liquefaction plants. We had asked him to come and help us develop certain parts of the staff and identify places where we needed additional resources. He and I were working together as I was building the marketing business for Cheniere in London. I had the opportunity to work a lot with Martin and built a good relationship with him.

I would say that coming to Tellurian was almost like coming home. Charif was there, Martin was there, several other people that I’ve worked with before were there. So it’s really an amazing team of people who trust each other and can make decisions very quickly. That’s why we can move forward so fast.

On March 2, 2017, Driftwood LNG received authorization from the United States Department of Energy to export LNG to free trade agreement (FTA) nations. Tellurian has also submitted an application to export LNG to non-FTA nations and expects to file a Federal Energy Regulatory Commission (FERC) application later this quarter.