Devon targets 2017 CapEx of $2.0-$2.3 billion

Devon Energy (ticker: DVN) reported fourth quarter earnings yesterday and 2016 reserves today, showing net earnings of $331 million, $0.63 per share. Full year earnings are a loss of $3.302 billion, or ($6.52) per share.

2016 year end reserves are down to 2,058 MMBOE, from 2,182 MMBOE last year. Much of this decrease is due to the sale of assets that Devon completed in 2016. 34% of Devon’s reserves are comprised of oil, 45% are gas, and 21% are NGLs. Estimated finding costs in 2016 were $5.01/BOE.

2016 divestitures paid down debt

Devon completed a major divestiture program in 2016, selling off much of its non-core assets. These included:

- Mississippian acreage in Oklahoma, sold for $200 million in April

- Midland Basin acreage, sold in June for $858 million,

- East Texas, Granite Wash, and Midland Basin acreage, raising a combined $1 billion in June,

- Midstream assets, sold in July for $1.1 billion.

The proceeds from these sales were used to pay down $2.5 billion in debt in 2016, and left the company with a much more concentrated asset portfolio.

Oil production to grow by 13 to 17 percent

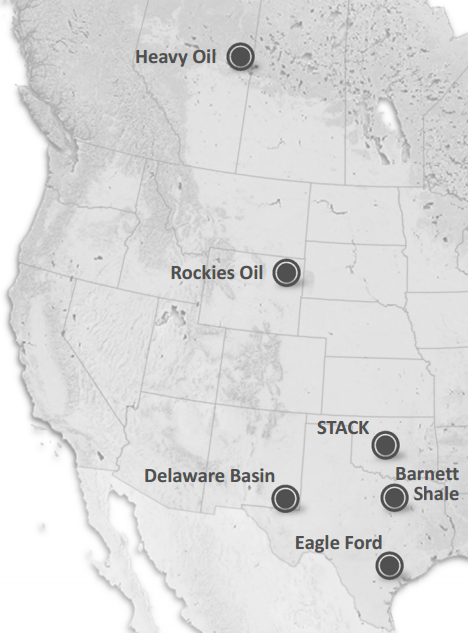

Devon plans to focus on its core assets in 2017, the STACK and Delaware Basin. Expected 2017 CapEx of $2.0 to $2.3 billion will fuel increased drilling activity, with 15-20 active rigs expected by the end of 2017. This accelerated activity is expected to drive 13 to 17 percent oil production growth in the U.S. during 2017 compared to Q4 2016.

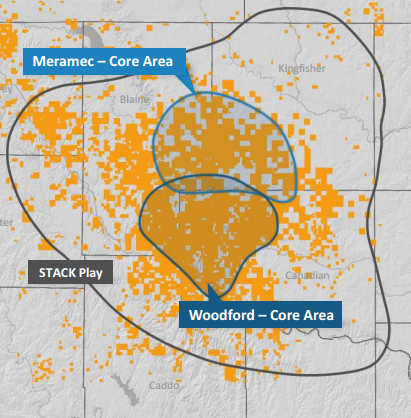

Devon expects to significantly develop its STACK assets in 2017, where the company owns more than 625,000 net acres. Production increased in the play by 37% in 2016, and is expected to grow by an additional 35% in 2017. Devon plans to increase its active rigs in the play from 6 to 8-10 by the end of 2017. 2017 CapEx in the basin will also increase significantly to $750 million, up from $450 million in 2016. This spending is expected to result in 100 gross operated wells coming online in 2017. With an estimated 5,400 undrilled locations in the STACK, the company expects to be active in the basin for decades.

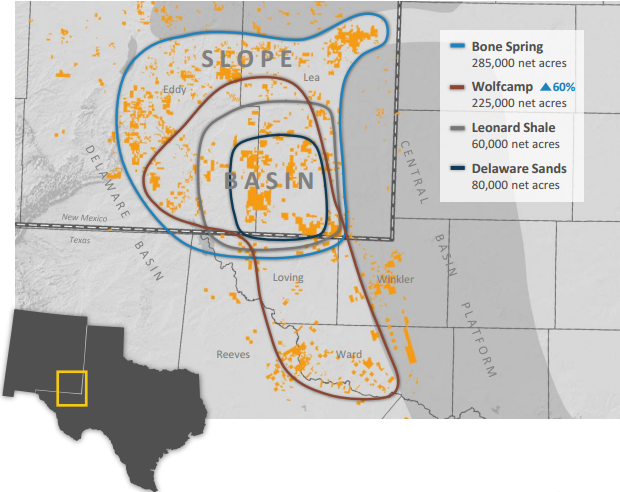

Devon’s operations in the Delaware Basin, where the company owns about 670,000 net acres, are expected to increase in 2017 as well. Only 3 rigs are currently active in the basin, but the company plans to have 7-10 active by year-end 2017. Devon expects to invest $700 million in CapEx in the formation, drilling about 100 operated wells in 2017. Between the many stacked plays in the Delaware basin Devon estimates it has 5,850 undrilled locations available for development.

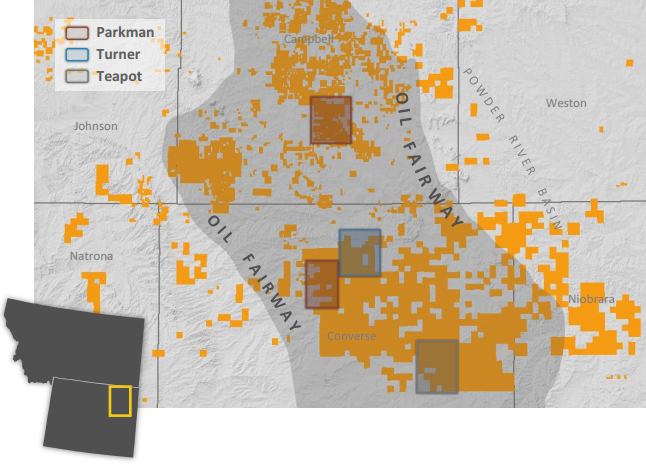

Activity in the Rockies has also increased, where the company saw LOE decline by 53% in 2016. Drilling activity has resumed in the Powder River Basin with one rig operating in Q4 2016. About 20 new wells are planned for 2017, stabilizing Devon’s falling production in the region. The company puts 2017 CapEx at about $175 million in the area, with 240 potential undrilled locations.

Q&A from DVN Q4 conference call

Q: You’ve added significant locations in the Meramec and you have a large location upside in the Delaware where you’re ramping-up activity most this year. I guess the question is how do you think about the portfolio impact if your location count continues to grow? And do you have enough confidence in the current direction to trigger another round of asset sales in 2017?

DVN President & CEO David A. Hager: Well, we obviously are working our way through the appraisal of a number of different zones, as you highlight, both in the STACK play and the Delaware Basin. And the results so far have been very, very encouraging that we’ve seen with the – not only the number of zones that are working in both of these plays as well as the potential or downspacing in both of these plays.

So we think we’re positioned in a couple of the best basins in onshore North America, and we have some of the best position in those best basins. So we feel really good about that.

We do want to further our understanding before we make any strategic decisions such as that. We’re also working some of these other areas that may be consideration and we’re improving the results in those areas at the same time. We are going to have, for instance in the Barnett, we’re going to have a refract program that is substantially lower cost and we’ve done previously that could really be a game changer in terms of the returns on that program. We’re also going to drill some new wells with modern drilling and completion technology that hasn’t been done for several years.

So we want to see all of this work come together as far as finalizing or getting more data as far as how big our inventory really is in these top-tier resource plays. And then doing some work in some of these other plays to really understand the full potential of these plays before making any sort of strategic decision. Now I’ll say, if you go back over the past few years, we haven’t been hesitant to make the right decision at the right time as far as optimizing our portfolio. We think it’s really important, if we ever do make a decision this way, that we have the best information available when we do that.

Q: You talked about Devon being a leader of Big Data. To the extent that you’re comfortable, can you tell us where your operations you’re using Big Data that is yielding good results? And what makes you a leader? And what sort of things should we look for going forward from your efforts on this front?

David A. Hager: And it’s probably about three years ago we made a large commitment internally to be more fact-based and data-driven in our day-to-day work. We spent quite a bit of time in that, we brought in and incorporated some people from outside the industry to help us get through that work. So collectively, it’s been a big effort. So as we have taken the information or that data collection and we talk about all the different types of subsurface data that we are acquiring, also that has been included in our surface work.

So we stood up some decision-support centers was the first thing that we did, just monitoring all of our producing assets from around the company. Minimizing downtime, trying to maximize the production rate from that, but it really has greatly expanded from that. So while we are acquiring a lot of this information, we’ve found ways now to get that information in the hands of our technical teams, more real-time than we have in the past. And so the data reporting has elevated us to a new level here internally. We’re incorporating that into all phases of our business. And some different areas that we are working on, as you mentioned, was on the artificial lift-roll ability.

So now we are watching daily information – more than daily information on all of our submersible pumps and gas lift injection rates across the company and are able to better predict the reliability of those pumps. We’re able to better schedule maintenance on those pumps so we have limited downtime. We are also incorporating this data into our well flowback type work. We’re able to monitor our rates and pressures and really get the wells off of the well flow back environment quicker. That happens to save about $50,000 per well. We’ve incorporated this data into our coil tubing drill outs and the completion phase of our work. And so while we are seeing this pressure and rate information on that portion of our business, it’s also accelerating our coil tubing drill outs to the point of saving about $100,000 per well.

Q: Can you talk more about the nature of your activity [in the Delaware]? Is it primarily an appraisal-type activity or is it in the explorational realm? Thanks.

David A. Hager:It’s really not in the exploration nor the appraisal. We’re doing a little bit of appraisal work across our position, but for the most part we’re moving into developments in 2017. And so you will see on the operating report on the Delaware section there the four core areas that we’re working. We’ve already got three rigs stood up right now working the Thistle area. That’s going to be predominantly a Leonard Shale development. We’ve announced in December that we had a couple of good wells stacked on top of each other in the B and the C, and we’ve seen industry work in the A. So we think we have a very hearty development plan there for the Thistle area.

And Cotton Draw has been an area that we’ve had a – the majority of our historic second Bone Spring work. And again, we’ll have rigs working there through the year, developing additional Bone Springs, Delaware, Leonard and some Wolfcamp-type activity. And in the Rattlesnake in the southeastern portion of our position there, we’ll actually be standing up work there in the second half of the year, prosecuting the Leonard Shale but primarily the Wolfcamp. And we’ve seen some really outstanding results from some operators adjacent to our footprint there in Rattlesnake that have had some stellar wells. So we’re really trying to move our Delaware and STACK into the development mode as quick as we can. We continue to do some amount of appraisal work year in year, out just, just to prepare for the next years’ developments.