Oil prices move higher as markets expect high levels of compliance among OPEC and non-OPEC members

Oil prices were up over $1 per barrel Friday as markets felt hopeful that OPEC and non-OPEC members taking part in production cuts were complying with their agreement.

A committee designed to monitor oil-producer compliance with the cuts is scheduled to meet this weekend.

Saudi Arabia Energy Minister Khalid al-Falih said multiple times throughout the World Economic Forum in Davos this week that there has been strong compliance among the group so far. News reports quote him as saying Friday that 1.5 MMBOPD of the roughly 1.8 MMBOPD of promised cuts have already been taken off the market.

“The petroleum markets are moving higher in Friday trade on the latest round of positive talk about how much supply oil producers have taken offline ahead of Sunday’s review by OPEC and non-OPEC representatives in Vienna,” Tim Evans, Citi Futures’ energy futures specialist, said in a note.

On Monday, al-Falih said that the production cuts would likely last six months. The group of OPEC and non-OPEC producers is scheduled to meet again in May to decide whether or not to extend production cuts, but it is unclear if six months of lower production will be enough to rebalance markets.

“For a lasting balance to be restored on the oil market and the very high stocks reduced, the agreement will need to be strictly implemented over a considerable period of time,” Commerzbank said in a note.

“This is particularly true given that U.S. oil production is rising again and given that the oil supply from Libya and Nigeria may be expanded.”

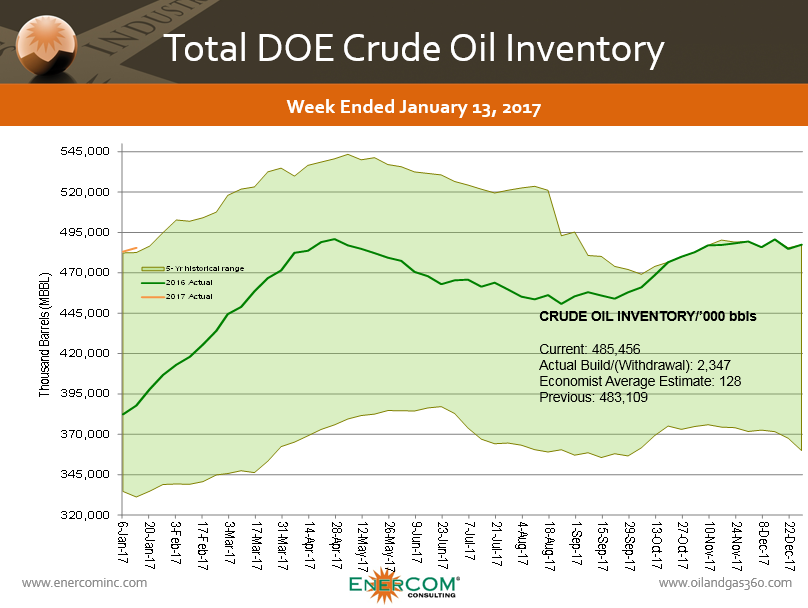

Crude oil inventories in the U.S. rose 2.3 MMBO in the week ended January 13, 2017, but a draw of 1.3 MMBO at Cushing, Oklahoma, the delivery point for WTI oil, helped to keep prices up Thursday. Gasoline builds were larger than expected as demand softened.

If the OPEC committee finds there has been little cheating among the group on production cuts, there may be more potential upside for oil prices, but both WTI and international crude oil benchmark Brent are likely to see their value capped by increased shale production in the United States.