Parsley plans to complete 120-140 gross operated horizontal wells in 2017, company targets 60% annual production growth in 2017

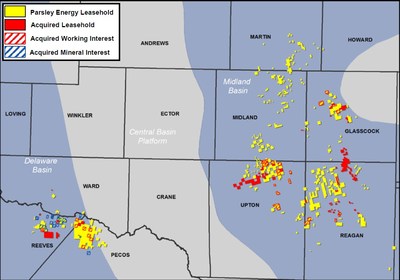

Parsley Energy, Inc. (ticker: PE) has entered into unrelated transactions for undeveloped acreage and producing oil and gas properties adjacent to its existing operating areas in the Midland and Southern Delaware Basins.

The company said it acquired the properties for an aggregate purchase price of $607 million in cash, subject to customary closing conditions. Parsley also acquired certain mineral interests in the Southern Delaware Basin for an aggregate purchase price of $43 million.

Parsley intends to finance these acquisitions through an equity offering announced concurrently with the acquisitions.

Acquisition highlights

-

Approximately 23,000 net leasehold acres

-

Estimated current net production of approximately 2,300 Boe per day

-

Approximately 340 net horizontal drilling locations in primary target intervals (Wolfcamp A, Wolfcamp B, Lower Spraberry, and Bone Spring formations)

-

Approximately 660 net royalty acres

Midland

- Approximately 25,200 gross / 17,800 net leasehold acres in Upton, Reagan, Glasscock, and Midland Counties, TX for approximately $402 million

- Estimated current net production of approximately 1,200 Boe per day

- Approximately 230 net horizontal drilling locations in the Wolfcamp A, Wolfcamp B, and Lower Spraberry target intervals, with additional locations in less developed intervals and potential upside from tighter spacing and additional flow units in primary target intervals

- Those transactions not yet closed are scheduled to close on or before February 27, 2017, subject to the satisfaction of customary closing conditions.

Southern Delaware

- Approximately 6,600 gross / 5,200 net acres in Reeves, Pecos, and Ward Counties, TX for approximately $205 million

- Estimated current net production of approximately 1,100 Boe per day

- Approximately 110 net horizontal drilling locations in the upper Wolfcamp and 2nd and 3rd Bone Spring target intervals, with potential upside from tighter spacing and additional target intervals

- Mineral rights translating to a 17% average royalty interest in approximately 3,900 net acres, or approximately 660 net royalty acres, in Reeves and Pecos Counties, TX for approximately $43 million

- Those transactions not yet closed are scheduled to close on or before January 31, 2017, subject to the satisfaction of customary closing conditions.

“We are excited to announce a set of acquisitions that add to our premier asset bases in both the Midland and Southern Delaware Basins,” said Bryan Sheffield, chairman and CEO of Parsley Energy, in a statement.

“Together, these properties will increase our net acreage by more than 15%, and we believe that our track record of operational excellence, productivity enhancement, and cost leadership makes us the best owner of these assets.”

2017 capital program

All figures except the reference to 4Q17 net production refer to full-year 2017 totals or averages, the company said.

- Average net production of approximately 57.0-63.0 MBoe per day

- Oil volumes to account for 68-73% of total net production

- 4Q17 net production of approximately 70.0-80.0 MBoe per day

- Capital expenditures of $750-$900 million

- 120-140 gross operated horizontal completions, with average working interest of 85-95%

- Average lateral length of approximately 8,000′

Parsley President and Chief Operating Officer Matt Gallagher said, “Having maintained healthy activity levels, steadily supplemented our acreage portfolio, and increased our operational capacity throughout the downturn, Parsley has a head start toward leading production and cash flow growth in a more benign commodity price environment. The Company’s 2017 capital program spans our development areas and demonstrates our commitment to pulling value forward from new and legacy assets, alike. On top of sustainable growth from our reliably prolific and expanding Midland Basin resource base, we believe 2017 will mark an inflection point for Parsley in the Southern Delaware Basin as years of exploration and delineation begin to pay substantial dividends. We expect production from the Southern Delaware to increase fourfold by the end of the year and, boosted by this contribution, we expect to generate significant production momentum through the end of 2017. This production growth should be characterized by robust returns and expanding margins as a function of meaningfully higher average lateral lengths, net revenue interest, and oil as a percent of total production, accompanied by lower unit costs and development costs per lateral foot.”

2017 Capital Program and Operational Guidance Detail

| 2016E | 2017E1 | ||

| Production | |||

| Annual Production (MBoe/d) | 37-39 | 57-63 | |

| % Oil | 65%-70% | 68%-73% | |

| Capital Program | |||

| Drilling and completion ($MM) | $395-$435 | $630-$750 | |

| Infrastructure and other ($MM) | $65-$75 | $120-$150 | |

| Total development expenditures ($MM) | $460-$510 | $750-$900 | |

| Activity | |||

| Gross operated horizontal completions | 80-90 | 120-140 | |

| Midland Basin | 75-83 | 85-95 | |

| Delaware Basin | 5-7 | 35-45 | |

| Average Lateral Length | ~7,000′ | ~8,000′ | |

| Average Working Interest | 85%-95% | 85%-95% | |

| Unit Costs | |||

| Lease operating expenses ($/Boe) | $4.25-$4.75 | $4.00-$4.75 | |

| Cash general and administrative expenses ($/Boe) | $5.00-$5.50 | $4.50-$5.25 | |

| Production and ad valorem taxes (as a % of revenue) | 6.5%-7.5% | 6.5%-7.5% | |

| 1These estimates are based on our current planned capital expenditures, drilling activity, and well results, as well as our current expected unit costs for 2017. Achieving these production estimates and maintaining the required drilling activity to achieve these estimates will depend on the availability of capital, regulatory approval, commodity prices, drilling and completion costs, actual drilling results, and other factors. To the extent any of these factors changes adversely, we may not be able to achieve these production and drilling results. | |||

Parsley targets 2017 completions of 75% more net lateral footage than in 2016

Parsley plans to complete 120-140 gross operated horizontal wells in 2017. At an average lateral length of approximately 8,000 feet, 2017 completions would represent approximately 75% more net lateral footage than the company completed in 2016. Parsley said it does not expect significant variation in the level of drilling activity over the course of the year.

Anticipated capital spending of $750-$900 million incorporates the horizontal wells and also associated facilities, infrastructure, and other expenditures, which will represent a larger portion of total development spending in the Southern Delaware Basin than in the Midland Basin as Parsley transitions to development mode in the Southern Delaware Basin.

Given an anticipated increase in oil as a percent of total production, Parsley said it expects growth in oil volumes to outpace overall production growth in 2017. While Parsley expects to generate robust year-over-year production growth of approximately 58%, the company expects even sharper oil volume growth of approximately 65% versus 2016. Drilling and completion activity should account for more than 95% of anticipated 2017 production growth, with an estimated contribution of approximately 1,000 Boe per day from already producing wells associated with newly announced acquisitions.

The company expects steady production growth over the first half of 2017, followed by steeper growth through the end of the year as projects initiated early in the year come online.

Capital allocation

Parsley intends to deploy approximately 60% of planned 2017 development capital in the Midland Basin, with the balance allocated to the Southern Delaware Basin—a ratio that should hold relatively steady throughout the year.

While Parsley regularly implements new designs and technologies across its development program, approximately 20% of planned capital expenditures are specifically designated for projects that could be classified as delineation activity inasmuch as it involves less proven target zones and/or spacing configurations. Accordingly, Parsley said it expects to take significant steps toward an optimized development program even as the company generates superior production growth.

Parsley expects to bring 85-95 horizontal wells online in the Midland Basin. Drilling and completion activity in the Midland Basin will focus on the Wolfcamp A and Wolfcamp B intervals, with additional activity planned for the Lower Spraberry, Middle Spraberry, and Wolfcamp C formations.

Parsley expects to bring 35-45 horizontal wells online in the Southern Delaware Basin. Drilling and completion activity in the Southern Delaware Basin will focus on the upper Wolfcamp interval, with additional activity planned for the Middle Wolfcamp, 2nd and 3rd Bone Spring, and additional flow units in the upper Wolfcamp interval. In addition, contemplated drilling locations in the Southern Delaware Basin are weighted toward leasehold on which the company holds mineral interests, enhancing the economic profile of such drilling projects.

Cost outlook

Unit cost guidance for 2017 represents incremental reductions relative to anticipated 2016 averages, which in turn represent significant declines from prior period costs. Parsley also expects lower development costs per lateral foot in 2017 than in 2016 despite a significantly greater capital allocation to more intensive Southern Delaware drilling projects, higher average completion intensity across the development program, and modest service and equipment cost inflation.

Hedging update

In view of the anticipated production growth outlined above, Parsley has added meaningfully to its oil hedge portfolio, thereby reducing the variability of its anticipated cash flows and enhancing the Company’s ability to execute its expressed development plan. Given increased visibility to near-term commodity prices, the Company has elected to hedge a larger percentage of its anticipated oil volumes in the second half of 2017 than in the first half of 2017, and has also established a meaningful position in 2018. Parsley hedges oil volumes with put spreads, which provide downside protection while retaining exposure to higher oil prices. Based on the possibility of basin-specific tightness associated with potential Permian Basin production growth, the Company has also entered into basis swaps covering the next several quarters.

Open Oil Derivatives Positions

| 1Q17 | 2Q17 | 3Q17 | 4Q17 | 1Q18 | 2Q18 | ||||||

| Put Spreads (MBbls/d)1 | 13.8 | 13.6 | 35.7 | 45.5 | 23.3 | 13.2 | |||||

| Put Price ($/Bbl) | $49.93 | $49.93 | $52.66 | $52.80 | $53.21 | $53.75 | |||||

| Short Put Price ($/Bbl) | $36.14 | $36.14 | $41.80 | $41.95 | $41.43 | $43.75 | |||||

| Premium Realization ($ MM)2 | ($4.9) | ($4.9) | ($16.4) | ($20.0) | ($9.5) | ($4.4) | |||||

| Mid-Cush Basis Swaps (MBbls/d) | 11.3 | 11.3 | 12.2 | 12.2 | 1.0 | 1.0 | |||||

| Swap Price ($/Bbl) | ($1.00) | ($1.00) | ($1.05) | ($1.05) | ($0.95) | ($0.95) | |||||

| 1When NYMEX price is above put price, Parsley receives the NYMEX price. When NYMEX price is between the put price and the short put price, Parsley receives the put price. When NYMEX price is below the short put price, Parsley receives the NYMEX price plus the difference between the short put price and the put price. | |||||||||||

| 2Premium realizations represent net premiums collected (from restructured positions) or paid (including deferred premiums), which are recognized as income or loss in the period of settlement. | |||||||||||

Equity offering

The company has filed a registration statement (including a prospectus) with the SEC for an equity offering.

Parsley priced an underwritten, upsized public offering of 22,000,000 shares of Class A common stock for total gross proceeds (before underwriters’ fees and estimated expenses) of approximately $770.0 million. The company said the 22,000,000 share offering represents a 2,000,000 share upsize to the originally proposed 20,000,000 share offering. The underwriters have an option for 30 days to purchase up to an additional 3,300,000 shares of Class A common stock from the Company. The Equity Offering is expected to close on January 16, 2017, subject to customary closing conditions.

The Company intends to use a portion of the net proceeds of the Equity Offering to fund the aggregate purchase price for certain acquisitions of oil and natural gas interests in the Midland and Southern Delaware Basins, and the remaining net proceeds will be used to fund a portion of the company’s capital program and for general corporate purposes, including potential future acquisitions.

The Equity Offering is being made pursuant to an effective shelf registration statement, which has been filed with the Securities and Exchange Commission (the “SEC”) and became effective June 5, 2015.