Acquisition Simplifies Complex Corporate Structure, Reduces Operating Costs

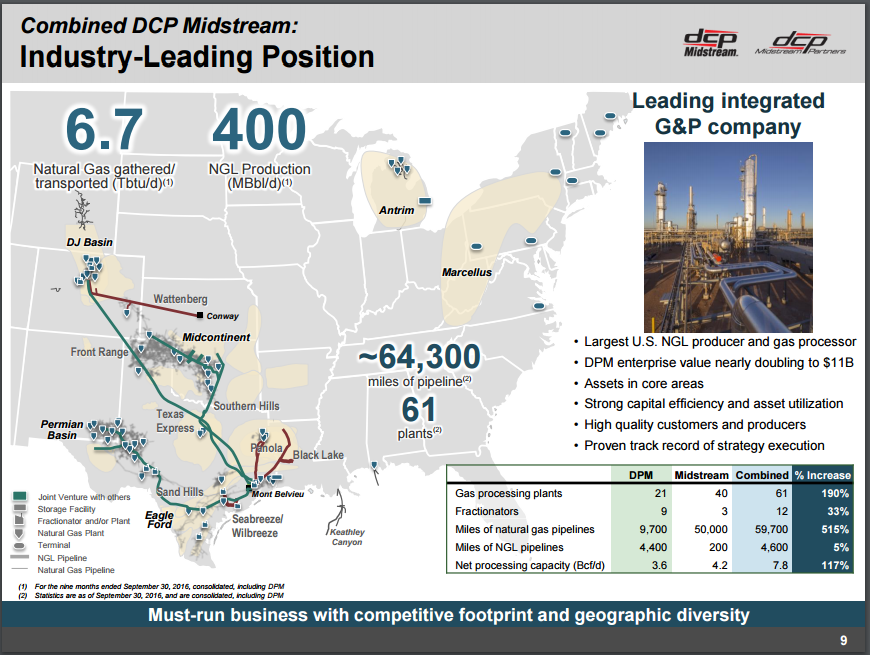

DCP Midstream, LLC announced that it will combine with DCP Midstream Partners, LP (ticker: DPM), simplifying the corporate structure and creating the largest natural gas liquids producer and gas processor in the U.S. The combined company, to be named DCP Midstream, LP and trade under the ticker DCP, will have an enterprise value of $11 billion.

DCP Midstream, LLC is a 50/50 joint venture between Philips 66 (ticker: PSX) and Spectra Energy (ticker: SE). The transaction will increase both companies’ ownership 38%, allowing greater participation in increased earnings from MLP growth.

“This transformational transaction provides a platform of premier assets with strong growth opportunities in the key U.S. producing basins at a multiple that paves the way towards future distribution growth,” said Wouter van Kempen, chairman, president, and CEO of both companies.

The deal follows a trend of energy infrastructure companies simplifying their complex corporate structures to reduce operating costs. Energy Transfer Equity LP, controlled Sunoco Logistics Partners LP and Energy Transfer Partners, combined in November.

DJ Basin Expansion

The combined company plans to expand projects in the DJ Basin to increase local processing capacity by 50% to 1.2 Bcf/d by 2019. The 200 MMcf/d Mewbourn 3 cryogenic natural gas processing plant is planned to be in-service in late 2018 and a second 200 MMcf/d plant is planned to be built in 2019.

Gas infrastructure continues to be a concern for DJ Basin operators. These capacity expansions will help alleviate constraints due to elevated line pressure, which Wells Fargo has stated could potentially “pose challenges as temperatures heat up in the summer months of 2017 and 2018.”

“We see elevated line pressure as an issue facing basin operators who might be forced to look to small projects and work-arounds to address gas processing/takeaway needs until these larger projects come online,” said David Tameron, Senior Analyst at Wells Fargo.

Currently, DCP is constructing field compression and plant bypass infrastructure that will add 40 MMcf/d of incremental capacity by the summer of 2017. These plants will connect to the Front Range Pipeline for NGL takeaway to Mont Belvieu.

Permian Expansion

The company also plans to increase NGL takeaway capacity by 30% on its Sand Hills Pipeline to 365 MBOPD at the end of 2017 to meet production growth from owned and third party plants in the Delaware, Southeastern New Mexico, and the Cline Shale of West Texas.

The newly combined company will own two-thirds interest in Sand Hills, with Phillips 66 Partners owning the remaining third.