COP adding 5 rigs in the Bakken and Eagle Ford in Q4 2016

The world’s largest independent E&P, ConocoPhillips (ticker: COP), reported a third-quarter 2016 net loss of $1.0 billion, or ($0.84) per share today.

But the company snagged its analysts’ attention in today’s conference call when executives disclosed that it had shifted capital from deepwater and large projects into two U.S. shale basins.

In its Q3 conference call COP executives said they are putting four rigs to work in the Eagle Ford and four in the Bakken in Q4 2016.

“This rush to the Permian by everybody else has really left us advantaged in the Eagle Ford and the Bakken,” Al Hirshberg, ConocoPhillips’ EVP of production, drilling and projects, said during the call.

“In the Eagle Ford, there’s all kinds of people offering us good deals,” he said, referring to favorable pricing COP is getting from oilservice providers in the basin. “We have already been able to secure drilling rigs and pressure pumping crews at attractive rates to maintain our low cost of supply. So we expect this incremental drilling work to start ramping in November. This work will have no impact on 2016 volumes but will give us a head start on our 2017 production,” Hirshberg said during the call.

COP Analyst Q&A

In the Q&A, Hirshberg gave further clarification as to the movement of capital and rigs into the Bakken and Eagle Ford:

Q: I’m just curious when we look at the maintenance capital, and obviously that theoretically rolls off next year, is that the kind of level we should be thinking about in terms of what pivots to unconventional spending per your comments in the quarter?

COP: The $1.5 billion was sort of the roll off amount. About $1 billion of that was from some mega projects finishing up, and about $0.5 billion was deepwater related. And some of that I’ve said in the past will roll into some other mid-cycle type projects that are coming up and the rest will tend to roll in the Lower 48 unconventionals. So I do expect that a fair chunk of that is going to go into Lower 48 unconventionals in 2017, and that’s what you see us kind of starting now as that work has rolled off, we’ve gotten ourselves ready. First, we went out and checked the market to see what kind of pricing we could get on rigs and frac crews. And provided that we still can get attractive rates similar to what we’ve been getting all year long, we were interested in getting started in that. And that’s what we have found, and so we’ve done that.

Q: How many rigs are you at right now into Lower 48?

COP: As of right now we’re still at the three rigs that we’ve been running all year. We have contracts now to add five more, and so I expect that we will be at eight before the end of the year.

Q: Just following up on the Lower 48 commentary, the five additional rigs, where do you expect those to go? And then generally I guess, how are you thinking about the exit rate on production? And what the rig additions could mean for 2017?

COP: Using this roll off CapEx to move to Lower 48 unconventional in 2017 is not a change in plan for us. This timing, taking advantage of today’s rates to get started a little earlier in 2016 is a little bit of a shift, but where we’re adding in the Eagle Ford and in the Bakken. So we have the three rigs. There’s been two in Eagle Ford, one in Bakken. We’re going to add three in the Bakken and two in the Eagle Ford, so that we have four and four.

So that eight rigs that I mentioned earlier [where] we expect to be at the end of the year, will be four in the Bakken, and four in Eagle Ford. We will be looking to add rigs in our Permian acreage in 2017, but that’s not part of this late 2016 effort.

In the Bakken, we’ve been fairly steady there, our progress in terms of recoveries and costs, but recently we’ve put a new completion design into place that we’re going to talk more about in our Investor Day. And so we’re really pretty excited. That’s part of why we are eager to get some rigs back to work in the Bakken. In the Eagle Ford, if you look at our cost of supply there, we’ve got such a huge segment that’s gotten down in below $25, fully-burdened cost of supply, single well cost supply the mid-teens. And so who wouldn’t want to go run more rigs there in the Eagle Ford? So that’s where we’ve got those extra rigs allocated in those two places right now.

Q: And then as you think about allocating rigs to North America, as everyone else is starting to do, what type of inflation assumptions do you think it’s prudent for investors to think about?

COP: So far we have not seen any increases in costs in these rigs or pressure pumping crews as we’ve gone back, and that’s part of what’s driven us to move ahead. I think we have a ways to go where we’ll be in that situation.

We are also helped somewhat by the fact that we are, as I said earlier, focused on places like the Eagle Ford where a lot of the other folks have left and the rigs are down 85% from where they were, and everybody is busy flogging the Permian. And so that actually makes it easier to continue to get good logistics and infrastructure costs, and net backs and contracts in the Eagle Ford. So we do assume in our plans that there will be some reflation as we move over the next couple of years if prices improved. We haven’t seen any of that so far.

I just want to be clear about one thing so that nobody gets the wrong impression. When we talk about adding these five rigs back and rotating some of this major project and deepwater CapEx over to the unconventional, I don’t want anyone to get the wrong impression that hints in any way at increase in CapEx for us next year versus this year. That’s certainly not what we have in mind, and we’re going to – you’ll see a plan at our Investor Day that continues to show strong discipline in the way that we are spending our capital.

Q: Any color on the resilient performance of the U.S. onshore volumes? Is that just lower than expected declines? Or have you adjusted completions and that’s driving improved productivity? Anything you can share there?

COP: Yes. It really is as we continue to use our latest technology, latest things we’ve learned from are simulated rock volume work, I’m going to show me some of that at the Investor Day. We continue to get better recoveries and better production for longer from these wells. So it’s all about well performance and better IPs and slower declines than what we had put into our plans back when we set up the budget a year ago.

Q: Al, I think it’s come across quite clearly that this is a change in rig count that is essentially is a sustaining change, that is to say where you’ve been growing you’re not adding rigs, but you are in the areas where you’ve been declining. At the same time, I assume that the cost of these rigs is essentially baked into firstly your lower guidance for this year but also the idea that you’re going to hold flat for next year?

COP: Yes. That’s right. I don’t know about the whole flat for next year. I think that’s a number we will talk about in a few weeks. I suspect it might even creep down some more. But, yes. That is built in. The additional – the $300 million savings, the getting down to 5.2 on our CapEx guidance for this year includes those costs, although because they’re coming on fairly late in the year, it’s not – it’s $100 million to $150 million of additional CapEx from those five rigs coming in late in the year for 2016. But we’ve got – with all the roll off, there’s plenty of room to increase rigs in Lower 48 unconventional without any kind of CapEx increases in 2017. And that leaves us very good shape to be able to hold our production volumes.

Q: My follow up would be on the topic of the Permian and growth this quarter. Can you just remind us of the current size of your Permian position as it stands today, the Midland Delaware split? And also, was the rationale behind not adding a rig there this year? Is that just an economics decision? Is it due to the smaller position? Is it infrastructure related? Just trying to understand the thought process there.

COP: We’ll be getting into that at the Analyst Day in quite a bit of detail, also. But we have on the order of 100,000, 110,000 acres in the core part of the Permian. That’s both in the Delaware and the Midland Basins. And we’ve done enough appraisal work there to see that we’ve obviously got very attractive acreage in the heart of those plays that is going give us excellent economics, just as you hear from everybody else.

But we’re not in a hurry to go start drilling that up before we completely understand it. If you look at the very disciplined process that we’ve used in the Eagle Ford and in the Bakken where we make sure we understand it; everything from the spacing, to the completion design, to being able to drill with maximum efficiency. Lining all that out we go before we go out there and just run a whole bunch of rigs drilling is our view of how to develop the asset the most efficiently and create, and derive the most value from it. And so, we’re approaching the Permian in that same way.

And in fact, this rush to the Permian by everybody else has really left us advantaged in the Eagle Ford and the Bakken because we don’t have nearly as much competition for suppliers there, for midstream.

Everyone in the Permian is worrying now about all the pipes filling up and plants going up and not being able to get capacity. And just the way it used to be in the Eagle Ford. These days in the Eagle Ford there’s of all kinds and people offering us good deals. With the exports coming out of Corpus Christi, we’re getting good netbacks because there’s not as much volume flowing out of there, so it’s all good in the places where we’re at.

ConocoPhillips Q3 Results

The company said that excluding special items, third-quarter 2016 adjusted earnings were a net loss of $0.8 billion, or ($0.66) per share, compared with a third-quarter 2015 adjusted net loss of $0.5 billion, or ($0.38) per share. Special items for the current quarter included a tax functional currency change at APLNG, restructuring costs across the portfolio, the termination of a rig contract for a Gulf of Mexico deepwater drillship and a deferred tax benefit from a change in U.K. tax law.

- Q3 production of 1,557 MBOEPD, up 3 MBOEPD from Q3 2015

- Increasing midpoint guidance to 1,565 MBOEPD

- Reduced 2016 capital expenditures guidance from $5.5 billion to $5.2 billion

- Moving capital from major projects to U.S. unconventionals

- Lowered full-year adjusted operating cost guidance to $6.6 billion from $6.8 billion

- Executed third-quarter major turnaround activity in Europe and Alaska

- First production achieved at APLNG Train 2 in Australia

- Repaid $1.25 billion of maturing debt in October

“In the third quarter we achieved cash flow neutrality, with operating cash flow covering capital expenditures and the dividend,” COP Chairman and CEO Ryan Lance said in a statement. “For the second quarter in a row, we are lowering 2016 guidance on our capital expenditures and adjusted operating costs, while increasing our 2016 production guidance.”

When adjusted by 53 MBOEPD for the net impact of dispositions and downtime, production increased 56 MBOED, or 4 percent, the company said.

The company’s total realized price was $29.78 per barrel of oil equivalent (BOE), compared with $32.87 per BOE in the third quarter of 2015, reflecting lower crude and natural gas prices, partially offset by higher natural gas liquids and bitumen prices.

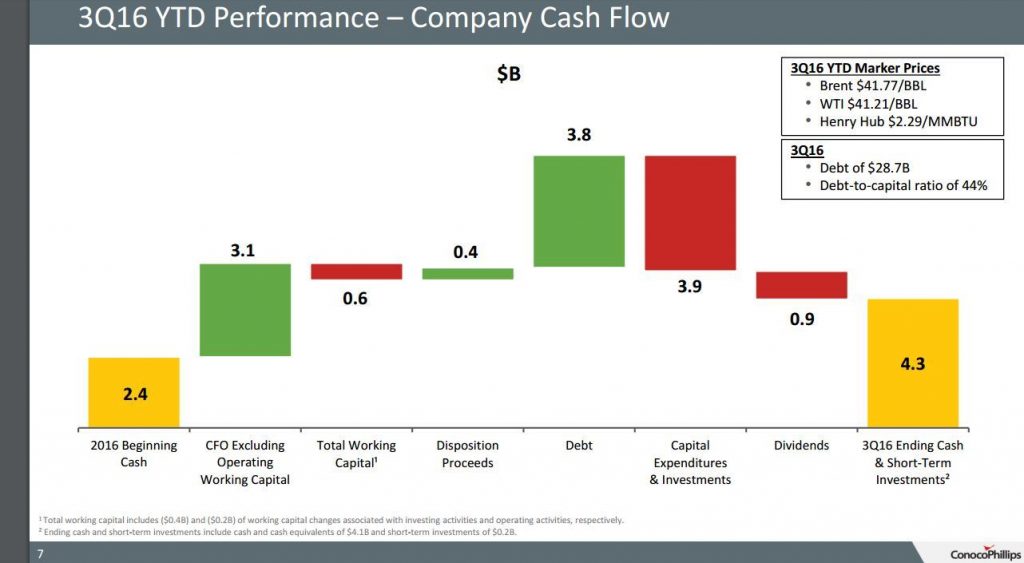

For the quarter, cash provided by operating activities was $1.3 billion, the company reported in today’s 3Q news release.

Excluding a $0.1 billion change in operating working capital, ConocoPhillips generated $1.2 billion in cash from operations. In addition, the company received proceeds from asset dispositions of $0.1 billion, funded $0.9 billion in capital expenditures and investments, and paid dividends of $0.3 billion. The company also sold $1.1 billion of short-term investments in anticipation of debt maturities in October.

Guidance

- The company increased its midpoint full-year 2016 production guidance to 1,565 MBOED, reflecting a range of 1,560 to 1,570 MBOED on strong year-to-date performance across Lower 48, Europe and Asia Pacific. Fourth-quarter 2016 production guidance is 1,555 to 1,595 MBOED. Production guidance excludes Libya.

- Guidance for production and operating expenses is $5.7 billion, which results in improved adjusted operating cost guidance of $6.6 billion versus prior guidance of $6.8 billion.

- Guidance for capital expenditures has been lowered to $5.2 billion versus prior guidance of $5.5 billion.

COP will provide a strategy update and its 2017 operating plan during a live webcast on its Analyst Day on Nov. 10 on the ConocoPhillips Investor Relations site.