Trends suggest that operators are using their DUCs as a more capital efficient means of tapping production, rather than using them to grow production

For the past year, discussions in the oil and gas industry have been focused on asking what role drilled uncompleted wells, or DUCs, will play in the industry’s recovery.

Most analysts have predicted a rapid reduction in DUCs as soon as prices swing back into more favorable territory, bringing production back up very quickly. But is that really how it will work?

In its Mid-Year Global Energy Outlook, Bloomberg Intelligence has made a case that the picture is more complicated than that. The report shows that while overall DUCs levels are holding steady under current prices, diverging trends are emerging.

What County are YOU Looking at?

Many counties in the same play or sub-basin show differing trends in their aggregate DUC inventory levels. Often companies operating in the same county employ different strategies.

BI’s presentation suggests that operators are using their DUCs as a more capital efficient means of tapping production instead of using them to grow production.

With this in mind, DUC inventories will likely show localized, company specific effects rather than effects on overall production in the next year, the analysts concluded.

A significant increase in prices would likely see tapping of DUCs in unison among operators, depending on the speed with which service companies can respond.

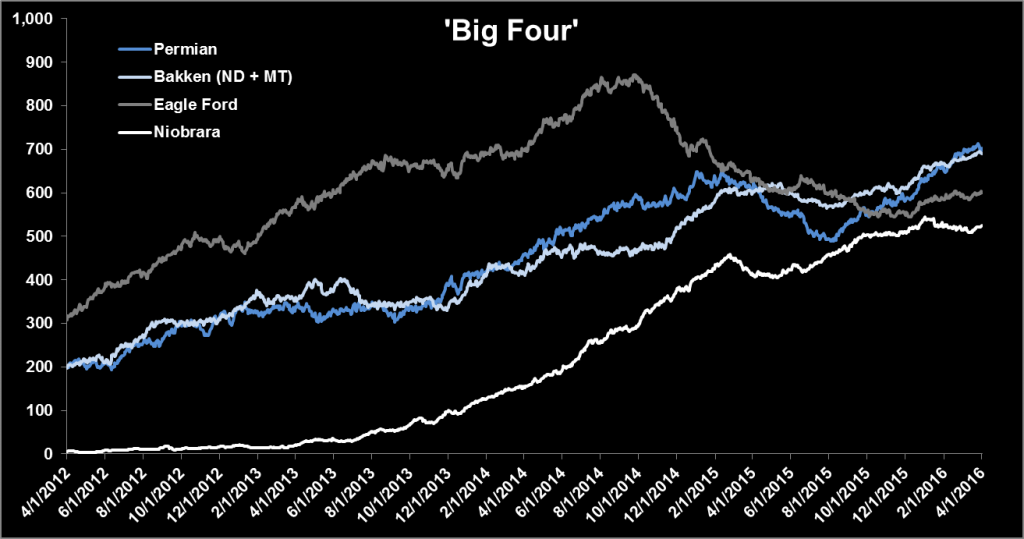

Permian DUC Inventory Grows the Most, but Sub-Basin Trends Differ

The first quarter saw 76 DUCS added in the Permian Basin, raising the grand total to 673. This was primarily due to robust rig activity as well as a falling completion rate.

The Delaware sub-basin, a darling of the financial community, held 343 DUCs as of April 1st. While Reeves County led Q1 DUC growth with 28 DUCs added by a diverse set of operators, Eddy County saw the largest decline mainly due to Concho and Devon drawing down their inventory. Devon, one of the leading operators in the Delaware, currently holds the most wells in the basin. As of April, Leas County holds the most DUCs in the Delaware with 93.

While the Midland Q1 DUC total was roughly similar to the Delaware at 330, a closer look shows how differently things can play out at the county level. Midland County added 33 DUCs in Q1 for a 38% increase, leading all counties in the Permian. This was primarily driven by big players Encana and Diamondback, which added 11 DUCs each. In contrast, most other counties in the Midland sub-basin saw their inventories decrease.

Bakken DUCs Grow Slightly, Likely to Continue as Continental Continues Plans to Build Inventory

Unlike the Permian, Bakken DUC growth was primarily driven by reductions in completions, with big dog Continental Resources leading the way. The company outstripped all other Bakken operators combined in inventory growth by adding total 78 DUCs in 4Q 2015 and 1Q 2016.

CLR has not been active in completions since September and plans to exit 2016 with a total of 195 Bakken DUCs. This along with the company’s regional heft has delayed expectations for Bakken inventory drawdown until 2017.

Statoil and Whiting added 27 and 20, respectively, while EOG and SM are currently in the process of decreasing their inventories. Smaller operators not listed saw their cumulative DUC inventories decrease by 42.

There are many reasons for these differing strategies. Many smaller players need cash flow and are more likely to tap their inventory. Moreover, sinking capital into a DUC limits forward returns. At the same time, companies locked into drilling contracts for non-economic wells will most likely opt to drill but not complete.

Niobrara DUCs See Drawdown

While the Niobrara was not heavily analyzed, Weld County holds the largest total DUC inventory for an individual county at 345. Total DUCs in the Niobrara shrank 3% in Q1, due to attractive well economics and shorter payback times.