Blackbird Energy announces 6 MMcf/d of firm sour gas processing – looking at long term capacity, growth

Alberta-based Blackbird Energy (ticker: BBI) announced today that it has signed a deal with a third-party company to process up to 6 MMcf/d of the company’s liquids-rich Montney gas. The company recently acquired 5 MMcf/d of firm full path service to the Gold Creek metering station south of its position, and now with sour gas processing lined-up, the company can begin moving toward production.

“There’s a progression with Blackbird,” company president, chairman and CEO Garth Braun told Oil & Gas 360®. “Initially, people said we would be stranded, both because of the high H2S content of our gas, and because of infrastructure.” Now Blackbird has addressed both those issues, and is beginning the construction phase of connecting its assets to the third-party’s system.

“Some had estimated we would need to spend $18 million to $24 million to build the sales gas line from our project and incur a total infrastructure cost of in the range of $34 million to $40 million. The actual costs we estimate is approximately $16 million as the sales tie-in is near our acreage,” Braun said.

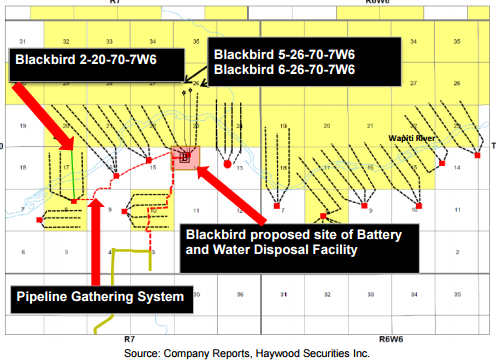

The tie-in is located about 2.4 miles south of Blackbird’s proposed battery site. The company plans to build a pipeline gathering system, and a water disposal facility offset to the battery.

“We’re building this infrastructure to go well beyond our current needs,” said Braun. “This gathering system gives us access to 75 de-risked well positions,” which gives the company the ability to scale up its production over time.

The anticipated start-up for processing is January 1, 2017, but may be advanced to as early as November 1, 2016 if facility upgrades are completed and if certain regulatory approvals are received. Braun said Blackbird is targeting the November date, but that the company will not be paying for the capacity until January, limiting downside.

Selling into a relatively high priced market and producing from economic assets

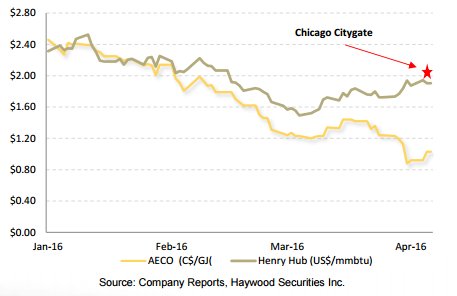

While presenting at EnerCom’s The Oil & Service Conference™ 14 in San Francisco, Braun explained that he decided to take transportation capacity on the Alliance Chicago Exchange Hub over the Alberta market because of better prices, a difference that has become increasingly apparent. Natural gas is currently selling for around US$2.00 per MMBtu at the Chicago hub, more than a dollar higher than on Alberta’s AECO spot market.

“We’ve elected to go to Chicago because it’s the premier market both near- and long-term,” Braun said.

“We’ve elected to go to Chicago because it’s the premier market both near- and long-term,” Braun said.

Adding to the upside the company sees from selling its gas into Chicago, its position in the Montney remains economic, even at today’s prices.

Blackbird’s 2-20 well achieved 1,768 BOEPD on a restricted flow, with 94 barrels per MMcf of production, and it’s that condensate that BBI is targeting, Braun said.

“Condensate trades on par with WTI,” Braun said during his presentation in San Francisco. “Even at an 8%-10% premium, at times.” This is excellent news for a Canadian producer, with Canadian benchmark WCS typically trading at a substantial discount to its U.S. counterpart. Blackbird sees additional gains when selling the condensate into the U.S. as well, because of the weakness of the Canadian dollar against the U.S. dollar, Braun explained.

Demand for condensate is also high in Canada, which consumes about 400-450 MBOPD, and only produces about 150-200 MBOPD domestically. The condensate is mixed with heavy oil sands crude so that it can flow through pipelines, making it essential to oil sands producers.

”The Alberta government gives us major credits for focusing on the condensate,” Braun said.

Drilling for growth

With the transition from exploration to production well underway, Braun said Blackbird plans to begin drilling a new well this summer, with the goal to increase the company’s delineated acreage and its production.

Even in the current commodity environment, Blackbird continues to hold a strong position. With zero debt on the books, and 72 sections of land in the Monteny, the company looks to have both the financial strength and position to scale production up.

“I don’t want to chase my production with drilling because that will put excess pressure on the company,” said Braun. “Let me put it this way though: on both the sour gas capacity and the takeaway, both are scalable to a substantially larger amount.”

During EnerCom’s TOSC™14, Braun said the company could scale its infrastructure up to handle as much as 30 MMcf/d, eventually.

“If prices remained compressed, we can continue to grow organically with this infrastructure, just with our cash flow,” he said.