“This is a cost problem, not a commodity problem.” – Tamarack Valley CEO Brian Schmidt

Tamarack Valley Energy (ticker: TVE, TamarackValley.ca) presented in EnerCom’s The Oil & Service Conference™ 14 yesterday at 11:30 a.m. PST. Tamarack Valley Energy is an oil and gas company involved in the identification, evaluation and operation of resource plays in the Western Canadian sedimentary basin. The company’s assets are focused on Cardium light oil resources in Lochend, Garrington/Harmattan and Buck Lake in Alberta, Viking light oil resources in REdwater, Foley Lake and Westlock in Alberta, and heavy oil southeast of Lloydminster in Saskatchewan.

Tamarack Valley’s President and CEO Brian Schmidt started the presentation off by saying the company remains focused on reducing costs, but he removed the decision from the current price environment.

“I’m not going to tell you that we’re here hoping for better prices. I think this is a cost problem, not a commodity problem,” said Schmidt. “Not long ago, we were looking at $30 oil and thinking that was probably alright. It’s the costs that really got away from us.”

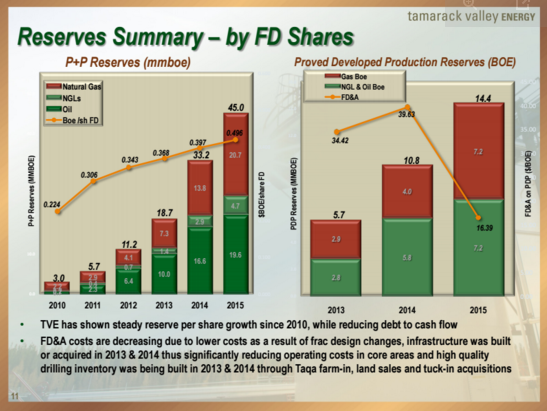

With costs in mind, TVE has shifted its focus away from growing its asset base to maintaining sustainable per-share growth during the downcycle. Tamarack lowered its FD&A costs on a per BOE basis to C$16.39 in 2015 from C$39.63 the year before. This 59% reduction has been possible thanks to “deploying capital [previously used to purchase acreage] onto the drill,” according to Schmidt.

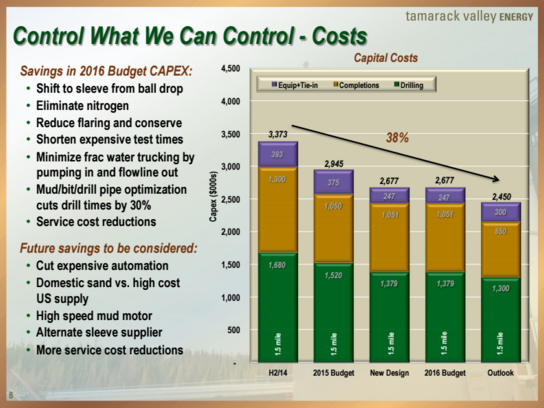

The company has consistently pushed down costs since the second half of 2014 when oil prices first started to dip into the double-digits. Tamarack Valley lowered its costs by 38% from $3.4 million in 2H’14 to $2.7 million in its 2016 budget. TVE hopes to push that figure down further to $2.5 million.

High quality assets that offer 1.5 year net-backs or less

At the foundation of this low-cost operation is a top-tier asset base, based off analysis done by a number of Canadian banks, referenced in Schmidt’s presentation. Research done by CIBC put Tamarack Valley’s asset in the top-ten percentile among its Canadian peers, and three of the top wells drilled in 2015 belonged to TVE.

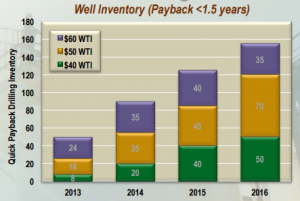

Tamarack Valley focus on high-return assets, only included wells in its inventory if they offer 85% rates of return with net-back at a year and a half, or less, said Schmidt. TVE has five years of inventory with these types of wells, according to Schmidt.

Focusing on that type of quality allows the company to maintain sustainable growth, said Schmidt.

Focusing on that type of quality allows the company to maintain sustainable growth, said Schmidt.

“We have positive free cash flow at $40 oil, and we can use that to pay down debt, or for tuck-in acquisitions,” he said.

Paying down debt

The company recently raised C$43.7 million in equity, which Tamarack used to help pay down its debt. Pro forma the raise, debt now stands at C$55-C$65 million, according to Schmidt, giving the company a 1.2x debt-to-cash flow metric. The company’s line of credit was also maintained at C$165 million in its most recent redetermination.

“When prices turn around, we can respond quickly,” said Schmidt. “We have a strong balance sheet, and good inventory.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.