Buy low, sell high is perhaps the most commonly (and overly) used phrase when it comes to investing. Now that commodity prices are near the floor (depending on who you ask), investors are cherry picking stocks in hopes of capitalizing on a down market and its inevitable recovery. It may not come in 2016, but oilservice giants like Schlumberger (ticker: SLB, www.slb.com), along with analyst firms like KLR Group, are pegging 2017 as the rebound year.

However, there are different recovery games for different sectors of the oil and gas industry. Exploration and production companies, especially those with minimal hedges, are exposed to quick revenue rebounds. In the meantime, companies are adjusting budgets and cutting dividends on a seemingly daily basis in order to navigate the oversupplied market.

Oilservice companies, on the other hand, have been forced to drop service costs in the ballpark of 20% to accommodate capital-cutting measures implemented by their clients. Less than one-third of the United States rig fleet remains in service, compared to numbers from just 13 months ago.

What Stage are We In?

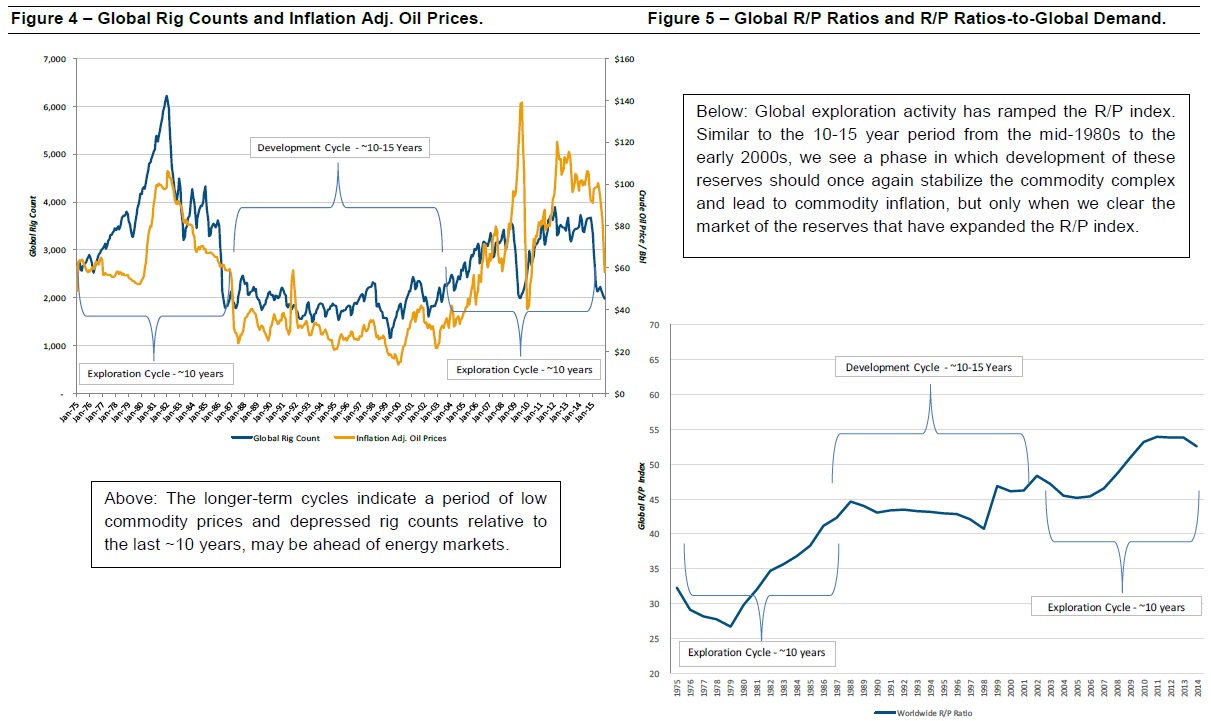

Analysts from Stephens Inc. say the pullback on activity is a cyclicality stage of the oil and gas industry – and a possible situation where the market overcorrects itself. Base model estimates from Stephens believe U.S. spending on drilling and completion will drop 41% on a year-over-year basis, while spending levels on international and offshore levels will fall by 12% and 22%, respectively.

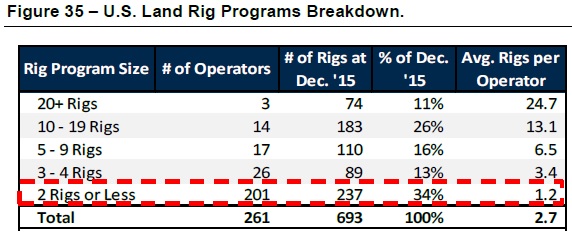

U.S. energy heavyweights followed through on that premise yesterday, with Continental Resources (ticker: CLR, www.clr.com), Hess Corp. (ticker: HES, www.hess.com) and Noble Energy (ticker: NBL, www.nobleenergyinc.com) each cutting their year over year budgets by at least $1.5 billion. But some views in the industry believe the drastic activity slowdown will be too great, resulting in a sudden undersupply in the market (Core Laboratories, for example, has stuck to this mantra ever since the downturn began). A breakdown on 2015 rig programs are detailed on the right.

U.S. energy heavyweights followed through on that premise yesterday, with Continental Resources (ticker: CLR, www.clr.com), Hess Corp. (ticker: HES, www.hess.com) and Noble Energy (ticker: NBL, www.nobleenergyinc.com) each cutting their year over year budgets by at least $1.5 billion. But some views in the industry believe the drastic activity slowdown will be too great, resulting in a sudden undersupply in the market (Core Laboratories, for example, has stuck to this mantra ever since the downturn began). A breakdown on 2015 rig programs are detailed on the right.

In the case, of such a market turn, Stephens outlined the following scenario: “This development cycle will lead to asset attrition, labor force shortcomings, and depletion of reserves relative to production (R/P), which will set up the next exploration cycle and some will even believe ‘we are running out of oil’ once again; however, until that time we are faced with the reality of lower break-evens and competition to bring production to market.”

The Keys to Investing

When picking an oilservice company, Stephens urges investors to consider four key factors:

- Stick to balance sheets;

- Don’t bet on pricing power hopes;

- Cash flow is critical;

- The importance of technology.

However, Stephens cautions this is not an overnight event. On a historical level, the last development cycle spanned more than 10 years before the exploration phase took over once again. “We think as the stage is set for 2016 to be worse than 2015 for most OFS companies,” explains the report. “Those placing hope that the ‘build it and it will come’ mentality to commodity markets could be setting up disappointments as the ‘recovery’ is moderated or extended.” Earlier in the 70-page note, Stephens describes the service industry as “tremendously overbuilt.”

As it turns out, the world is currently not only awash in oil from producers, and those producers are awash in options at the well head. Therefore, Stephens suggests that those with superior technology will stand out from the rest. Flotek Industries (ticker: FTK, www.flotekind.com), who, coincidentally, released a third-party report on its completion product earlier today, stands at the top of their list for upside and balance sheet stability.

As Oil & Gas 360® has seen in previous management comments, the oilservice giants like Halliburton (ticker: HAL, www.halliburton.com) and Schlumberger have the advantage of scale over their smaller competitors. Schlumberger has said before that select projects were operating at a loss, but the company elected to continue operations in order to retain the business partnership. This is the “market share” strategy we’ve become so accustomed to over the last year.

Therefore, balance sheet strength is of utmost importance in a market that has used a certain extent of debt to fuel its meteoric rise. HAL and SLB have strongholds in Stephens’ “Stock Thoughts” table, but described “quality” in drilling providers like Atwood Oceanics (ticker: ATW, www.atwd.com) and Helmerich & Payne (ticker: HP, www.hpinc.com) offer upside, while diversified growth models of service providers like Superior Energy Services (ticker: SPN, www.superiorenergyservices.com) reinforce their respective positions in the current market.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.