WTI falls below $30 per barrel for the first time in 12 years

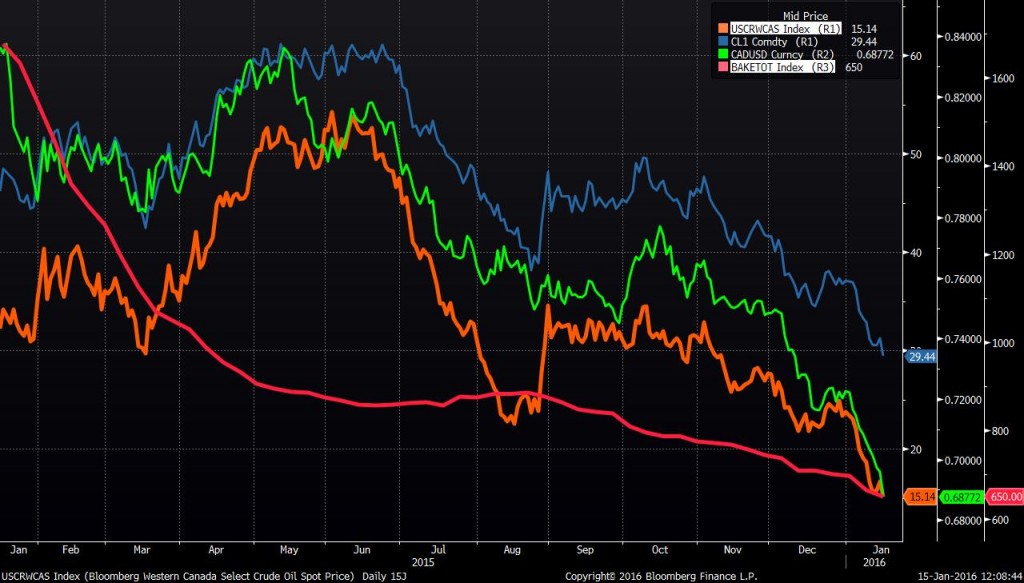

The price of a barrel of West Texas Intermediate crude oil fell below the $30 mark for the first time since 2003 this week. Continued concerns over China’s market are curbing demand expectations as the global oil glut persists. WTI was trading at $29.45 at 2:15 EST today.

More crude may soon be added to the glut as well, with Iran hoping to increase oil exports in the near future after sanctions surrounding its nuclear problem have been lifted. With both the supply and demand side of the oil price equation looking more bearish, the U.S. rig count continues to drop.

U.S. rig count hits 650

The number of rigs drilling in the U.S. continued to fall this week, with the total rig count declining to 650, according to information from Baker Hughes (ticker: BHI). The number of rigs drilling for oil declined by just one this week to 515, while gas rigs fell 13 to 135.

Most of the losses this week were seen in the Permian Basin, where seven rigs were laid down. The DJ Basin and the Eagle Ford tied for second-most losses this week, each losing three from the prior week’s count.

The Granite Wash Basin added two rigs this week, and the Cana Woodford, Marcellus and Mississippian each added one rig to their counts as well.

Canadian rigs on the rebound, but Loonie and WCS continue to fall

The Canadian rig count continued to grow for the second week in a row as Canada’s drilling season picks up. The Canadian rig count reached 227 for the week ended January 15, 2016, 37% higher than last week, and 173% higher than at the beginning of the month when the count was just 83.

Simultaneous to the significant increases in Canadian rig activity, the price of Western Canada Select crude oil continued a downward trend along with Canada’s currency. WCS was trading at $15.32 per barrel this afternoon.

Canada’s currency, known as the loonie, continued what is now the longest losing streak the currency has had against the U.S. dollar since it ended its peg to the U.S. currency in 1970, reports CBC. The Canadian dollar was trading at US$0.69 today, the first time the currency has dipped that low against its U.S. counterpart since April 2003.

“There is no sign of the [U.S. dollar] rally slowing or reversing,” Scotiabank currency analysts Eric Theoret and Suhaun Osborne said. “Ther is no apparent reason for the trend to change at this point either.