Samson Oil & Gas (ticker: SSN) has nearly doubled its output overnight, announcing a $16.5 million acquisition on January 6, 2016. The properties currently produce 720 BOPD from 41 net producing wells and contain proved reserves of 8.5 MMBO as of October 1, according to estimates from Netherland, Sewell & Associates. On a cash comparison, SSN is paying $22,916 for each producing barrel and just $1.93 for each proved barrel. Nearly 6.4 MMBO, or 75% of the reserves, are classified as proved undeveloped.

The properties span 51,305 net acres, equating to approximately $320 per net acre. It is important to note that Samson acquired the drilling rights down to the top of the Bakken formation, meaning deeper formations like the Pronghorn and Three Forks are exempt from the company’s drilling plans. According to the release, Samson did acquire “the rights to the deeper geologic section below the Bakken pool” for “a portion of the leases.”

The acquisition is conditional on Samson being able to exercise its $50 million credit facility, which currently has a borrowing base of $19 million. The seller was not disclosed.

A Bold Move for Samson

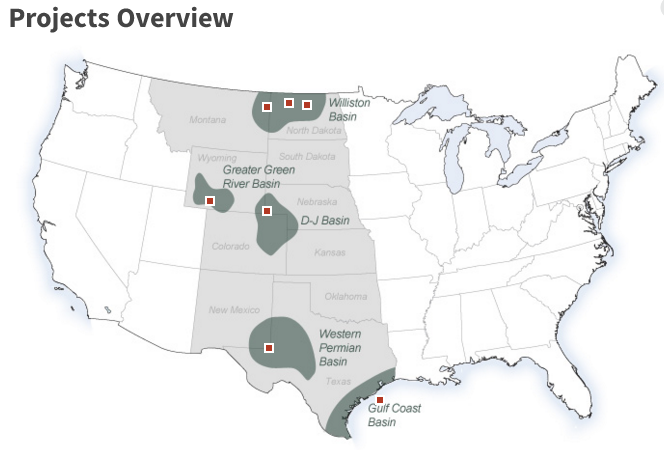

Samson Oil & Gas is a micro-cap exploration and production company based in Australia. The E&P also has an office in Denver and trades on the NYSE Market and Australian Stock Exchange. The company works as a non-operator and has activity in the Williston, Green River Basin, DJ Basin, Western Permian Basin, and the Gulf Coast Basin. The majority of its focus is on the Williston, however, as performance from its North Stockyard field has resulted in production rising by 77% on a year-over-year basis based on Q3’15 results.

Samson Oil & Gas is a micro-cap exploration and production company based in Australia. The E&P also has an office in Denver and trades on the NYSE Market and Australian Stock Exchange. The company works as a non-operator and has activity in the Williston, Green River Basin, DJ Basin, Western Permian Basin, and the Gulf Coast Basin. The majority of its focus is on the Williston, however, as performance from its North Stockyard field has resulted in production rising by 77% on a year-over-year basis based on Q3’15 results.

The standout statistic from its most recent deal, however, focused more on its expanding footprint rather than production, even though the incoming volumes nearly replicate its prior portfolio. The new acreage and its reserves increase Samson’s total reserve base by approximately 475%, considering its last reserve report in Q1’15 listed resources at about 1.8 MMBOE. The net present value of the new proved reserves is estimated at $84.9 million.

Samson’s Strategy

The transformative move, considering the commodity environment and the sharp decline in North Dakota drilling activity (rig counts are down 70% compared to year-end 2014), is intriguing because of Samson’s non-operating stance. However, Samson says in its release that its undeveloped reserves can be drilled within the United States’ required five-year time frame.

The company’s near-term focus will be on 17 proved developed non-producing wells, which Samson believes can be brought back online with “minimal capital expenditure.” The additional existing wells in the region will be exploited via infills and the use of Samson’s acid-based stimulation technique, resulting in anticipated production increases of 300% to 400%. The majority of the wells drilled to date have vertically exploited the formations above the Bakken, including the Radcliffe and Mission Canyon intervals.

Two saltwater facilities are also included in the transaction, which is expected to close on or before February 1.