Latest dropdown brings total transactions to $5.7 billion in just over a year

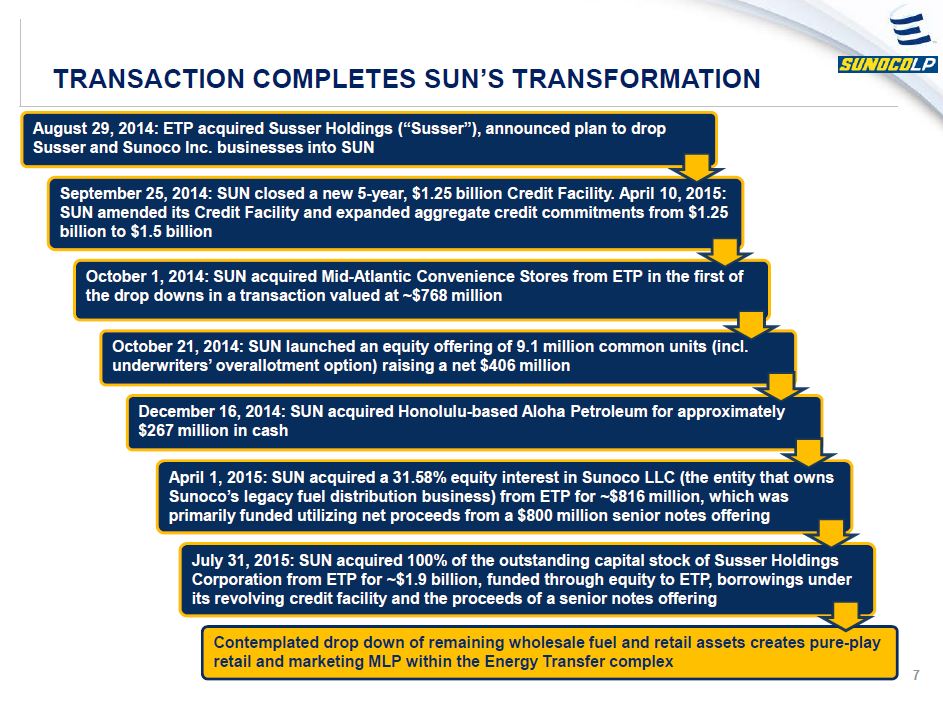

Energy Transfer Partners (ticker: ETP) announced the dropdown of its remaining retail business to Sunoco LP (ticker: SUN) for total consideration of $2.226 billion. Energy Transfer Partners’ dropdown consisted of its remaining 68.42% interest in Sunoco, as well as its 100% interest in the legacy Sunoco retail business. This dropdown is the latest in a series of deals between ETP and SUN amounting to a total of $5.7 billion in just over a year. The transaction will be effective January 1, 2016, and is expected to close in February 2016.

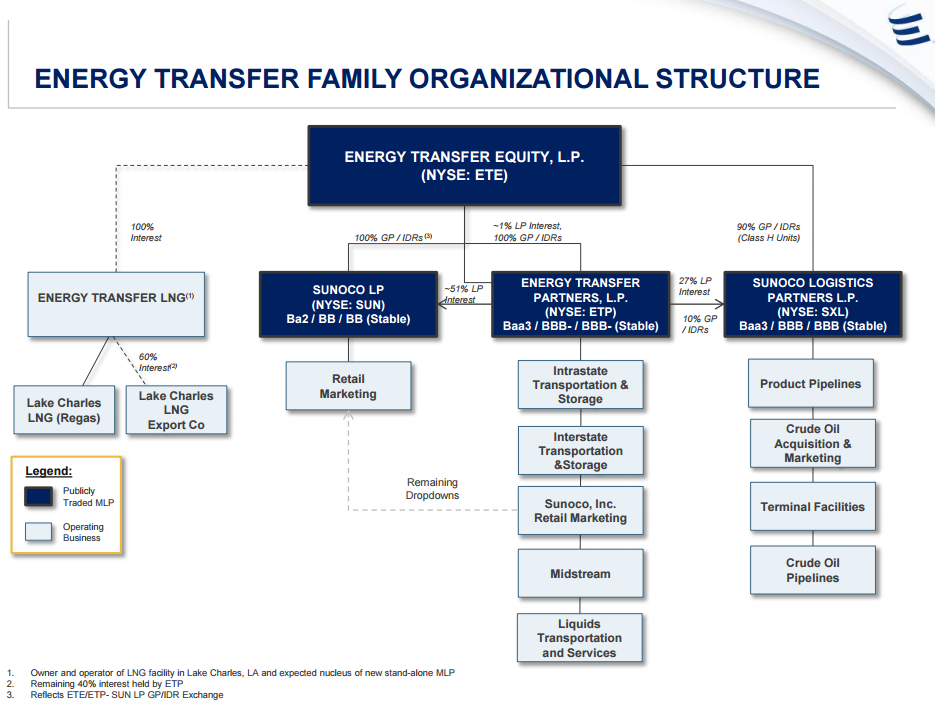

The majority of Sunoco’s consideration for ETP’s remaining interest in its retail assets will be paid in cash ($2.2 billion), with the remaining portion being covered by 5.7 million SUN common units, valued at approximately $194 million, according to an Energy Transfer Partners’ press release. Pro forma for the dropdown transaction and related equity private placement, ETP will remain the largest unitholder of SUN with an approximate 46% LP interest.

The majority-cash consideration surprised some analysts today, with analysts at Raymond James modeling a dropdown at 50/50 debt/equity to ETP. The 91% cash consideration deal will help fund Energy Transfer Partners’ 2016 capital program of approximately $5 billion. The extra cash should help ETP “navigate this period of aggressive spending,” the Raymond James note read.

Based on data in EnerCom’s MLP Weekly Scorecard, Energy Transfer Partners has a capital intensity (the percentage of every dollar the company spends to maintain its current operations) of 185%, well above the group of 60 MLPs’ median of 79%. Its free cash flow per unit (FCF/U) of -$7.13 is also lower than the group median of $0.66.

Pro forma the dropdown, ETP expects to be at breakeven for DCF in 2016, according to its press release, due to the reduced amount of equity funding needed following the $2.2 billion cash infusion. Energy Transfer Partners also sees the SUN units as a strong investment with the dropdown expected to be immediately assertive to Sunoco’s distributions.

According to Energy Transfer Partners’ press release, $2.035 billion of the transaction will be provided by a term loan due October 2019, which is fully underwritten by Credit Suisse, Bank of America Merrill Lynch, Compass Bank, Mizuho Bank and Toronto Dominion. The terms of the term loan will substantially mirror SUN’s existing $1.5 billion revolving credit facility. The pricing of the term loan is LIBOR + 250 bps (with stepdowns in pricing tied to Debt/EBITDA levels at SUN).

A group of private investors (for $685.5 million) and Energy Transfer Equity (ticker: ETE, for $64.5 million) have also fully committed to purchase $750 million of SUN common units in an unregistered private placement, at a gross price of $31.00 per unit, prior to adjustments. The private placement is expected to close and fund in early December 2015, with the exception of ETE’s portion, which will fund at the closing of the dropdown transaction. The proceeds from the private placement will be used to repay borrowings under the revolving credit facility and for general partnership purposes.

According to a presentation given following the announcement of the dropdown, the implied 2015 estimated EBITDA of 8.5x, lower than the 11x multiple usually associated with Energy Transfer Partners dropdowns. During a company conference call Jamie Welch, group CFO and head of business development for Energy Transfer, acknowledged that the multiple was lower than normal, but said the large cash sum and the lower multiple were required “to find the right marriage point between ETP and SUN.”