Gazprom makes first steps towards spot market pricing with natural gas auction

Russia’s state-owned gas giant Gazprom (ticker: OGZPY) announced that it will hold a natural gas auction in Europe as the company explores new ways to expand its market share. Traditionally, Gazprom’s gas contracts have been linked to oil prices, a formula the company has fought to maintain despite calls from purchasers to participate in the spot market, but the recent downturn in oil prices has made the long-term, oil-linked contracts much less profitable. The first set of auctions will be held this week, with the goal of selling a total volume of 3.24 billion cubic meters (114 billion cubic feet), according to the Gazprom.

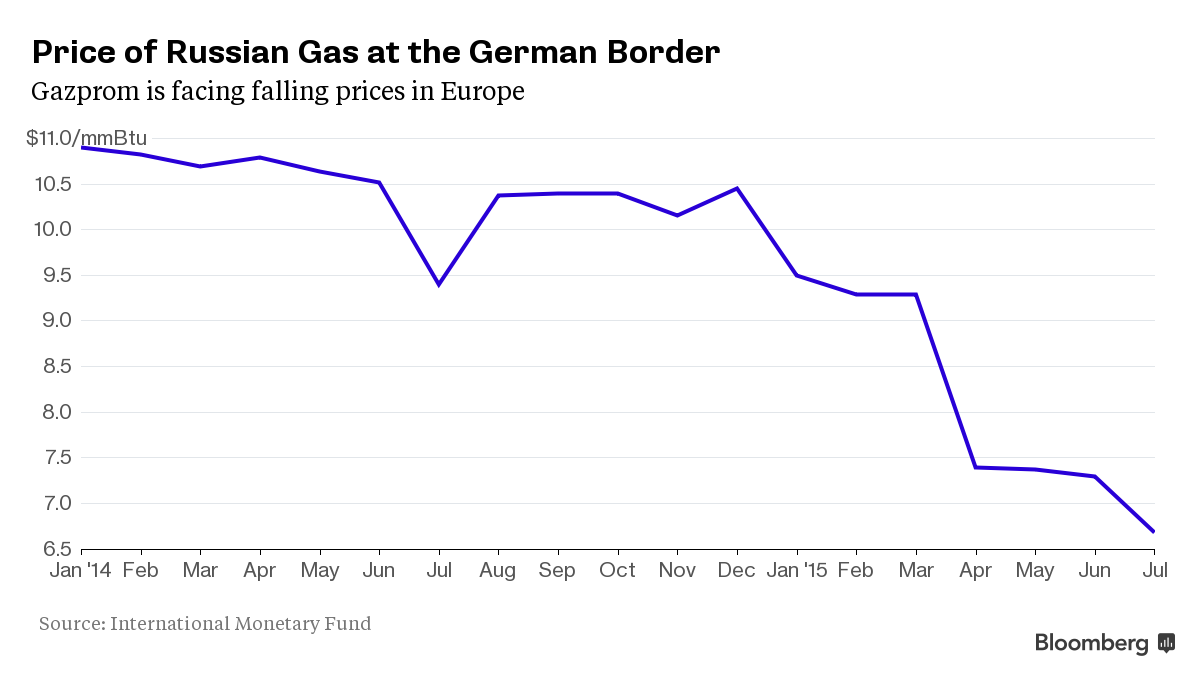

The auctions are for a relatively small amount of gas, representing about 2% of Gazprom’s annual sales to Europe, but the decision to complement the traditional long-term contracts with auctions is hoped to help the company develop a more favorable position in the European Union. Gazprom is seeking to boost supplies to Europe and Turkey by 7% this year to make up for an anticipated 30% drop in the price it will receive for its fuel, Valery Nemov, a deputy department head at the company’s export arm, said on the first of the month.

“The move represents a fairly historic shift in Gazprom’s marketing of gas to Europe,” Trevor Sikorski, head of gas, coal and carbon at Energy Aspects Ltd, a London-based consultant, told Bloomberg. “It is one of the most high profile interactions Gazprom has had with the concept of putting spare gas into the spot market.” Not only does it represent a significant shift in the company’s pricing, but it offers several benefits to the Russian producer as well, says Sikorski.

Alexander Medvedev, deputy CEO of Gazprom, said the price of gas in the tender would be higher than the level set in the company’s long-term contracts. Gazprom’s average gas price for 2015 is set at between $235 and $242 per 1,000 cubic meters, according to Reuters.

Vitol SA, Gunvor Group Ltd., Goldman Sachs Group Inc., Glencore Plc and Novatek Gas & Power are among potential bidders, Elena Burmistrova, head of Gazprom Export, said in St. Petersburg Monday. 39 bidders pre-qualified for the auction, according to Nemov. The company plans to use its spare capacity on Nord Stream to deliver the gas for the time being, but Burmistrova said other delivery points may be possible in the future.

The E.U. wants Gazprom to calculate more of its contracts using European spot gas prices. Only around 16% of its contracts were based on spot gas prices as of the end of 2014, reports Reuters. The move could be “moderately bearish,” though, says Sikorski.

U.K. gas for the six months through March fell last month to its lowest level since the contract began trading in July 2010, and Europe as a whole is not in desperate need of additional natural gas. Already, surplus liquefied natural gas (LNG) cargoes are being diverted from Asia to Europe and the gas influx as LNG production expands will put further pressure on European prices, according to analysts from UBS.

“The auction will bring additional volumes to northwest Europe, and as the market is already well supplied and most market participants should have hedged most parts of their physical short position for the winter, it does have a negative effect on the market price,” said Andreas Holzer, a senior portfolio manager at Montana Energie-Handel GmbH, a German energy trader. “Timing of the auction is likely not the best to receive high revenues, auctioning volumes in the second quarter would have been more successful.”

About more than just prices

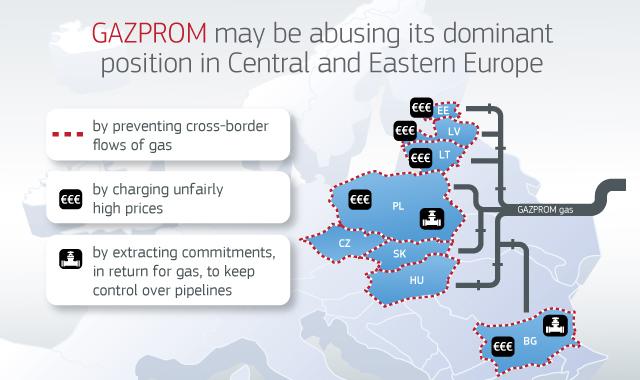

The move is also expected to be viewed favorably by the European Commission’s Antitrust Regulator, which has a case open against Gazprom for abusing its dominate position in the market to overcharge some E.U. countries by up to 40%. Along with concerns over pricing, the E.C. has also accused Gazprom of imposing territorial restrictions on purchasing nations, and using its position in the market as leverage in obtaining unrelated infrastructure commitments.

Medvedev, however, said the move was not related to the E.C. antitrust probe. “We may talk about expanding such an instrument [as the auction] after the first test is over. Given how the market has been developing such a form of gas sales has good prospects,” the deputy CEO said.

As recently as last year, the company’s CEO, Alexei Miller, said Europe had “shot itself in the foot” by pushing the idea of a spot gas market. “This concept of spot trading bears grave risks to the European gas market,” he said.

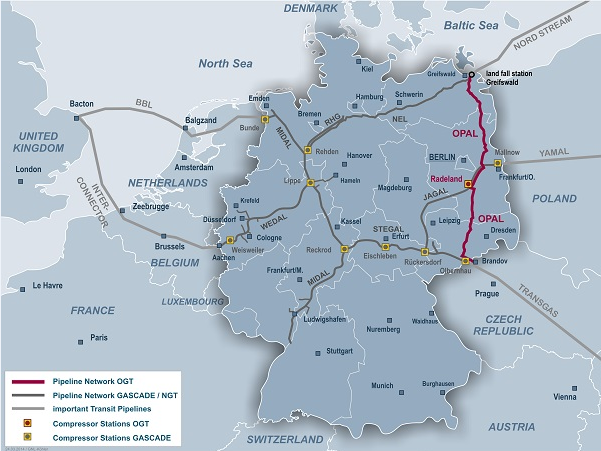

Also factoring in to Gazprom’s calculations is the Opal pipeline that runs through Germany, reports FT. Brussels and Berlin have frustrated Gazprom by blocking it from using more than half of the pipeline’s capacity in line with regulations designed to ensure a more competitive E.U. gas market.

Full use of the pipeline is crucial for Gazprom’s future plans to reduce transit of its gas through Ukraine, which continues to negotiate with Gazprom over a divisive gas deal. Last month, Ukrainian Prime Minister Arseniy Yatsenyuk said that Ukraine and Russia should implement a deal similar to the one reached last winter, and that Russia should also write-down 20% of Ukraine’s debt, like the rest of the country’s creditors.

Without more than 50% use of the Opal pipeline, the expansion of the Nord Stream pipeline across the Baltic Sea, which Gazprom along with five European partners announced last week, would make little sense, analysts said. “It’s really critical for Gazprom to use more than 50% of Opal,” said Tatiana Mitrova, head of oil and gas at the Energy Research Institute of the Russian National Academy of Sciences. “[Russia has] realized if they want to work in this market [the E.U.] then you have to play by the rules.”

If the auction is successful, Gazprom may be able to send more gas through the Opal pipeline under different ownership, says Jonathan Stern, chairman of gas research at the Oxford Institute for Energy Studies. If that route does not prove fruitful, Gazprom can argue that no third parties want to use the pipeline and therefore the commission’s position to the pipeline under 50% usage is illogical.

“This is the new Gazprom strategy,” said Stern. “The penny finally dropped: basically what they’ve understood is, ‘We can play this game; we now understand the rules.’”