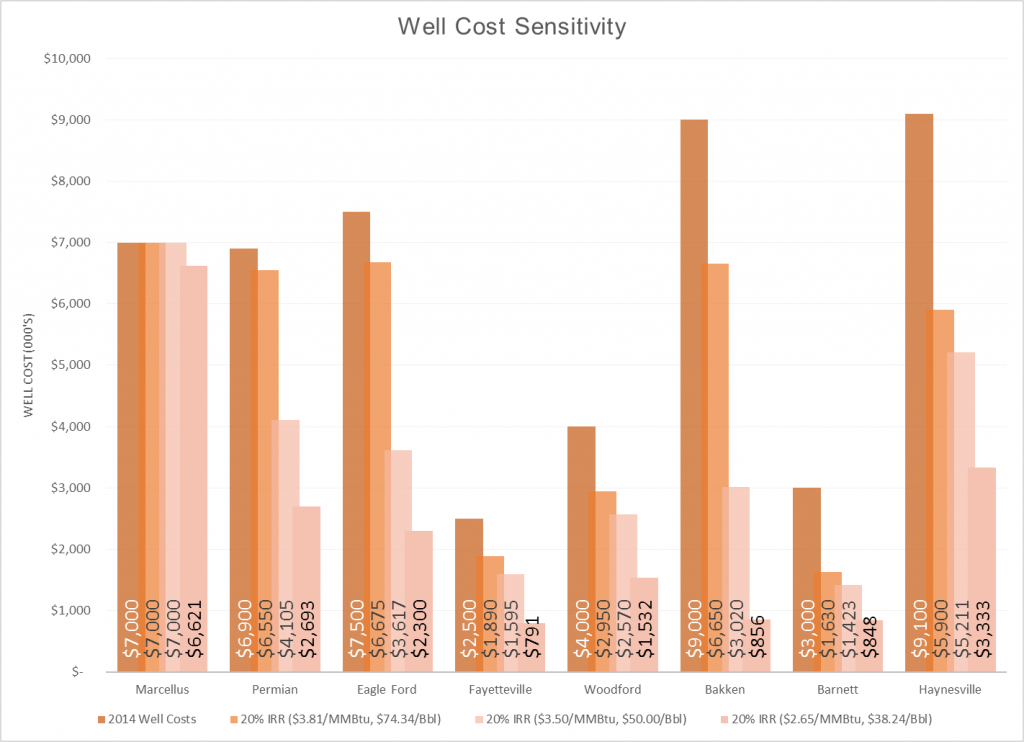

EnerCom Analytics’ well cost sensitivity by basin

EnerCom Analytics ran an analysis of well costs for various basins in December to help illustrate at what cost wells needed to be drilled to generate at least 20% IRRs. With oil prices down even further from where they were at the end of last year, EnerCom Analytics ran the numbers again, this time including a model for $38.24 per barrel of oil.

The first bar shown in the chart represents an average of actual 2014 well costs (000’s) for a group of E&P companies operating in each basin. EnerCom Analytics used data from 40-50 companies in the 8 basins, including wells which were hydraulically fractured.

The second bar in each set of data represents the analysts’ adjusted well costs to reflect a 20% IRR at the price level in November, 2014, which was $3.81 gas and $74.34 oil. The third bar reflects the well cost that an operator would need to meet in order to maintain the 20% IRR at $3.50 for gas and $50 oil. The final bar is the same calculation assuming $2.65 for gas and $38.24 oil, the closing prices yesterday, August 24, 2015.

The Marcellus group remains the same during the first three calculations because operators in the basin would not need to reduce well costs in order to achieve at least a 20% IRR on their wells in those price environments.