Even as overall production declines, new-well production is up

With just two exceptions, every major play tracked in the Energy Information Administration’s (EIA) Drilling Productivity Report (DPR) for August is showing lower month-over-month production, but the EIA anticipates greater production per new-well in every play except oil wells in the Haynesville, where the EIA expects no change. According to the EIA, the DPR uses information from the current month to estimate changes in production for the following month.

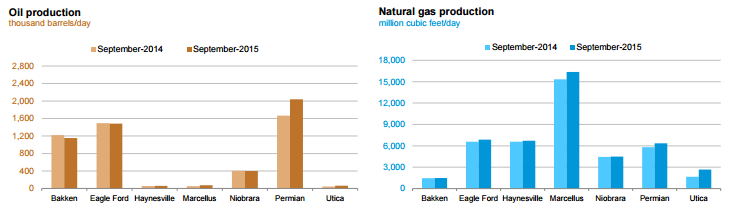

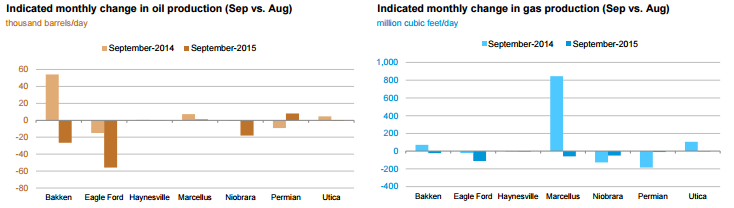

The EIA anticipates that the Marcellus and Permian will be the only regions to report higher oil production in September, with 1 MBOPD and 8 MBOPD increases, respectively. All other regions will show declines in oil production. Every region, including the Marcellus and Permian, is expected to report lower gas production in September than in August.

Despite the lower overall production expected from U.S. plays in September, the new-well oil production and gas production per rig are both expected to exceed their current levels. The EIA anticipates that the Eagle Ford will see the largest changes in oil production per rig, increasing by 26 MBOPD to 792 MBOPD in September. For gas producing wells, the EIA expects the largest change will be in the Utica. The DPR predicts that in September, Utica new-well gas production per rig will climb 185 Mcf/d to 7,246 Mcf/d.

U.S. production begins to slow

The EIA’s DPR predicts that the overall production of both oil and natural gas will decline in September from August levels. For this month, the EIA is reporting production levels of 5,363 MBOPD for oil and 45,162 Mcf/d for gas production. In September, the EIA predicts that those numbers will fall by 93 MBOPD and 261 Mcf/d, respectively, to 5,270 MBOPD and 44,901 Mcf/d. While production levels for September are expected to be lower than in August, they are similar to, or higher than in the same period of 2014.

Lower production could help to bolster crude oil prices, which fell below $44 dollars per barrel last week as the U.S. rig count continued to grow. Continued concerns of a global oil glut pushed prices down despite a crude oil inventory draw that beat expectations last week.