Over 25,000 acres of federal forest land auctioned in recent BLM sale

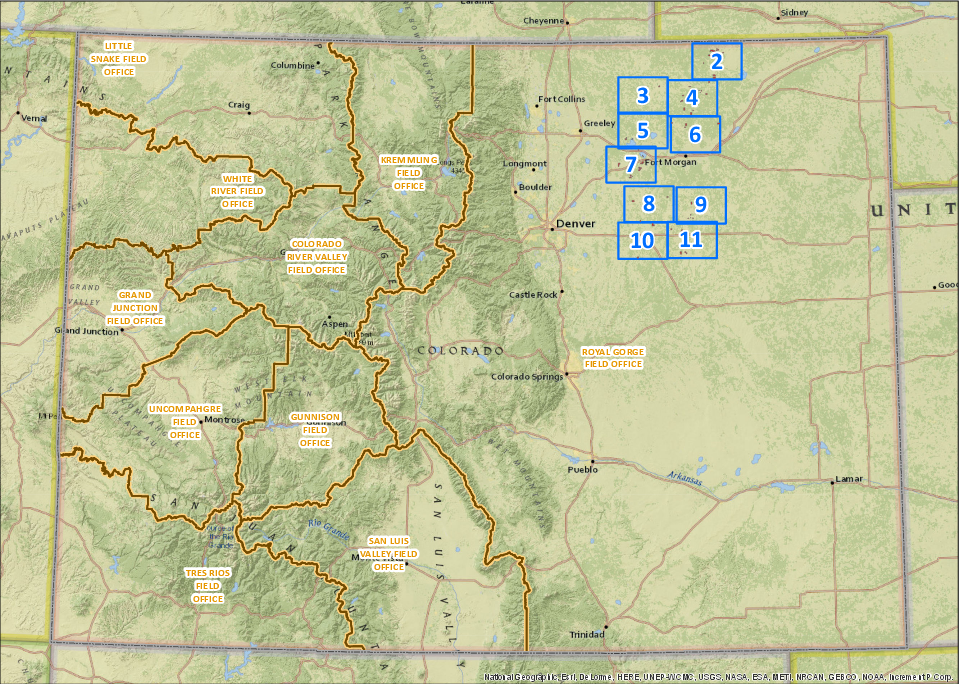

In its largest oil and gas lease sale in Colorado since 2008, the Bureau of Land Management (BLM) sold 73 parcels totaling 32,962 acres for $32.1 million last Thursday. The highest per-acre price was for a 1,919-acre parcel in Weld County, sold to Ironhorse Resources for $10,100 per acre, according to a BLM press release.

Other operators who won bids in the sale include Contex Energy Company, Retamco Operating, Colorado Energy Minerals, Mason Resources, Energy Land Services, Raisa DJ Basin I and Baseline Minerals. The average bid during the sale was $973.22 per acre. For the full list of the sales results, click here.

Of the 73 parcels, 44 are United States Forest Service parcels totaling 25,215 acres that sold for $30.8 million within the Pawnee National Grassland. The Forest Service recently conducted an Environmental Impact Statement granting the BLM consent to offer parcels in the Pawnee National

Grassland.

The parcels in the Pawnee National Grassland contain a No Surface Occupancy (NSO) stipulation, which means lessees will have access to the subsurface minerals, but not the surface acreage. Leases with this stipulation are typically accessed through horizontal drilling. The NSO stipulation will result in 10% to 60% fewer roads, pipelines and well pads that would be required to develop the existing patchwork of mineral resources, according to the BLM.

The sale of the Pawnee National Grassland sparked controversy with environmental groups who said development of the area could damage local ecosystems. “The Pawnee is a healthy prairie ecosystem, and federal lands on the plains are far and few between,” said Jeremy Nichols, head of WildEarth Guardians’ climate and energy program.

The group challenged the lease sale, saying the BLM did not assess the air quality and climate impacts of more wells in Weld County. The BLM rejected WildEarth Guardians’ formal protest, saying that at this early stage, it couldn’t project impacts, reports the Denver Post.

Colorado’s booming oil county

In 2014, Colorado produced a record 95 MMBO – 85% of which came from Weld County. In fiscal 2014, Colorado received more than $169 million from royalties, rentals and bonus bid payments for federal minerals, including oil and gas, according to the BLM. One of the many companies developing Colorado’s Wattenberg Field in Weld County is PDC Energy (ticker: PDCE). PDC expects to bring 40 to 45 new wells on line in the Wattenberg in the second quarter.

Another company with significant operations in Weld County is Synergy Resources (ticker: SYRG). Synergy has 39 gross producing horizontal wells in the Wattenberg field. The company attributed its 3% revenue growth largely to the 98% production growth from its Bayswater acquisition in the Wattenberg Field, according the company’s Q2’15 filings.

Anadarko (ticker: APC) continued expanding its program in the Wattenberg as well, according to a company presentation. APC averaged 10 rigs and drilled 89 wells in the Wattenberg during Q1’15. The company’s horizontal program averaged approximately 169 MBOPD during Q1’15, up 15% from the previous quarter.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.