Staying focused on what is within the company’s control

Low oil prices are out the control of individual E&P companies, and every single producer has felt the pain from the 40% commodity price haircut stemming from OPEC’s decision last November to maintain production levels.

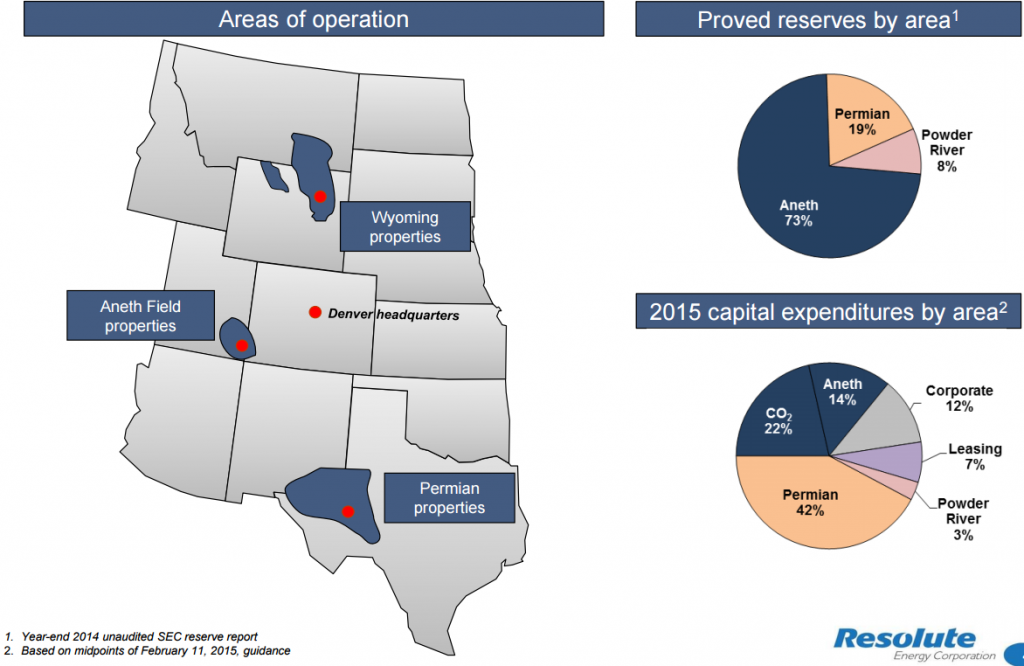

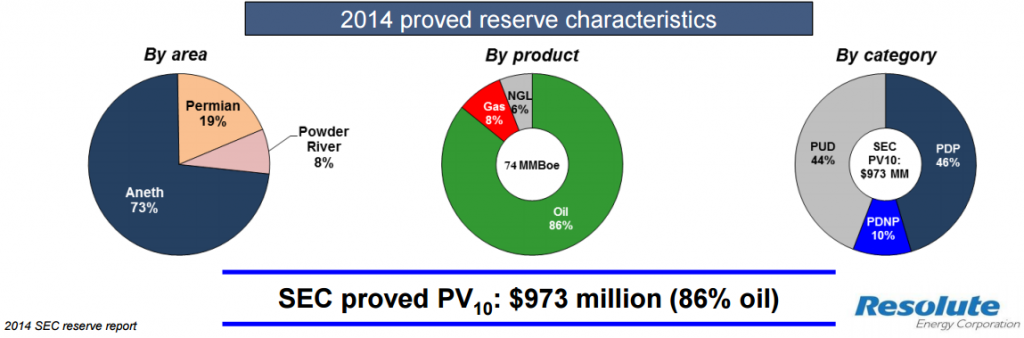

Resolute Energy (ticker: REN) is focusing on the costs they can control in its oil-weighted asset base to persevere in the current price environment.

During the company’s first quarter conference call, Chairman and CEO of REN, Nick Sutton, said the company’s approach to remaining a strong and competitive operator is to focus on maintaining production volumes, lowering controllable costs, increasing liquidity and reducing capital spending in order to reduce debt.

Resolute detailed its plan of action to achieve those goals in its Q1’15 release, announced on May 11, 2015. Company-wide production averaged 13,500 BOEPD in the three months ended March 31, a new record for REN. “This level was 7% higher than the same quarter last year, and 1% above the fourth quarter rate of 13,341 BOEPD,” said Sutton. “First quarter production was driven by increases in volumes from both Aneth Field and the Permian Basin, offset partially by a decline in the Powder River Basin.”

The company lowered its lease operating expense (LOE) to $16.59 per BOE, down 33.7% from Q1’14 and 22% sequentially. “Cost reductions were driven by a beneficial combination of working constructively with our service partners, and having our own people assume many tasks that we previously would have outsourced,” said Sutton.

REN sold non-core assets to strengthen its liquidity during the quarter, divesting its assets in Howard and Martin counties in Texas for $42 million. According to the company’s quarterly report, outstanding indebtedness at the end of the quarter consisted of $240 million in revolving credit facility debt, $149.6 million of a second lien term loan and $400 million of senior notes. The company holds a current borrowing base of $270 million.

Theodore Gazulis, executive vice president and CFO of REN, said the company does not have any meaningful debt maturities. “Our revolving credit line and senior notes mature in 2018 and 2020 respectively,” he said. “We’re in compliance with our debt covenants and have sufficient liquidity and forecast cash flow from operations to both fully fund our 2015 capital budget and to reduce debt.”

Focus on the Permian

During the first quarter, REN spent $22.1 million, nearly half of the company’s full-year budget of $45 to $50 million, on completing three horizontal wells in the Permian Basin. It’s no surprise the company is focusing its capital in the Permian after seeing a 17% increase in year-over-year production.

The three Permian (all targeting the Wolfcamp B formation) wells averaged a peak 30-day rate of 1,140 BOEPD, with the Great Divide 1402BR reaching 911 BOEPD (52% oil), the Harpoon 1401BH well climbing to 1,275 BOEPD (37% oil) and the Queen City 302BH well topping out at 1,235 BOEPD (46% oil). The 24-hour rates of those wells averaged 1,313 BOEPD – nearly 200 BOEPD higher than the combined average of four Wolfcamp B wells completed in the area last year.

Financial Joint Venture Opportunities in the Permian Assets

During the conference call, Sutton said the company was also considering “financially-oriented” joint ventures within Resolute’s Permian asset base. “Think of it as development financing more than as a typical industry joint venture,” he said.

“Proposals cover a range of possible structures from, for example, one where Resolute would put up no capital and earn a 90%-plus reversionary interest in the wells drilled once the investor has earned its targeted rate of return. Another example is a structure where Resolute would fund part of the capital cost at the time of drilling and own 100% of our current working interest in the well, subject only to the investor earning a stated rate of return.”

Aneth Field

The remainder of the company’s 2015 capital budget is expected to be focused on its assets in Aneth Field. Sutton said REN expects that 60% of Aneth’s capital budget will be used to purchase CO2 and to fund a power system upgrade to support the production rate in the region.

The remainder will be used for electrical power upgrades for well and facility work that should improve operating efficiencies.

“It bears mentioning that during this down cycle it is advantageous to have a legacy oil asset like Aneth Field,” said Sutton. “Its low decline production profile is a steady source of consistent and predictable cash flow, giving us a stable platform, from which to manage through this product price cycle.”

LOE in Aneth Field was reduced by 32% per BOE to $18.88 from $27.68 in the first quarter of 2014, a difference of $4.5 million overall.

Moving forward

Resolute has been helped by its strong hedge book, which will continue out into 2016. Approximately 74% of 2015 forecasted daily oil volumes, or 6,600 BOPD at a weighted average floor price of $86.40 per barrel, Sutton said during the conference call. REN also has 6,500 BOPD in 2016 at a weighted average price of $80.42 per barrel and has started layering in some hedges for 2017.

Sutton also said much of Resolute’s leasehold is held through production, meaning the company does not need to drill wells in the current price environment. “100% of our Powder River Basin and our Aneth Field acreage is held by production,” Sutton said. “In the Permian Basin, approximately 62% of our leasehold is held by production, and what is not can be extended with lease modifications.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.