Leading Natural Gas Producer not Slowing Down

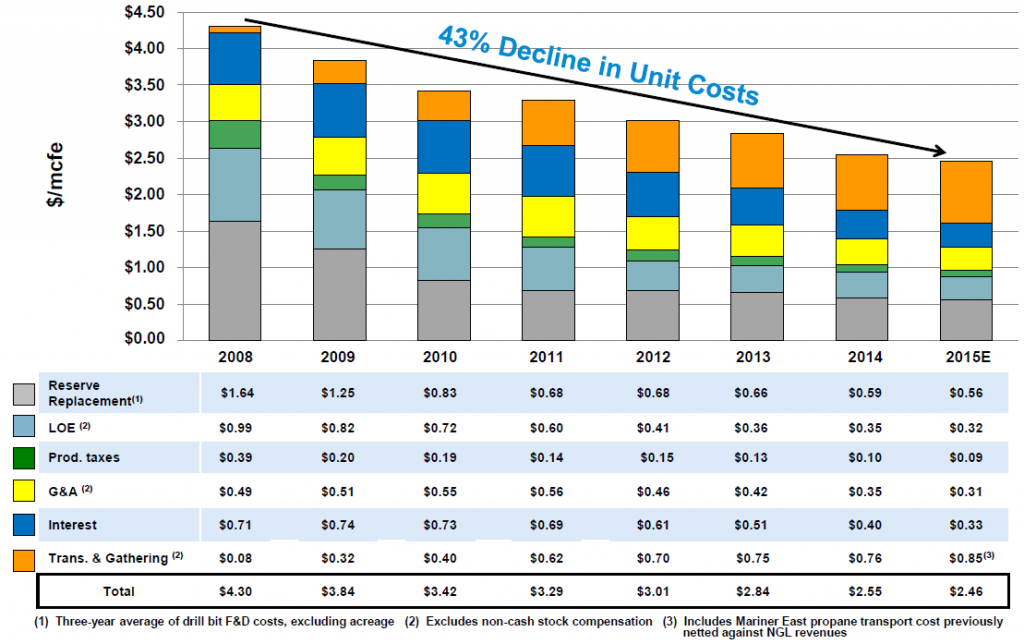

Range Resources (ticker: RRC) maintained its 20% to 25% annual line-of-sight growth strategy in its Q1’15 results, announcing a new production record of 1,328 MMcfe/d in the quarter. Volumes for 2015 are expected to average 1,394 MMcfe/d (30% liquids) for the fiscal year based on the company’s guidance of 20% growth, even though its capital expenditures are down roughly 45% compared to 2014.

Revenues for the latest quarter totaled $462.6 million with net income reaching $27.6 million, or $0.16 per share. Total sales of $422.9 million decreased by about 10% compared to Q1’14, even though the company’s average realized prices were 28% less due to the commodity fallout. Production increased by 26% over the same time frame and unit costs dropped by 15%.

The company has budgeted $870 million for expenditures in 2015 but believes the number may decrease due to reduced service costs.

Gas on the Rebound

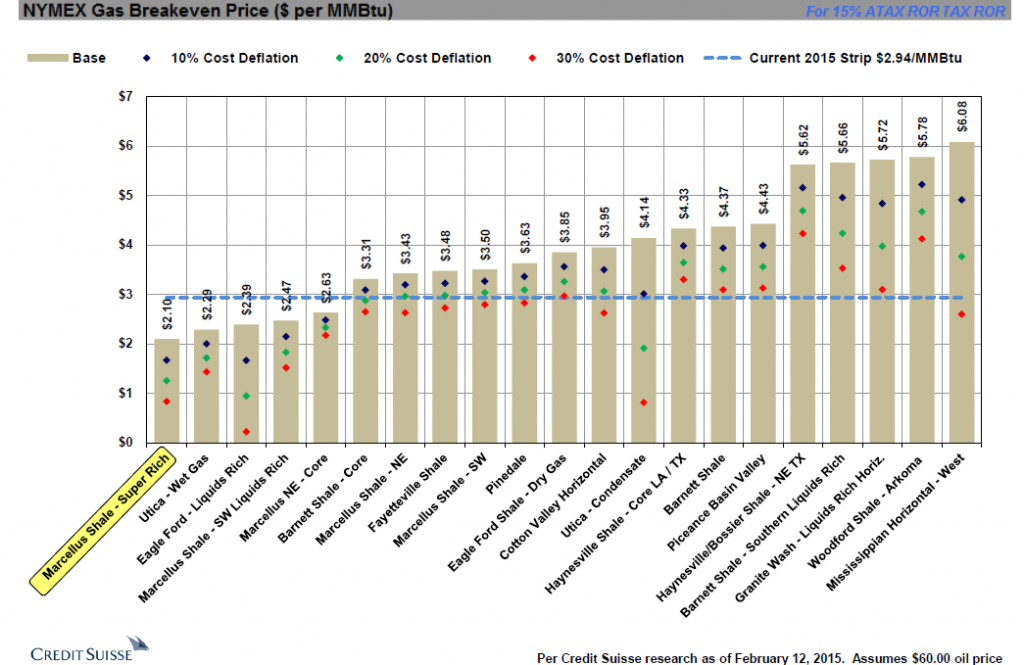

Jeff Ventura, President and Chief Executive Officer of Range Resources, opened up the company conference call with a macroeconomic perspective on natural gas and the role of the Appalachia region. Considering Range discovered the Marcellus Shale and has been one of the longest tenured operators in the northeast, its words hold significant weight.

“We believe that over the last year, the U.S. gas market typically has been oversupplied by about 2 to 4 Bcf/d,” said Ventura. However, RRC believes demand is expected to increase by about 2 Bcf/d in 2015, followed by annual growth demand of 3 to 4 Bcf/d from 2016 to 2020. Overall, about 20 Bcf/d of incremental gas demand will be realized by 2020. Even the Energy Information Administration has projected the United States will become a net exporter of natural gas by 2017.

Ventura then broke the supply side into two segments, with gas production coming from both oil wells and gas wells. An estimated 16 Bcf/d of recent production is estimated to come from oil wells, with half of that number associated with shale operations. “The first year declines of unconventional resource oil wells are much steeper than gas wells and typically are in the 70% to 90% range,” said Ventura. “Given the continuing steep drop in the rig count and typically steep first year declines of those oil wells, I believe that we’ll see a production response in the second half of this year.”

Ventura explained this downturn is different than the one in 2008, especially since horizontal rigs consisted of about 30% of the fleet that year, as opposed the current makeup of approximately 75% in the latest Baker Hughes rig count update. The efficiencies and pad drilling techniques have improved, but the nature of the rigs will play a role.

“The operators dropped their vertical rigs first because they were not driving production,” said Ventura. “Today, there are no vertical rigs drilling the Marcellus or Utica, so decreasing the rig count should have an impact.”

Record Setters

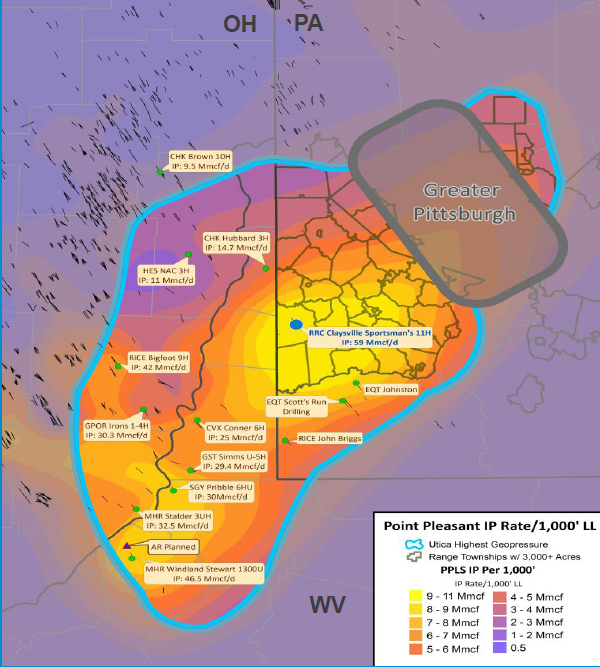

Range’s prominence in the Appalachia was compounded last year with its record-setting Utica well (87.5% working interest) in Washington County, which returned an initial 24-hour rate of 59 MMcfe/d in Q4’14. The well was brought online in January and, despite constrained rates, has returned 1,200 MMcf to date. Three additional Utica wells are planned in 2015 and the first has already been spud.

In a note, Stifel said RRC’s estimates of gas in place in the region are as much as 40% higher than that of its neighboring operators. Ray Walker, Chief Operating Officer, backed up Range’s confidence in the call by saying, “The rock rules and our results indicate we’ve captured some of the best rock in North America.”

On the Marcellus side, a well in the wet gas area of Washington County returned a 24-hour rate of 43.4 MMcfe/d – a Marcellus record, according to the company. The Washington County region and its nearby acreage will be the focal point of Range’s 2015 operations, and 35 of the 38 wells turned to sales in the quarter are based in the Southern Marcellus region. The Northern Marcellus Shale division will run one to two rigs for the remainder of 2015 and anticipates turning 11 more wells to sale for the remainder of 2015. A total of 150 wells are expected to be turned to sales in 2015, which would amount to 112 more wells being placed online.

UBS Financial Services points out that RRC’s unbooked resource base is seven times greater than its proved resource base of 10.3 Tcfe (even before considering Utica potential), and Range management said it still has “thousands and thousands” of future wells in its portfolio.

Appalachia Results

Range’s ability to develop its wells at a low cost (its three year finding and development costs per Mcfe ranks fifth out of 88 companies in EnerCom’s Weekly Benchmarking Report) is a testament to its advancements in completion techniques and well designs. In the call, management said RRC’s estimated ultimate recovery (EUR) per 1,000 foot of lateral in the southern part of the play is the best among its peers, while its overall EUR/lateral foot in the entire Marcellus region is second only to Cabot Oil & Gas (ticker: COG). Its Nora Field in Virginia, acquired from EQT Corp. (ticker: EQT) as part of an acreage swap in Q2’14, are performing at their best rates in 20 years and receive a price premium due to their location on the southeast Atlantic Coast.

In a note covering the release, SunTrust Robinson Humphrey said: “We believe Range continues to deserve a premium versus the peer group given its solid production growth along with likelihood the company becomes cash flow positive relatively soon and should remain so thereafter.”

Market Utilization: NGLs

Range management said the richness of its gas combined with favorable contracts allow the company to utilize its resources in several ways. Previous information has been provided on its ethane market, and 80% of the company’s 2015 ethane flow is tied to different indices than Mont Belvieu.

Range also upped its stake in the international LNG market, securing an overseas buyer for a long-term agreement of 50,000 Mmbtu/d. The company now has 200,000 Mmbtu/d in contracts. The Marcus Hook harbor facilities, designed to save RRC $0.20 per gallon of propane, is expected to be operational in Q3’15 and will be utilized on the company’s 20 MBOPD of propane volumes. The arrangement is expected to increase RRC’s annualized cash flow by $90 million. Stifel estimates this could result in a NGL price uplift as high as 25%.

Cash in Mind

RRC is heavily hedged in 2015, with more than 85% of total volumes locked in at prices of $3.77/Mmbtu and $87.44/barrel. Close to half of its anticipated 2016 production (about 700 MMcfe/d) is already hedged, with average liquids prices of $70.54/barrel.

The company also switched its bank facility from debt-to-EBITDAX to a EBITDAX-to-interest-expense covenant, a setup that will save money and improve cash management, according to Chief Financial Officer Roger Manny. “It was actually a pretty easy conversation as evident by the fact that all 29 banks unanimously approved the change,” he said. “But when the banks do the borrowing base determination, they basically take all your cash flow until your next review date and toss it out…The borrowing base is their primary tool to manage leverage and the reason is pretty simple. It’s a forward-looking test…The debt-to-EBITDAX covenant, that’s a rearview mirror test. So it’s really not as applicable to managing leverage over time.”

The EBITDAX to interest expense covenant of 2.5x is supported by an existing $3 billion borrowing base. The ratio of the present value of proved reserves to total debt covenant of 1.5x will apply until Range has two investment grade ratings. Current liquidity is approximately $1.2 billion. Management added that most of the production volumes increases are backloaded for the end of the year, an attribute that will help the company hit 2016 with a running start – the same time frame in which management expects prices to rebound.

In October, Oil & Gas 360® published an article entitled “How One Man’s Decision Cracked Open an Energy Revolution: The Marcellus Turns 10.” The article is based on a detailed account from Jeff Ventura about Range’s 2004 discovery of the Marcellus shale play.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.