Libya’s National Oil Company has declared force majeure on eleven oilfields

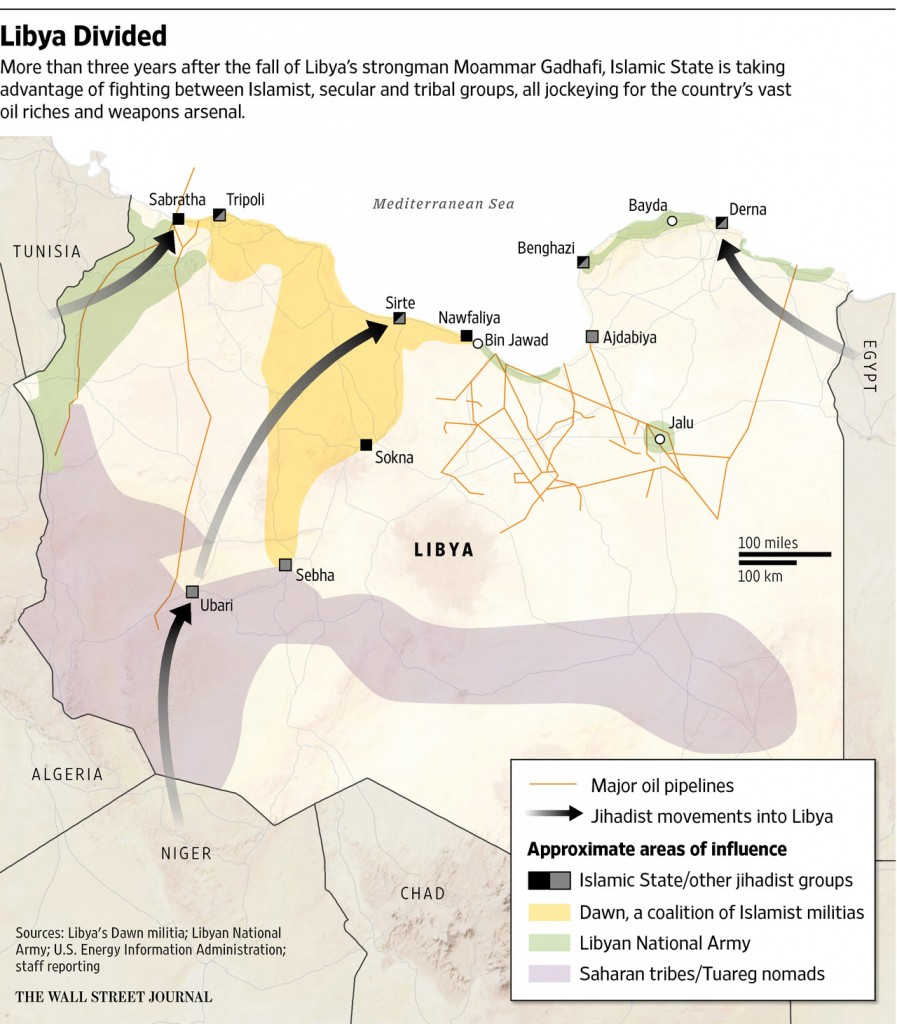

Libya’s state-run National Oil Corporation (NOC) declared force majeure on eleven of its oilfields Wednesday due to the deteriorating security situation in the country, reports Reuters. The country’s oilfields are being increasingly targeted as rival governments seek to gain control of the country’s main source of income.

In a statement posted on its website, the NOC said it was no longer able to ensure security in the eleven fields in the central portion of the country. The decision to declare force majeure on the oilfields guarantees legal protections from claims against any future disruptions.

The oil assets covered by the force majeure include Mabrouk, Dahra and Bahi, which security officials said were overrun by Islamist militants earlier this week after security forces guarding the installations were forced to retreat. Both Mabrouk and Bahi oil operations were empty after staff was evacuated earlier.

Mabruk once produced 30 to 40 MBOPD and is operated by a joint venture between Libya and Total (ticker: TOT). Bahi and Dahra are operated by a partnership with Marathon Oil Corp. (ticker: MRO), Hess Corp. (ticker: HES) and ConocoPhillips (ticker: COP), reports The Wall Street Journal.

Even before these most recent attacks, Libya’s production was down 80% from its 2011 output. NOC’s inability to maintain control over its assets has directly impacted its oil production, which accounts for 90% to 95% of the country’s revenue.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.