The cycles of the oil and gas market are inevitable, and throughout its history the industry has consistently recovered from downturns even as severe as the one we are experiencing today.

Although the market swings are hardly ever uniform, independent E&Ps are engaging in various methods to weather the current downturn. Industry experts like Tom Petrie, Chairman of Petrie Partners, doesn’t see the effects of this decline as severe as the one from 1986. In a December interview with Bloomberg, he said: “This isn’t like the mid-80s, where half of the consolidations that occurred were mergers and the other half were bankruptcies. This time around, I see the amount of forced reorganization being around 10% to 15%.”

Ever since Saudi Arabia decided to rewrite the oil market novel, the global balance has sent companies, on both public and national levels, into survival mode. Saudi recently bumped up its April delivery prices to Asia by $1.40, citing increased demand, but a true recovery to the oil price swoon remains unfinished.

Preface: CapEx Cuts

Preface: CapEx Cuts

The first defensive move by E&Ps to protect their balance sheets involved slashing capital expenditure costs and shelving exploration projects until oil prices improved to more cost-effective levels. The overwhelming majority of such companies announced reduced year-over-year expenditures for 2015. A total of 65 companies compiled by EnerCom, Inc. averaged cost reductions of 34% for the time frame – induced by deferring well completions and laying down rigs. Some companies have revised 2015 guidance twice in just the last few months.

Coincidentally, the U.S. rig count has fallen by 34% since December 5, 2014, and is currently at its lowest amount in five years. A handful of small to micro-cap E&Ps have temporarily deferred their entire drilling programs, while larger companies like California Resources Corp. (ticker: CRC), LINN Energy (ticker: LINE), Oasis Petroleum (ticker: OAS), Rosetta Resources (ticker: ROSE), Whiting Petroleum (ticker: WLL) and WPX Energy (ticker: WPX) all cut back 2015 expenditures by at least 50%.

This Chapter: Capital Raisings

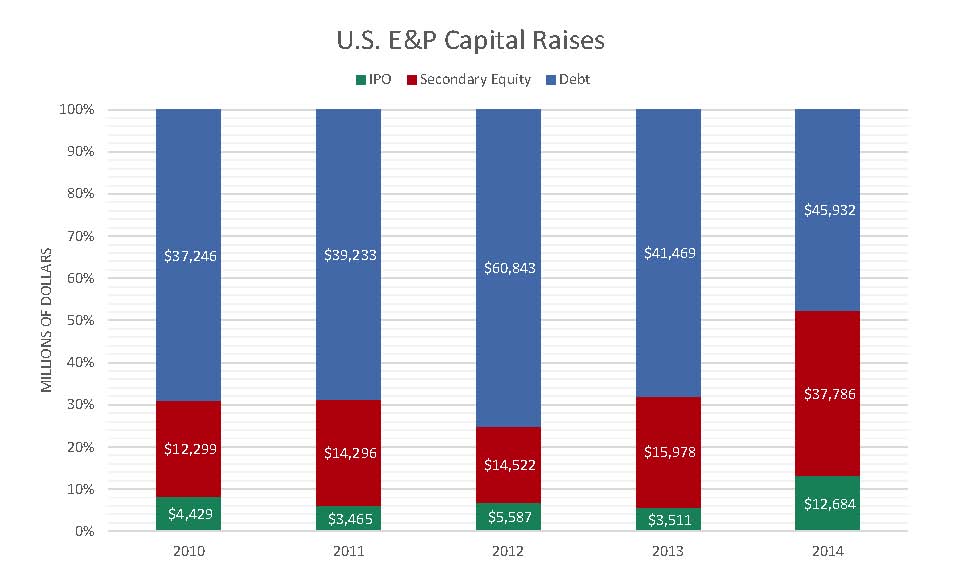

In early 2014, supermajors like Royal Dutch Shell (ticker: RDS.B), ExxonMobil (ticker: XOM) and Chevron (ticker: CVX) were already planning on trimming expenditures, and that was before oil prices were essentially cut in half. Now, those same companies are padding their balance sheets via equity raisings and bond sales in a very volatile energy market. A list of recent transactions include:

- Antero Resources (ticker: AR) – $0.75 billion

- Chevron – $6 billion

- Concho Resources (ticker: CXO) – $0.65 billion

- ExxonMobil – $7 billion (according to a Bloomberg report)

- MarkWest Energy (ticker: MWE) – $0.65 billion

- Newfield Exploration (ticker: NFX) – $0.82 billion

- Noble Energy (ticker: NBL) – $1 billion

- Plains All American Pipeline (ticker: PAA) – $1 billion

- Williams Companies (ticker: WMB) – $3 billion

- Woodside Petroleum (ticker: WPL) – $1 billion

All companies said the money raised would be used to pay down short-term debt. Shell took a slightly different approach to strengthening its balance sheet by implementing a scrip dividend program, which allows shareholders to receive their dividends in shares rather than in cash. The recent stabilization of oil prices has helped the E&Ps take advantage of an “insurance policy” opportunity by adding cash without building debt.

Byron Cooley, Senior Vice President of DNB Bank, told OAG360 last week that the size and strength of the larger E&Ps gives them an advantage over their smaller competitors, who may have no choice but to increase their bank revolvers. “The larger companies are recognizing that the debt markets might not be optimal at this time, plus do not want to risk being over-levered in this market,” he said by phone from his office in Houston, Texas.

Conclusion

This, unfortunately, cannot be accurately depicted due to the numerous moving pieces of the oil market, but short-term bearish views from experts like Charles Cherington, Managing Partner of Intervale Capital, can be reinforced by supply trends. “Things will get worse before they get better… and will get considerably worse in the first half of this year,” he said in an interview with Fox Business in February. Cherington says the supply/demand balance has changed due to the shale boom, in which the United States has added approximately 4 MMBOPD to the global market in the last few years. “We have about 2 MMBOPD of excess supply and the United States will add another 0.7 MMBOPD this year,” he explained. “Even if demand is increasing by 1 MMBOPD per year, it’s going to take awhile for the market to balance itself.”

Timothy Hess, a Petroleum Expert with the Energy Information Administration, told OAG360 in an interview that the steadiness in production volumes is attributed to producers pulling rigs from less efficient areas. “At the same time, the average production per well is actually going up because you’re getting away from some of the marginal areas,” he said. In EnerCom’s 65-company guidance list, a majority of E&Ps were expecting volumes to remain flat or increase on a year over year basis despite the capex pullback.

Cherington said in the Fox Business interview that oil demand is anemic and inelastic, which has led to crude oil inventories reaching the highest level on record. Nearly 48.6 MMBO have already been added to inventories in fiscal 2015, and analysts polled by Bloomberg believe another 4 MMBO will be piled on in the next Weekly Petroleum Status Report (to be released on March 4). Hess says part of the build can be attributed to producers opting “sell it forward” on the futures market, which currently consist of prices of $56 and $60 for August 2015 and February 2016, respectively. “This has led to contango, because nobody is going to pay up for oil right now because there’s so much of it on the market,” he said.

The futures price reinforces Cherrington’s notion that the price slump may extend into the first half of 2016, resulting in further capex adjustments by E&Ps. “As oil prices go up, equities will go up as well,” said Cherrington. “The challenge is figuring out the timing. But that doesn’t mean you’ve seen the bottom yet – in fact, you probably haven’t.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.