Ethane, one of the natural gas liquids (NGLs), is a byproduct of natural gas production. Ethane is used as petrochemical feedstock and is key in making polyethylene—plastic. Ethane is also used in the production of products like antifreeze and detergents.

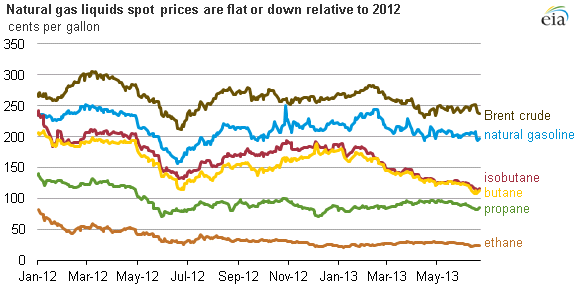

Ethane prices in the U.S. have dropped with the abundance of gas coming out of the U.S. shale basins. The oversupply has led domestic ethane to be rejected in recent years—i.e., forcing natural gas producers to sell ethane at fuel value, rather than as a petrochemical feedstock. But European markets appear to be an outlet for future U.S. ethane exports, and contracts to build ethane infrastructure facilities have been on the rise in recent months. Expensive import and export facilities are starting to take shape on both sides of the Atlantic.

New European Ethane Import Facility

Switzerland’s $41 billion petrochemical manufacturer INEOS Group AG has contracted Germany’s TGE Gas Engineering to start construction of what has been described as Europe’s largest ethane storage facility. The Grangemouth [Scotland] plant will store and process ethane from shale gas “as North Sea supplies dwindle,” said INEOS Chairman Jim Ratcliffe. “Our ability to import U.S. shale gas underpins the future of manufacturing at Grangemouth and across many businesses in Scotland.”

INEOS said it has invested more than £300m at its Grangemouth petrochemical site as part of a long-term survival plan. It will bank on a £230m loan guarantee from the UK government to build the new ethane facility.

INEOS said it has invested more than £300m at its Grangemouth petrochemical site as part of a long-term survival plan. It will bank on a £230m loan guarantee from the UK government to build the new ethane facility.

The company said the “new facility is central to the site’s plans to import shale gas from the USA. It views turning Grangemouth into a shale gas-based facility by 2016 as essential if it is to compete in world markets beyond 2017,” according to a BBC News story on July 17.

“[T]he new import terminal and ethane storage facilities is a key step in securing the long-term future of the site,” said Scottish Finance Secretary John Swinney.

INEOS owns two of Europe’s four gas crackers capable of using U.S. shale ethane gas feedstock. The other two are in Norway.

New U.S. Ethane Export Facility

Last Thursday, Houston’s Enterprise Products Partners L.P. (ticker: EPD), announced it has secured long-term commitments for approximately 85% of the capacity of its new Houston Ship Channel ethane export terminal, presently under construction. In a press release the company said it is evaluating expansion options for its new ethane terminal, “supporting further development of the world’s largest ethane export terminal,” said Teague, chief operating officer of Enterprise’s general partner.

Enterprise is targeting completion of its new ethane terminal for third quarter of 2016. The company said it will have the capability to load fully refrigerated ethane at approximately 10,000 standard barrels per hour. An 18-mile, 24-inch diameter ethane pipeline will be constructed from its existing Mont Belvieu natural gas liquids fractionation and storage facility to supply the new export terminal with ethane.

Range Resources (ticker: RRC) has also created a market based purely off of its ethane extraction. Contracts are already in place to move a total of 75,000 barrels of ethane per day to three LNG hubs across North America, and two of the projects are currently operational. Once all three are running, RRC will see a 25% cost uplift as compared to selling as a BTU.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.